The CEOs of some of the largest employers with the lowest-paid workers in the US are more “focused on their own personal short-term windfall” – spending significantly more money on stock buybacks than capital investments and contributions to employee retirement plans, according to a new report released by the Institute for Policy Studies.

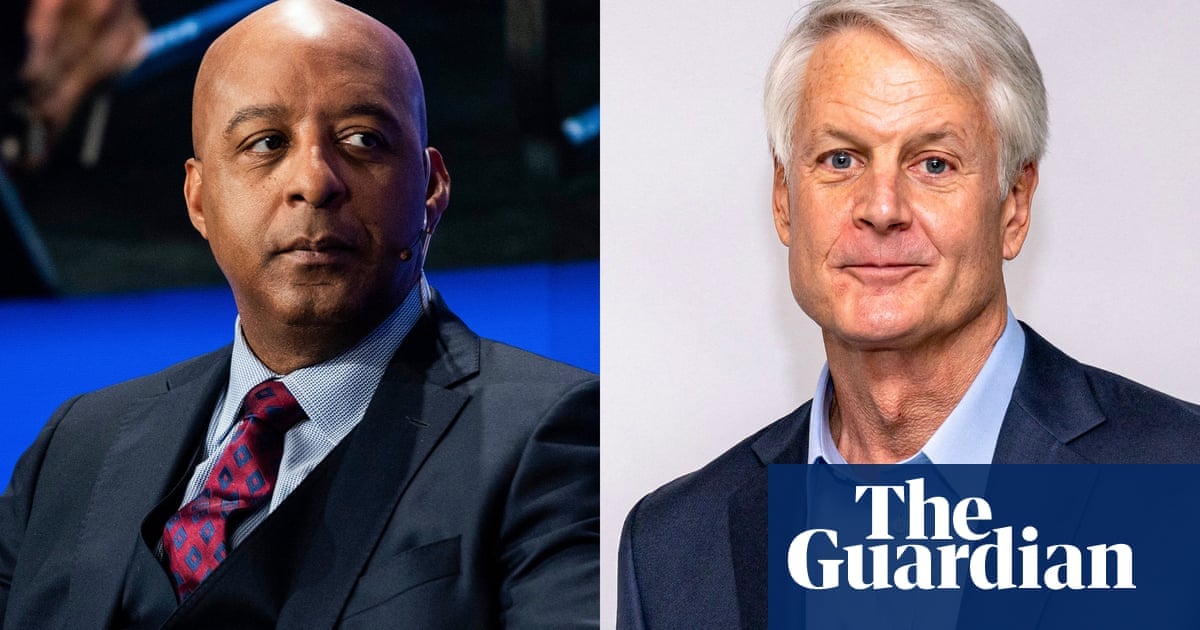

Between 2019 to 2023, the 100 largest low-wage employers in the US, the 100 corporations in the S&P 500 with the lowest median worker pay, spent $522bn on stock buybacks. Lowe’s and Home Depot spent the most on stock buybacks, with Lowe’s spending $42.6bn during this period and Home Depot spending $37.2bn.

The report cites that Lowe’s could have used those funds to give every one of its 285,000 employees an annual $29,865 bonus for five years, and Home Depot could have used those funds to give five annual $16,071 bonuses to each of the retailer’s 463,100 employees.

cant wait to read all the “water is wet” comments on this post. love seeing that comment every time it gets posted

Well, voting hasn’t worked to curb these issues and government has been inept at doing much beyond fines. Our option then is really just to murder them all. I am not going to spearhead that. Are you? Would love your solutions since you are sick of the action we can take.

?

commenting “water is wet” is not political action. it’s a tired joke.

Cool. So I provided examples of things can be done, tried, and didn’t move the needle.

What’s your plan? We make tired jokes because things that get tried don’t work so that’s how many cope with shittiness.