One in 4 middle-income new homeowners — twice as many as a decade before — are buying into cost-burdened situations.

The share of middle-class Americans who are buying wallet-squeezing homes has more than doubled in the previous 10 years.

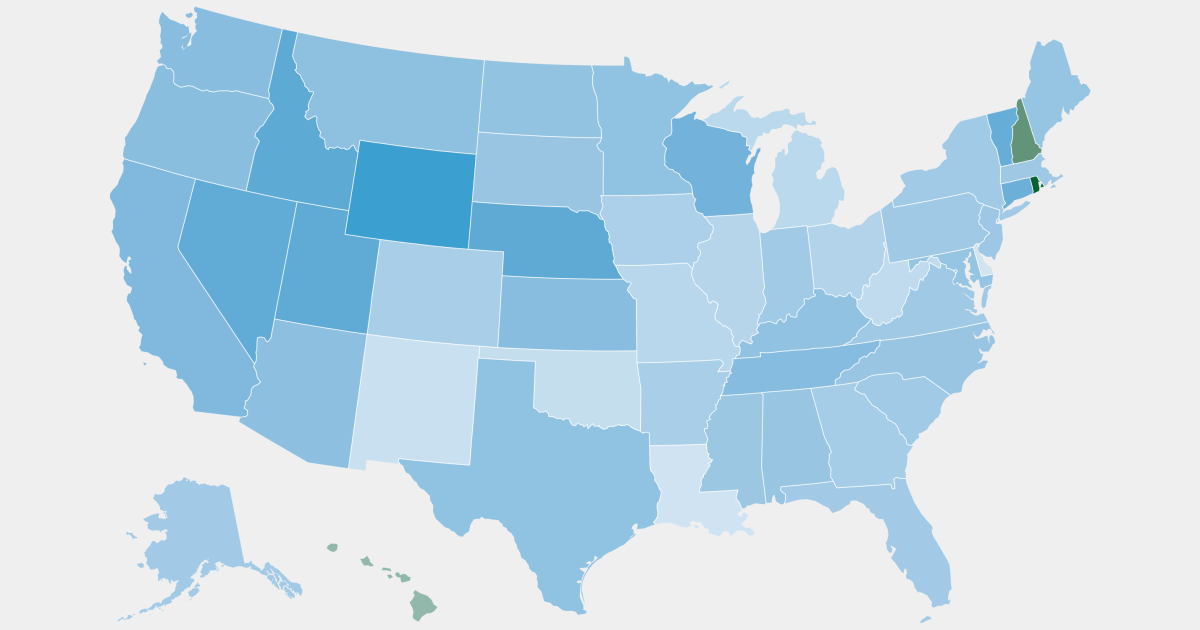

Almost 30% of middle-class homeowners bought homes with monthly payments costing more than 30% of their income in 2022, an NBC News analysis of Census Bureau data found. That’s more than twice the share from 2013, with experts warning it leaves many households with less money for groceries and emergencies and less able to get ahead in the future.

That “cost-burdened” benchmark — in which a household devotes over 30% of income to housing costs — is a widely used measure of affordability for both homeownership and renting. The Census Bureau measures housing costs against it, and the Department of Housing and Urban Development has used it for decades.

And most of those willing to take on the additional risk will look back at their decision positively. Shit’s not getting any cheaper.

When the options are rent you can barely afford or a mortgage you can barely afford ,the choice is obvious .

More importantly, can you lock in a mortgage payment that won’t change much, vs. a rent that may skyrocket in the next 6 months? And sometimes a mortgage can be less than rent (although there are other costs to be considered). In our situation we were very lucky to be able to leverage money and jump on a house before things got stupid, and if we hadn’t taken that jump I’m not sure where we’d be right now since rent prices got crazy while we’re now still paying a decent monthly price.

Then there’s the unlucky few like myself who are perpetually single and stuck in a state where I spend half my income on renting someone’s garage, but a house would be almost 80% of it…

I literally just hit an income level where I could start looking for a house and then fucking COVID ruined everything…

Rent, where someone else is held responsible for maintenance and plumbing/electrical work and landscaping? Maintenance ain’t cheap.

My landlord doesn’t fix shit

It can be, especially if you have steady tenants.

I know ex landlords of mine that barely had to pay out anything over the course of years, while they made 5 figures/year.

Even as a home owner, you can have a string of luck. I have relatives with 20 year old water heaters going strong.

My HVAC is 25 years old and going strong. Only quirks it has is the airflow sensor needs to be blown (haha) once in the winter. Only maintenance outside of the usual I’ve done is replace the fan capacitor.

My water heater is about 10 years old but one of the perks of my gas utility is a water heater warranty so when it comes time to replace or repair part of the cost will be covered.

Condos are a happy in-between, where the COA handles anything outside of your studs, including the roof and landscaping. My condo even has free water and the pipes and tank are maintained by the COA. Free heat too. All I need to worry about is the electrical.

That’s no different than paying for home maintenance as you’re just paying monthly into a pool of money to be used for repairs which is then handled by the condo board. This can also have drawbacks as that money can be mismanaged or wildly underfunded.

In Miami, they’ve passed a law saying all condo buildings need a structural inspections and repairs after a building collapsed recently. Many of these condo owners are getting massive 5 or 6 figure bills when structural damage is discovered. This is a really bad spot to be in since you likely can’t sell the condo if the new buyer discovers that they’ll need to fork over $100k on top of the purchase price and if you don’t have the money you can be foreclosed on by the COA.

That’s a very valid point. It’s crucial to do due diligence before buying into a condo, especially in an older building.

Yeah, but don’t kid yourself thinking that shit is free.

It’s a gamble, as long as your income remains steady and you don’t have any major expenses crop up, the gamble pays off.

Boomers are all about to die off though. So housing inventory might increase in the near future. Though investors and corporations might just fill the demand gap…

There’s no guarantee that it will all turn out positive, though. That’s why they call it “risk”.

Those first few years will be the most vulnerable, as you are not paying down principal very fast. All it takes is a job loss combined with a modest short-term real estate downturn to end up underwater on their house but still needing to sell.

But if someone is able to buy in now, maintain stable employment, and keep paying that mortgage for 5 years or so, then they will likely be better off than if they had rented all that time. How many people here can say they are confident in their job security over the next 5 years, though?

You might be a bit optimistic there