Fucking do it already. We’ve been hearing “impending recession” for the last decade.

Oh it’s here, but the economists most news agencies talk to only look at rich people metrics like stock prices and meaningless poor people metrics like unemplyment %.

We are the canary in the coal mine and they’re determined to mine everything of value while we die and before they have to leave.

Except Real Wages, incidence of home ownership, full-time employment, and GDP per capita are all up. This all while inflation continues to drop and has never risen anywhere near the levels seen abroad.

Yeah all that sounds like a recession to me, too.

“We’re getting pissed on less than those abroad!”

OK, you keep ignoring how you’re still getting pissed on, then.

See the first paragraph. Do you need a drawing to understand it, son?

Hey Trump’s think tank said the same thing yesterday!

But The Telegraph is a highly respected news source, isn’t it?

The Daily Telegraph is politically conservative and has endorsed the Conservative Party at every UK general election since 1945.[48][49] The personal links between the paper’s editors and the leadership of the Conservative Party, along with the paper’s generally right-wing stance and influence over Conservative activists, have led the paper commonly to be referred to, especially in Private Eye, as the Torygraph.[48]

Oh.

Yea, and Jerome Powell is a Republican. If you think I’m trying to make this seem like Biden’s fault, it has nothing to do with the Executive branch of the government.

MIT Professor Paul Samuelson’s famous quip, “the stock market has predicted nine out of the last five recessions”

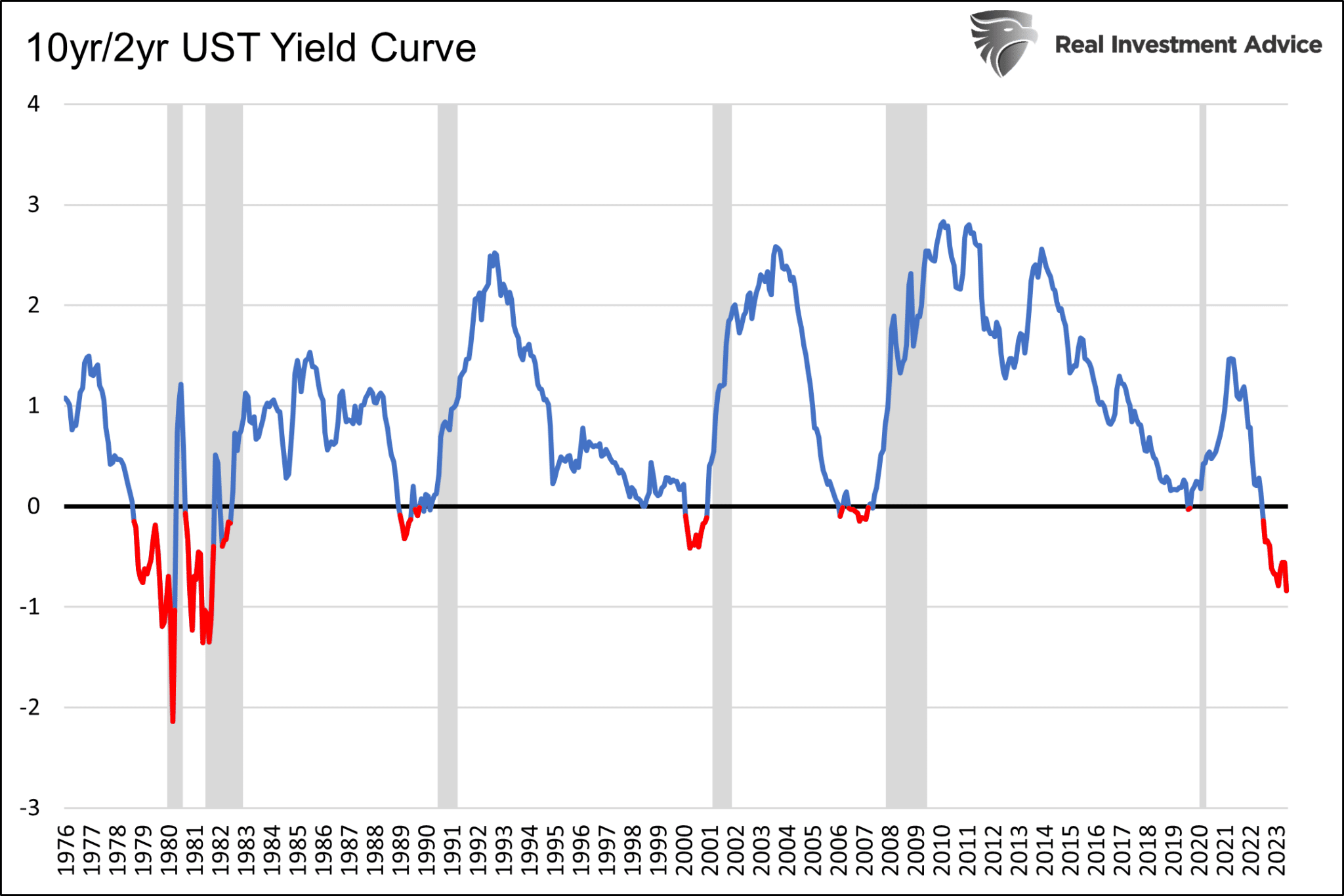

Inverted yield curve has predicted every previous recession and it’s as inverted as it was before the 1980s recession. Now people are simply saying it’s no longer reliable. 🥴

From this graph, it looks like you’re suggesting the 2019 yield curve inversion predicted the 2020 coronavirus recession?

My opinion is that the COVID pandemic wasn’t the recession it should have been. We should have entered a recession alongside the pandemic, but instead the government printed a fuck ton of money and pumped it straight into the economy. This led to increased inflation and the situation we’re in now. That’s why the grey line in 2020 is so thin, and why the yield curve is so deeply inverted now. They basically postponed it by about 4 years.

The total public debt helps explain why there wasn’t a recession:

Interesting. How soon after an inversion does a recession need to happen for it to be considered “predicted”? It looks like the longest in your chart is the recession ~2 yrs after the 1978 inversion. The most recent inversion was July 2022. If we’re not in recession by this summer, will that still be “predicted”? 2025? 2026?

It’s never been the same amount of time since the beginning of the inversion, but there has always been a recession after the inversion goes back to normal. There are a lot of events that are building up that will bring the recession, it will happen over time. My guess is within the next 6-12 months.

I don’t think that really answers my question. Saying “there is always a recession after an inversion” is incredibly vague. The only scenario that wouldn’t happen is if we somehow fixed the economy perfectly & never had a recession every again ever. But if a recession happens 100 years after an inversion, it’s farfetched to say the inversion predicted it. Where’s the line?

I bet they have an answer for avoiding it and I’ll bet even more it’s stupid AF.