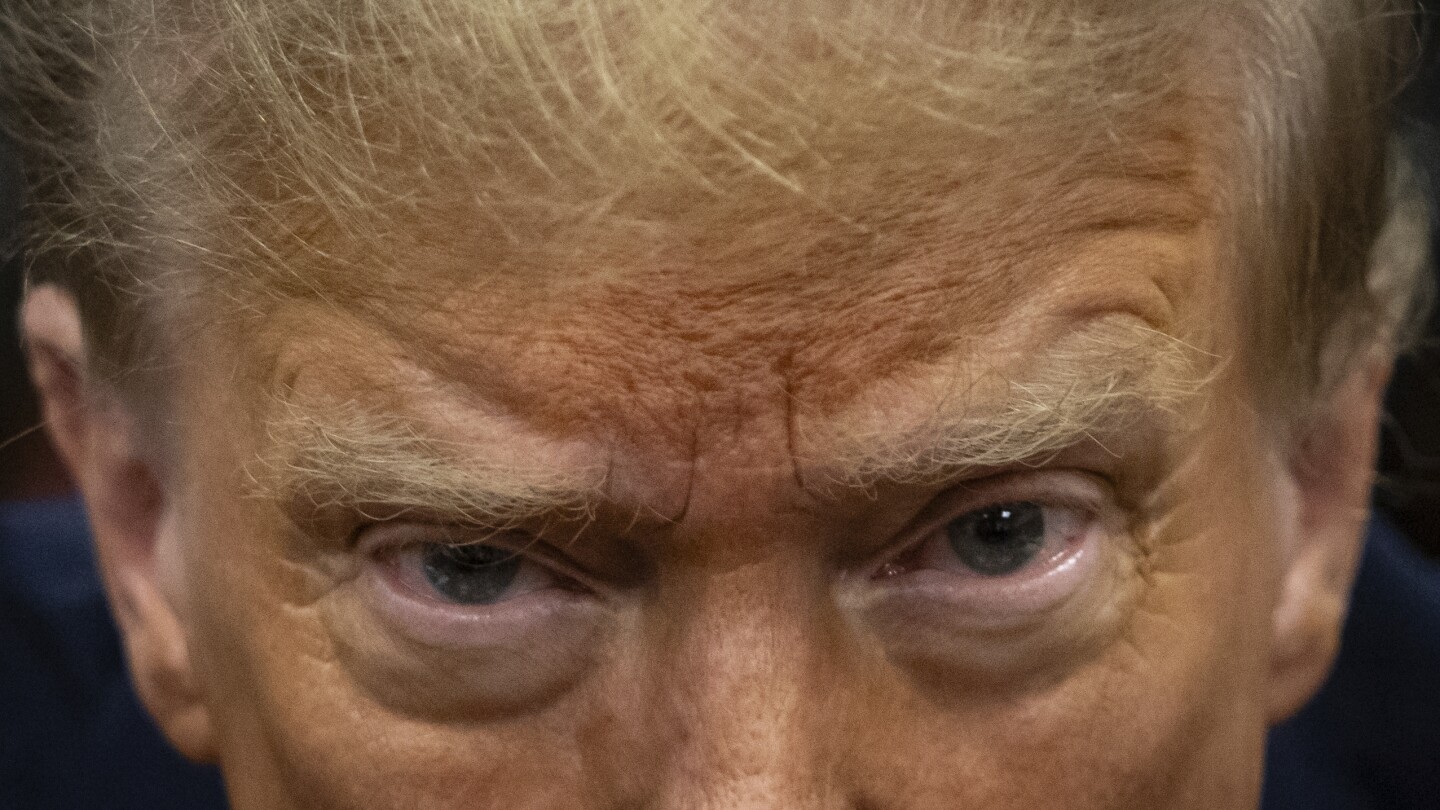

Rooting for Donald Trump to fail has rarely been this profitable.

Just ask a hardy band of mostly amateur Wall Street investors who have collectively made tens of millions of dollars over the past month by betting that the stock price of his social media business — Truth Social — will keep dropping despite massive buying by Trump loyalists and wild swings that often mirror the candidate’s latest polls, court trials and outbursts on Truth Social itself.

Several of these investors interviewed by The Associated Press say their bearish gambles using “put” options and other trading tools are driven less by their personal feelings about the former president (most don’t like him) than their faith in the woeful underlying financials of a company that made less money last year than the average Wendy’s hamburger franchise.

Shorting a stock can be fairly risky, and if you’re not familiar with it then don’t do it.

However, if you are willing to risk some money and think a stock will go down within a certain time frame, then you could buy a put. Owning a put will allow you to get some of the gains from the stock falling for a fixed price. The risk is defined because you can’t lose more than you buy the put for. So if the stock price goes up, you will have a defined loss.

The other wrinkle with puts (or calls) is that they expire (which a short stock does not). So you need to be aware of how the price will change with time as well. It is worth doing some reading on this subject. Getting the basic idea isn’t too hard, but it is necessary before you make a purchase.