- cross-posted to:

- fuck_ai

- cross-posted to:

- fuck_ai

Evolution of Capital Gains Tax in Canada

This inclusion rate increased to 66.67% in 1988 and to 75% in 1990. This lasted about a decade and in February 2000, the rate was reduced down to two thirds, which lasted until October 2000, where it was dropped back to 50%, where it has remained to this day.

1988 Mulroney increased

1990 Mulroney increased

2000 Chretien reduced and reduced.

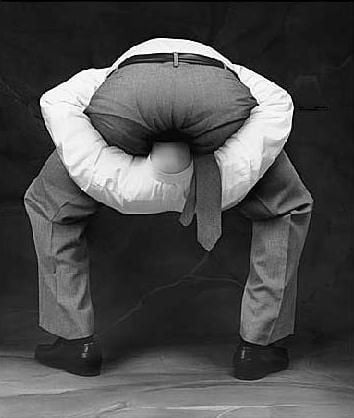

Notice anything?

Y2K?

Another Con con.

First off, taxpayers fork out good money for staff researchers for all parties so what they present is factual and responsible. Unfortunately, this PC dandy didn’t like, didn’t want, or didn’t ask for anything reality-based. Much better to use a shitty app for flawed and deceitful results to inflame the base. You know the base, the 2% of people across the country who aren’t worried about fact or figures, just how they feel. Unless the feeling is empathy, then they’re stone cold; dead on the inside.

Secondly, and inconveniently, it has been a historically proven fact that Cons increase deficits, lower monetary value and raise middle class taxes not to pay for expanded defence or social programs, but to make certain their election-funding mega-rich class enjoy all the perks of living in a polite society with paying one goddamn red cent for the privilege.

“Another island, Galen?”

“Yes.” “Here you go. It looks like your penis is flaccid, let me get that for you”And so on, and so on, and so on…

Chantal Hebert talked about it on the radio the other day, there are people who make 50k/year who are now convinced that their taxes will increase because of that…

I love Chantal Hébert. She’s one of my favourite parts of CBC election coverage. What a rad Canadian

Ooh, they a-scared

This is going to affect hard working Canadians (who make more than $250,000 a year in capital gains)!

It’s my belief that the guy is trying to be so embarrassing that he sweeps this video under the rug.

Feck. Can’t get that 3 minutes back. But, you’re probably right…

Imagine using an LLM for accurate numbers haha