At the end of WW2 most of the world’s major economies were in shambles, with a lot of international debt outstanding. Political leaders wanted to do something to handle that in order to head off what had happened after WW1, when international debts were defaulted on and countries started manipulating their markets to gain advantages over each other. The economic mess after WW1 had contributed to the making of WW2; being able to avoid any kind of a repeat was a priority.

So in 1944 economists and policymakers from 44 different nations, including every Allied nation, got together in Bretton Woods, New Hampshire, to work out some kind of agreement about how the world economy would work after the war ended.

The agreement they came to was that all the nations would establish fixed exchange rates with each other, and all nations had to agree to maintain convertibility of their currency to U.S. dollars. U.S. dollars, in turn, would always be convertible to gold at a certain rate. The agreement also established the International Monetary Fund and (what became) the World Bank to maintain this system and to provide a means of cooperation between the countries.

The representative from the U.K. (Keynes) wanted the system to be based on a made-up currency, but the U.S. threw its weight around and made it the dollar.

The system worked because of the economic dominance of the United States. You could count on the dollar. But it also meant that the United States had to be putting money out into the world, so that other nations had dollars with which to trade. The United States had to maintain a “balance of payments” deficit with the world. One way to do that would be to buy a lot of stuff from other countries and thus make dollars flow out, but we didn’t want to do that because we had a strong economy; we produced stuff here and didn’t need to buy it elsewhere. So the U.S. decided to just start donating money to other nations. Here you go Europe: a blank check to help you rebuild from the war. Here you go Asia: money to help feed your poor. And so on. We were fine with that because that money bought influence. The U.S. gained some say over how other nations did things.

This all started to break down when our position drew us into Vietnam. We were financially supporting South Vietnam when the North Vietnamese started fighting it, and so we got involved. First under JFK, then LBJ, then Nixon. We ended up spending over $130 billion in Vietnam ($1 trillion in today’s money). Add to that LBJ’s Great Society, which increased domestic spending. This all added to America’s debt, which began to impact the strength of the dollar and our ability to give money away to the rest of the world.

Here we are, printing money… but remember that we’ve agreed that dollars would always be convertible to gold at a certain fixed rate. The amount of dollars in existence was going up but the amount of gold was not. Or not as fast, anyway, and so it became harder and harder to keep that gold promise. France, having always been skeptical of America’s dominance of the system, literally sent a warship to New York to retrieve its gold in August of 1971. They got it, but they were the last to do so. Nixon realized that the end was nigh for Bretton Woods and declared an end to the gold standard a few days later.

================================

When Nixon ended the gold standard in 1971 the dollar quickly devalued and it started a period of high inflation. OPEC embargoed the US starting in late 1973, in retaliation for American support of Israel. The embargo and reduced output from OPEC caused recessions in other parts of the world, leading to tension between the US and some of its allies, who faulted the US for provoking the embargo.

Enter: the “petrodollar”.

Once the embargo ended the United States and Saudi Arabia, OPEC’s biggest member, worked out a deal. The deal was that OPEC would export oil only in dollars, keeping our buck on top post-Bretton Woods, and in return the United States would provide weapons and military assistance to the Saudis.

It kept us on top. You have to have dollars if you want to buy oil, to this day, and you have to get dollars from the US, ultimately. In 2000 Saddam Hussein decided to start selling Iraqi oil in euros. By 2003 5% of the world’s oil was produced by Iraq and was being sold in euros. Which… was right about the time a WMD mirage appeared somewhere in the Iraqi desert and the United States started shooting bullets its way. Maybe there was a connection.

The petrodollar is still the system today, though America’s influence in the world seems to be changing, maybe even waning.

As a snowboarder I always thought it was …peculiar… that our modern monetary system was agreed upon behind closed doors at a remote ski area.

Ski areas have some of the shadiest people at them, I swear. The amount of money laundering going on by the wealthy in supporting their pet causes and “investing” in property is mind blowing.

It’s gonna be a double whammy. Global oil demand is going to go down, and dollar payments will be a diminishing share of that.

But it won’t happen overnight. Unless of course something really big happens in the next 4 years that makes holding dollars a liability.

If some people in the upcoming government have their way, cryptocurrencies might be used to further destabilize the supremacy of the US dollar.

The petrodollar system is not a good or sustainable idea, but the gold standard is also a terrible idea, especially with modern technology. It already fluctuated wildly whenever there was a gold strike where it was able to be mined by conventional means.

You know how they say you can extract gold from sea water? You can, but it isn’t being done because it isn’t profitable enough.

You can sure as shit guarantee they would find a way to make extracting gold from any place on the planet (and maybe eventually off-planet) a priority.

I think the concept of Bretton Woods was a good one, better than either of those two, but it would need a neutral controlling world body rather than rely on a single nation and that ain’t gonna happen.

Unfortunately, I think things will continue to be super fucked-up.

Edit: Me no English gud.

I wanna preface what I’m about to say by saying I’m not a crypto bro. At any given time I’ve owned less than $500 in crypto, and currently I own none.

But this makes a great argument for crypto, or at least the idea of some forms of it.

Up until the past few decades oil ran the world because you couldn’t make or ship products without it. Oil touches almost everything, from fertilizer to farm tractors to shipping produce across a country, let alone all the gizmos and gadgets that eventually end up in a trash heap.

For the past few decades that’s being surpassed by tech and electricity. Tech runs the world now, and it needs electricity to function. (Hence all the geopolitical posturing around Taiwan, as TSMC is located there and they’re the only ones making computer chips to that level). Oil is still important, and we are a long way from getting rid of its importance, but it is being overtaken by computing power and electrical output.

Crypto is to computing and electrical output what the USD is to oil. Crypto requires vast computing and electric resources to make it secure and to me crypto backed money is an abstraction of the change we’re seeing in society as electrical output’s importance is starting to surpass oil output.

If crypto was fairly governed by some sort of world body that governments all participated in a la the UN, I could see it working.

The problem right now is it is just anarchy.

You’re talking to an anarchist, so anarchy isn’t a problem to me. I want less control by government not more. More control = more opportunity for corruption. More centralized = more government power. More decentralized = more power to the people.

To me the problem with crypto is that it’s really easy for people who currently have power to consolidate their power even further by buying vast amounts of crypto in hopes that crypto will take over fiat money worldwide.

I don’t have a solution for stopping bad actors, and that is one of many reasons why I’m not a crypto bro.

But in a perfect world it would make a great abstraction of trading on computing power. And unlike the petrodollar it could be backed by only renewable resources and climate friendly. But again, perfect world.

I don’t mean anarchy in the sense you mean it, I mean it’s total chaos.

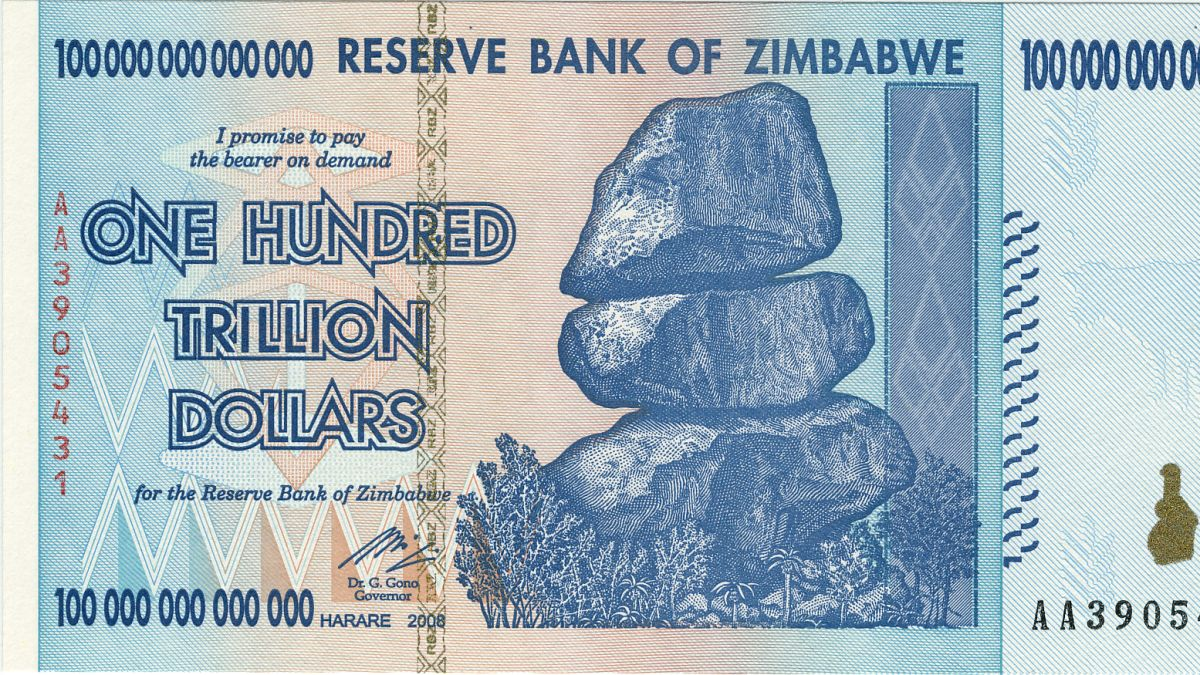

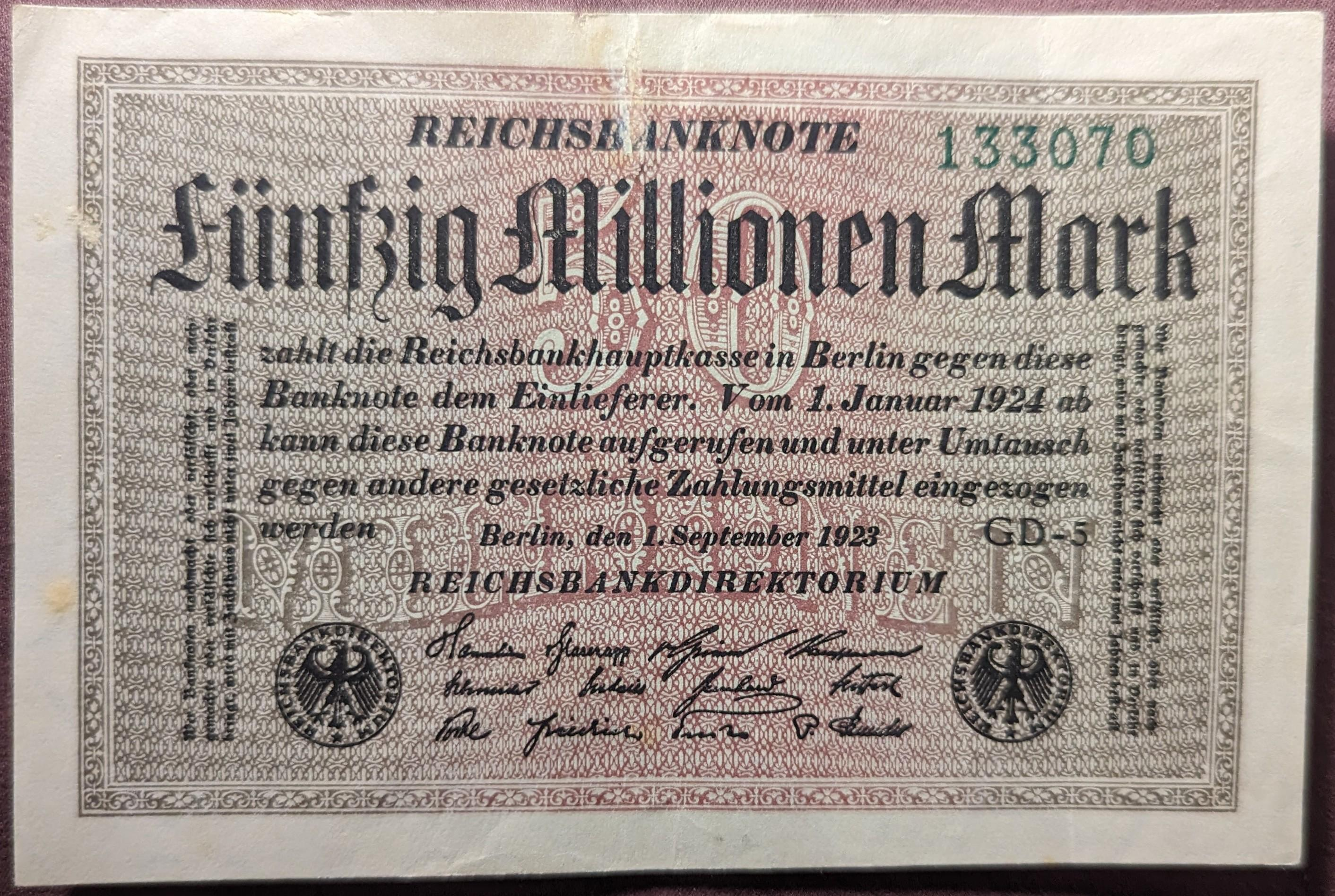

And no, in the case of currency, more decentralized means no one knows what the price of milk is from week to week. Currencies need stability or they are not very useful. Hyperinflation is not an imaginary scenario.

Those are not pictures of bank notes used by super rich people. Quite the opposite:

I don’t have a solution for stopping bad actors

Yes you do, you just don’t like it. The solution is a global governing and regulating body.

The limitations of computing power would regulate the value of the crypto, just like the supply of oil regulates the value of the petrodollar.

Governing bodies would just get corrupted. Gestures broadly at the world

One could argue that an OPEC like entity would emerge in the crypto space where they artificially control supply.

I’m not arguing in favor of crypto, I’m an ancom, I’d prefer a moneyless society entirely.

Who puts those limitations on it? Who gets to decide what those limitations are? Would those limits be baked-in forever (terrible idea) or changeable when new economic situations we might not even have thought of 10 years earlier arise?

Seems to me the global body I am talking about would be the rational people to be in control of all that.

As far as preferring a moneyless society, how would you propose people be encouraged to do dangerous but necessary jobs like mining for important minerals or servicing high voltage electrical cables if they aren’t going to be paid to do it? I think you’ll find that people generally don’t do those jobs because they think they’re fun.

The limitations would be innate. Especially if it were tied to renewable resources, there’s a finite amount of resources on the planet even with renewables which can’t be 100% renewable by default.

People work because they have an innate drive to do so. Look at firefighters and search and rescue for example. Most are volunteer (at least where I am) and they run into burning buildings to rescue people for no money. Or they’re hiking into remote wilderness in awful conditions (deep snow, -20F outside, high winds, miles from civilization, huge cliffs to fall off of and die) to rescue lost skiers and hikers. Hell there’s plenty of rich people who could retire yesterday and live their lives out drinking Mai tais on the beach without a care in the world and yet for some reason they still show up to work, because they want to.

I doubt people would be doing stupid pointless jobs pushing papers around in circles if they weren’t financially manipulated to do so.

Now just imagine how many US dollars are stored away in the vaults of this world just because the US$ is the “default valuta” for many business transactions. Anything dropping off that dollar in a big enough market will make countries to reduce those unproductive heaps of money. This would seriously devalue the dollar if said market is big enough, like oil. That’s why the US was not happy about the Euro, and that was the reason why hardliners insisted on war on Saddam Hussein - not because he had anything to do with 9/11, or being a piece of shit of a dictator, but because he dared to threten the US with offering oil for other currencies.

There are estimates that if the oil business would separate itself from the dollar, the dollar could drop to 10% of its current value. To 10%, not by 10%. That would be even worse than the economic massacre Trump is planning by tarriffs and work force deportation.

deleted by creator

Oh look, a libertarian gish gallop (it even quotes fucking Hayek) with absolutely no indication of who is behind the page.

But like good little capitalists, they made sure to put a link to a merch store.

It’s a site compiling a bunch of random graphs explaining how the American economy went to shot after the end of Bretton Woods, despite most Americans not realizing and living on as if their country still cares about them?

I don’t see the libertarian angle here so much. To me this is all speaking for Keynesian economics if anything.

Again, it literally quotes the god of Libertarian economics, Friedrich Hayek.

Graphs without context do not give a good picture of what actually happened. It certainly doesn’t discuss the negative effect Reagan had on the economy or the positive effect Obama had.

I agree the quote is not a particularly good addition, and the framing of “what happened” would be better answered by just telling people what happened. I just think it’s good to call on people to rethink economic structures, though arguably a Hayek quote foreshadowing crypto might not be the best way of doing it.

Interesting.

It is it’s own rabbithole

Not this neoclassical economics bullshit again: https://wtf1971.com/reading-list/

You’re right. I didn’t realize it was pushing bitcoin.

The only part you missed was the traitor Nader telling the Saudis to embargo to get weapons.