- cross-posted to:

- politics

- [email protected]

- cross-posted to:

- politics

- [email protected]

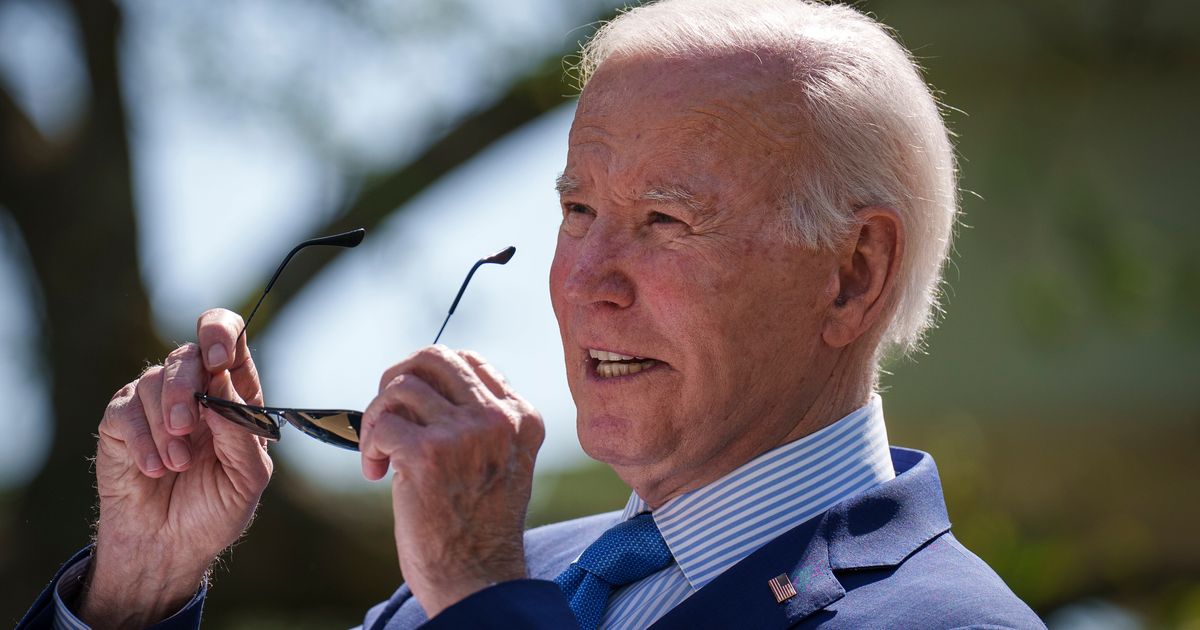

“Banks call it a service,” the president said. “I call it exploitation.”

Call your bank and tell them you don’t want the “protection”. It’s literally a service they provide “for your benefit”. Tell 'em no.

FFS, the very Consumer Financial Protection Bureau Biden is invoking made it mandatory for banks to offer the “no” option. Use it.

And $3 sounds totally fair. The bank, having given you a loan, deserves a bit of take on that. Loaning money for profit is kinda what they do for a living.

And if anyone really hates banks, like I do, go to a credit union. Many have been open to the general public for decades. They’re about as close to socialism as finance gets. Use them.

Amen to the credit union - that’s where I pay all of my bills from. Much prefer having my money parked in a place where it’s a non-profit and its wealth is solely because of its customers.

One of these days I really need to get my ass in gear and switch to a credit union. I keep balking at the work to change over direct deposits, various transfers, and ACH payments for bills and whatnot.

You know, you can just open the account, and slowly make the changes over time and as works for you.

My bank has a setting that allows an auto-transfer from my savings account in the event of an overdraft in my checking. Or at least it did. They either removed the feature without saying anything or charge the fee anyway. Banks are predators.

Pass a law to make them illegal.

Do we have to have a law to protect everyone from every bad decision?

Tell the bank you refuse overdraft protection. Done and done.

If you overdraft, they hit you with larger fees for your account going red.

It is exactly that…exploitation. I hope that I see this come to pass. While they’re at it, they could give the Payday/Title loan industry a public spanking for good measure.

Overdraft fees only exploit people that don’t know you can turn the “feature” off with a phone call. We should be shouting this to the rooftops. “You don’t have to pay the fucking fee!”

As to payday loans, they really came in handy when my ex and I bought this house. We didn’t have good credit due to medical bills and had landed a Habitat for Humanity mortgage. Suddenly we needed loads of things a renter doesn’t need. Lawn mower, weed eater string, misc. tools, on and on and on. Plus, we had a brand-new baby. Took us about 3-months to get on our feet, break the cycle. Never been back.

If you’re truly in a pinch, you can get $200 or $300 on the fly for $20 or $30 bucks. As long as you’re well aware that’s coming out of your next check, and plan accordingly, it works in the short term. <- Key word there: short term.

Yeah, they rape ya on interest, no doubt. But what do you expect? They’re in a high-risk game with the riskiest of clients. For all those they profit from, like me, they gotta cover for the people that don’t pay.

It’s a fundamentally predatory industry.

Just because some people are using it as advertised and getting benefit from it doesn’t change that fact.

It deserves to be cracked down on.

There’s perfectly legitimate reasons to be making and selling fentanyl, but that industry too needs to have tight regulatory control because of how it inherently generates victims for profit. So too with payday lenders.

Slightly unrelated: several states have made it illegal for medical debt to adversely affect your credit score. Check if yours is one and write your state reps if it isn’t.

I think the fundamental problem is that this “feature” is on by default. It should be opt-in, not opt-out. Yes, people are responsible for handling their own finances, but it’s also not difficult to fall into an overdraft accidentally.

“As little as $3” is still true if the outcome is up to $30.

While I think he could pull off single digits, it sure isn’t going to be $3.

Tired of plans and talk. I’ll beleive it when I see it

bullshit. the “merchants” would eat him alive.