- cross-posted to:

- economics

- cross-posted to:

- economics

Claire*, 42, was always told: “Follow your dreams and the money will follow.” So that’s what she did. At 24, she opened a retail store with a friend in downtown Ottawa, Canada. She’d managed to save enough from a part-time government job during university to start the business without taking out a loan.

For many years, the store did well – they even opened a second location. Claire started to feel financially secure. “A few years ago I was like, wow, I actually might be able to do this until I retire,” she told me. “I’ll never be rich, but I have a really wonderful work-life balance and I’ll have enough.”

But in midlife, she can’t afford to buy a house, and she’s increasingly worried about what retirement would look like, or if it would even be possible. “Was I foolish to think this could work?” she now wonders.

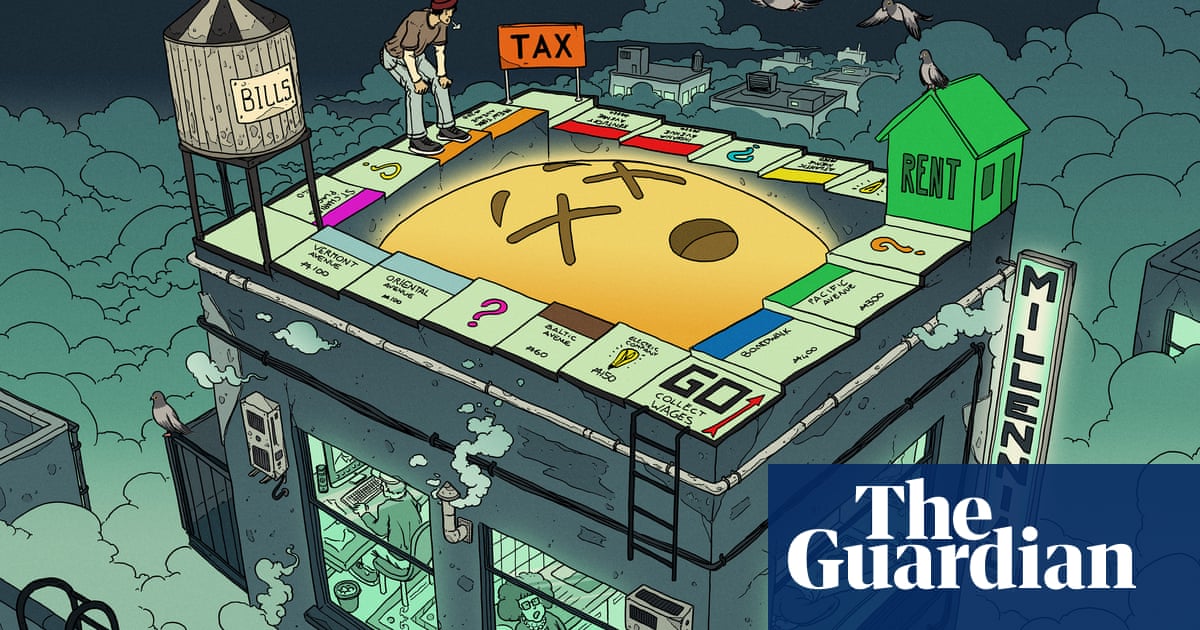

She’s one of many millennials who, in their 40s, are panicking about the realities of midlife: financial precarity, housing insecurity, job instability and difficulty saving for the future. It’s a different kind of midlife crisis – less impulsive sports car purchase and more “will I ever retire?” In fact, a new survey of 1,000 millennials showed that 81% feel they can’t afford to have a midlife crisis. Our generation is the first to be downwardly mobile, at least in the US, and do less well than our parents financially. What will the next 40 years will look like?

Unfortunately, living in the US, I would not take a job with a pension because the (private) pension system cannot be trusted. I remember the 00s when many company pension accounts went bankrupt, because companies were no longer offering it as a benefit and it was easy enough to screw over retired past employees. Companies would take poorly performing divisions and their pension plans, spin them off as a new company that would quickly file for bankruptcy.

I would not trust a pension without it being insured by an organization like the FDIC. Even then, I would be afraid that my pension would not cover living costs due to inflation.

Luckily there are alternatives. I have a 401k, which should give me a steady flow of inflation proof dividends… until a market downturn wipes it out. If that happens, I can fall back to Social Security. Don’t believe the baloney that the government will ever let Social Security go bankrupt. They will just cut down benefits.

I don’t deny things like that happened. You heard about them right? So did I. But that’s the thing, these are the stories you heard. It’s man bites dog, it is observation bias.

Also her pension is insured. And I am pretty sure the bankruptcy thing you mentioned was one particular case with a car part maker.