cross-posted from: https://lemmy.ml/post/16569040

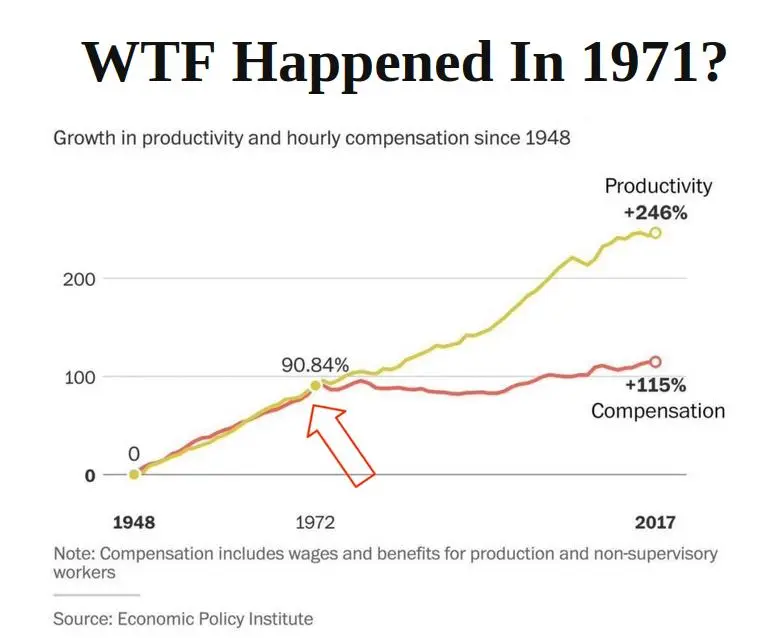

There’s a lot of talk about inflation and its causes. Is it corporate greed? Supply chain issues? One clear base cause of inflation less talked about is having an inflationary currency supply. Any other inflation caused by supply chain issues, corporate greed, lack of market competition, etc is just added on top of that. Fiat inflationary currency is a rather new invention in terms of the human timeline. In the US, Nixon is the start of it. Central banks aim for 2-3% inflation in “good years”. The money supply expands, the portion of that supply a single dollar represents, and therefore its value, decreases. This isn’t a conspiracy, it’s government policy, and both parties gleefully support it because it benefits their rich donors.

Think of it: in the last 50 years, everything has gotten cheaper to produce thanks to increasing mechanization, outsourcing to cheap labor/low regulation countries, and extremely efficient supply chains. Yet so many things “cost more” than they did 50 years ago. Even basics like bread. What used to be 5c in the US in the 50s now costs $5.00. How is that the case? Shouldn’t it cost less? Where is that “extra efficiency” going if not to lower prices? The answer: bread is the same value it’s always been, the money has gotten less valuable. This is how they keep working class people running on a treadmill, never able to achieve economic mobility.

Inflationary currency devalues the currency you worked hard to earn by increasing the supply. It hits the middle class the worst because they have more of their net wealth in cash, often in the form of emergency funds, savings, and putting together enough money for a down payment on a home. Rich people have their money in assets which aren’t harmed by currency inflation. Actually, even worse, it inflates the value of those assets! If the dollar loses value (all other things being equal), it takes more dollar to buy a share in Amazon, just like it takes more dollars to buy a loaf of bread. Poor people live hand to mouth, so their net wealth is not impacted much, but inflationary currency prevents them from saving and “moving up”. If you want to identify the causes of increasing wealth disparity, the inability of people to save money and theft of value from the middle class via money supply expansion is a major one.

A must watch to understand in depth how this scam works and how it came about.

Lecture: The Creature From Jekyll Island by G Edward Griffin

https://odysee.com/@TheTruthWillSetYouFree:a/Griffin_Lecture:f

G. Edward Griffin is awesome.

This was an absolutely fantastic video and I had read the book before seeing this so a lot of what he said in the video I already knew from the book but it was a very good video.

Absolutely by design. The economy and world banks are set up for us to be in debt. Slavery just changed, from metal chains to debt.

this is by design

of course

the reason why so many people just work and work and work and by the end of the month they can barely get by and they are always in debt is also by design.

you work and pay your taxes, corporations and the ruling class get richer. And you have to work 5 of every 7 days just to get by, what a coincidence.

And if you somehow managed to save some money or buy a house or whatever, then you end up spending all of that money in some cancer treatment or other modern disease making pharma and medical industry richer is also by design.

And so many people think that the stock market is a way out of it. It’s not. It helps, but it’s not a way out. The only way out is to stop using their money. You’ve got to cut the problem off at the root and the fundamental issue is their money. You should not use it.

It’s definitely by design. XMR is a threat to that system

Sorry, I disagree. Yes inflation makes things worse, but for most of human existence for all of the world, except for the era of prosperity that started in the 1950s, the standard was closer to 60 hours a week of back breaking work, with Abrahamic religions giving people one day of rest. Also, for most of human existence in all the world, a tiny fraction of people were actually rich, except for modern times when there was a legitimate middle class. Inflation is just the way the ultra rich return us back to the historical norm. Getting rid of fiat and getting rid of inflationary banking systems are our only hope, but they won’t return us back before the modern norm. 40 hours is the best we can do for the foreseeable future even if we’re successful.

The difference is that women used to not have to work outside of the home. So you can divide that 60 hours in half. When men got home everything was done and ready.

Currently both the man and woman have to work and earn income just to maintain the bills and expenses for a family, then there is all the house chores. So effectively the modern work week is more like 80 hours.

This was done by the bankers that duped women into the fraud known as feminism, which convinced them that relying on your husband was a bad thing. Now women are forced to earn just to exist, effectively doubling the money stolen in the form of the fraud known as “income tax”.

This post makes inflation sound bad, but deflation is worse. Bread might be 5c but it doesn’t matter because minimum wage is 0.0001 c per hour. Beef Jeezer already makes millions by just having a lot of money. At least there’s always more of it for the rest of us to make some rather than cpt bald owning all of it.

Well, if inflation is bad and deflation is bad, why not have a currency with pretty much zero inflation or deflation? Aka, Monero.

The communist central banking fraud went into full effect once they stripped all value backing the toilet paper currency. Monero is here to put these communist scum in their place.

https://wtfhappenedin1971.com/

The fact that Beef Jeezers are allowed to exist is the problem with any of these systems.

this