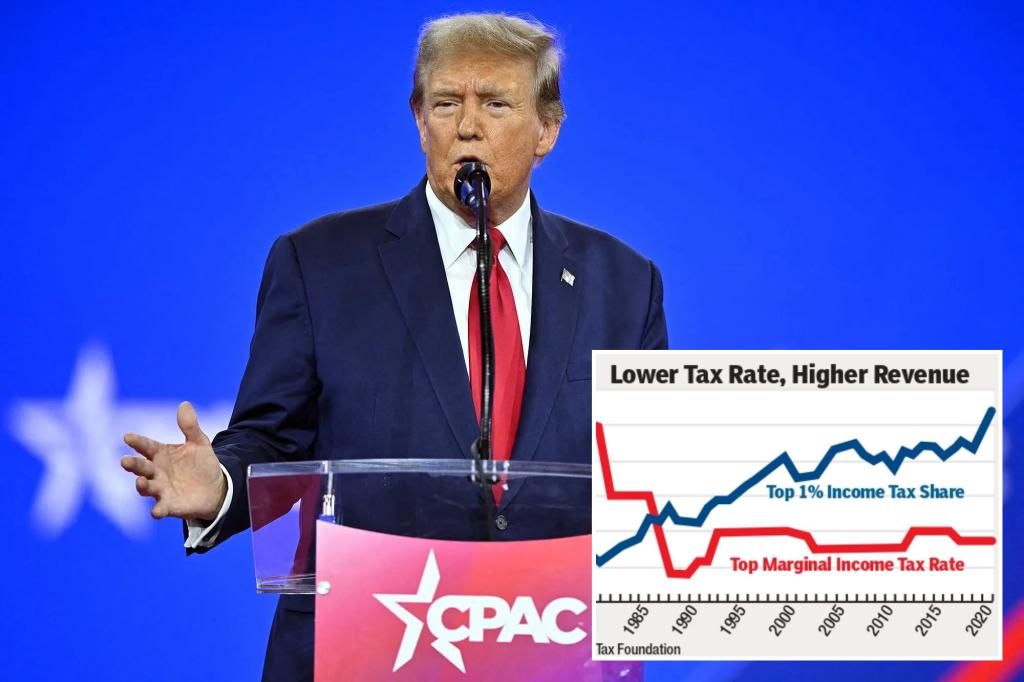

The latest IRS data on who bears the income tax burden demonstrate yet again the benefits of lower tax rates over higher rates.

When President Donald Trump entered office, the richest 1% of tax filers ($675,000 income and above) paid a little more than 40% of the income taxes collected.

The 2017 Trump tax cut reduced the effective highest federal tax rate to 37% from 42%.

But the most recent IRS tax return data (for 2021) confirm that even as these rates were lowered — not to mention the corporate tax rate cut from 35% to 21% — the share of the tax burden shouldered by the 1% rose to almost 46%.

Written by the guy who came up with the Laffer Curve, Arthur Laffer.

There is validity in the logic that lower effective tax rates lead to higher gross receipts. That is totally unrelated to the percentage of tax paid by the highest 1%. Other than a way to dunk (as long as you don’t think about it too hard) on democrats who hammer the “pay your fair share” line, it’s completely irrelevant.

Take the author, Arthur Laffer, with a grain a salt. Kansas for instance, took his taxation advice back in 2012, eliminating corporate taxes on pass through entities and slashing the tax brackets to just two and it failed so hard that they voted to repeal them and elect a democrat as governor after 6 years of budget crisis