- cross-posted to:

- upliftingnews

- cross-posted to:

- upliftingnews

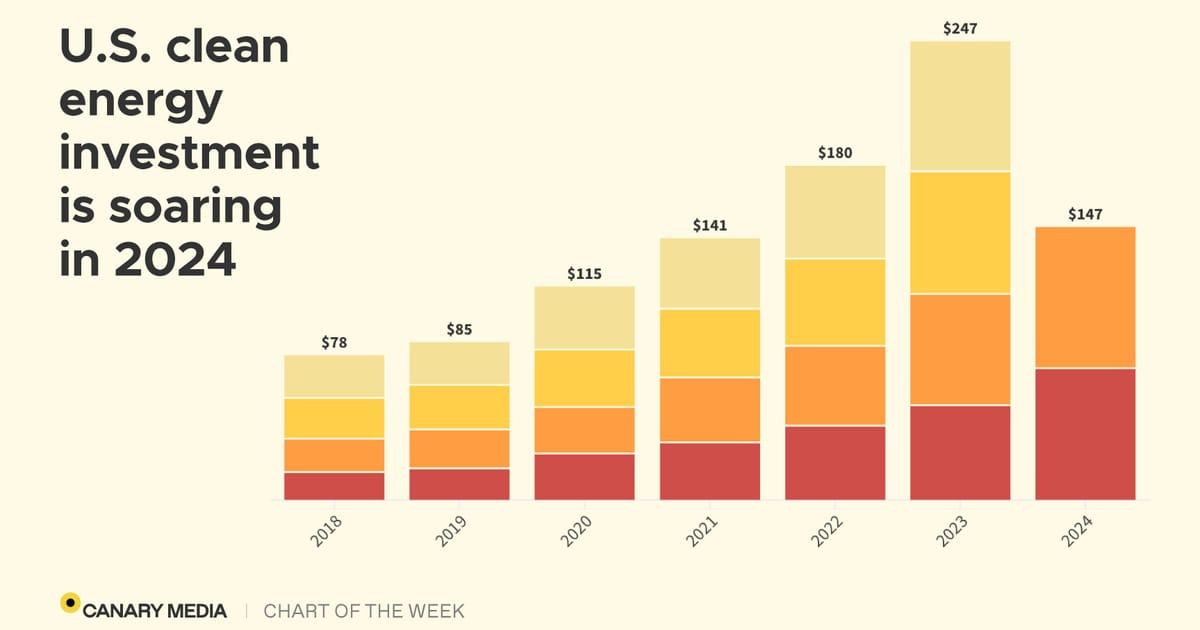

Private and public investment in clean energy rose to a total of $147B in the first half of this year — a record-setting figure.

Exactly two years ago today, President Joe Biden signed the Inflation Reduction Act, establishing a wide array of clean energy programs meant to supercharge spending on climate solutions.

Investment in clean energy projects — from solar manufacturing facilities to home batteries to hydrogen hubs — has taken off ever since, rising to record heights in the first half of this year.

Across the first six months of 2024, U.S. cleantech investment hit $147 billion, per new data from the Clean Investment Monitor, a joint project from Rhodium Group and the MIT Center for Energy and Environmental Policy Research. That’s a more than 30 percent jump from the first half of 2023. The report measures actual investment — not announcements or plans — from both public and private sources.

A moment of good news is nice, every once in a while.

I was going to check the inflation rates to see if they were actually higher, then just settled with accepting it as good news and not to check.

It’s genuinely impressive the US has spent more in Q1+Q2 than it has in 2021 and previously. A very good turnaround!

I think the US is taking this green energy seriously as they really want to be at the forefront of whatever new technological revolutions that shake out from green energy investments (as opposed to, say, China).

Whatever the reason, this sort of race is ultimately a good thing for humanity as a whole.

as opposed to, say, China

Could you expand on that?

China also aggressively pursues green energy and wants to be the leader in that field.

A 21st century green space-race is exactly what we need. Nothing furthers technology better than good old competition. And war. But competition will do.

Is there a corresponding shift to green energy production? Because spending is good, but I want to see actual reduction in fossil fuel use and an increase in green energy use.

The true measure of success is the percentage of our total energy consumption that comes from renewables/fossil fuels.

In 2013, renewables accounted for 5.8% of total energy consumption, fossil fuels accounted for 84.4% of total energy consumption.

In 2023, renewables accounted for 9.8% of total energy consumption, fossil fuels accounted for 80.6% of total energy consumption.

It’s certainly moving in the right direction, but much more needs to be done.

That was signed 2 years ago. I imagine that this wouldn’t appear in the renewable production metrics for a few years. Energy infrastructure projects don’t go from investment to output quickly. You have planning, hiring, permitting, building, etc. There is also a lag time from when a bill is signed to when an administration can staff offices to accept and review grants, cut checks, etc.

The federal government usually issues a report about annual energy production at the end of the calendar year. The report usually gets posted in Feb or Mar after the information has been collected and synthesized.

We might see a bump in the 2024 report, assuming Trump doesn’t win and we actually get a 2024 report. That said, I wouldn’t expect to see this money impacting the grid for a few more years out.

CO2 emissions in the US peaked in 2007 and have been on a steady decline since, for what it’s worth

Canary Media - News Source Context (Click to view Full Report)

Information for Canary Media:

MBFC: Left-Center - Credibility: High - Factual Reporting: High - United States of America

Wikipedia about this sourceSearch topics on Ground.News