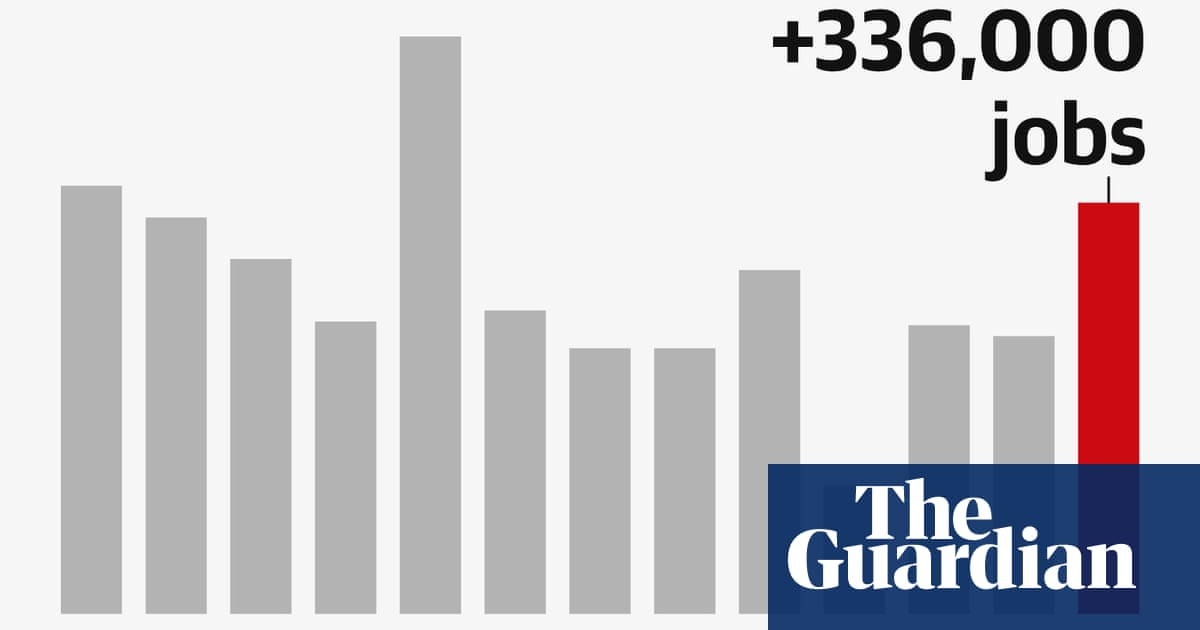

The US workforce added 336,000 jobs last month, much more than expected, as the world’s largest economy remained resilient in the face of higher interest rates.

The sharp acceleration in hiring saw non-farm payrolls rise during September by almost twice as much as economists had anticipated. Readings for July and August were also revised higher, with 236,000 and 227,000 jobs added, respectively.

Employment growth had been fading in recent months, according to official data, but remained largely resilient while the Federal Reserve battled to get inflation under control. This bolstered hopes that the central bank will manage to guide the US economy to a so-called “soft landing”, where price growth normalizes and recession is avoided.

[UPDATE] Links to the actual report in case you want to read it:

So this means a Fed interest rate hike incoming, before too many of the poors get a shot at owning land or other wealth generating property.

I have a chart I’ve been following. https://fred.stlouisfed.org/graph/?g=ZCP3 #unemployed and #unfilled jobs. Rate hikes have been bringing the unfilled jobs number down, but they haven’t touched unemployment, and there’s still way more jobs than people looking. Another 6 months, maybe, before the job market gets tight enough to remind the poors of their place in society.

Get your union organized and contracts negotiated soon.

Thats part of why im sure of another rate hike, because even optimistically it looks like multiple hikes are coming

Quote from Mary Daly at the Fed

“If we continue to see a cooling labor market and inflation heading back to our target, we can hold interest rates steady and let the effects of policy continue to work,”

So since the labor market is not cooling, there’s gonna be hikes until it does. They don’t hide why they do this.

And interest hikes only hurt us it doesn’t stop inflation because fucking greedy corporations will gladly keep raising prices with inflation. Unless the government puts limits on that we will continue to get fucked.

Any economy that needs people to be homeless and straving to fuction should be abandoned.

Interest rates hurt anyone trying to buy property right now because historic housing prices are not coming down near as fast as the rates are going up. Inflation is worse for rich people than poor people because their massive hordes and investments devalue while most poor people are in debt, which means their debt devalues. The worst part of inflation for the working man is that their salaries arent indexed to inflation and thus they’re at the mercy of their boss. Prices or domestic goods would rise a little and prices of foreign goods could rise a lot but the reason the fed tackles inflation this hard is to keep the rich peoples hordes and investments competitive with international capital.

Yep. If there’s one things that the Libertarians have correct it’s going after The Federal Reserve System.

I’ll admit that while I try to stay informed on their workings and motives and role in the economy I also don’t think I can confidently claim I’d know what happens if we outright abolished them without touching any other arms of global capital. I feel like a lot of these structural problems are so deep that simply removing a contributeter to the problems could cause very real short to medium term consequences that hurt the working people. Too many problems seem to be like that, if I had a solution I’d probably be somewhere other than online forums.