There’s a pretty popular savings chart in the personal finance community, and I just noticed it seems to be missing the option for when your employer offers an ESPP (Employee Stock Purchase Plan) unless I’m completely missing it.

Where would you guys put it if you could add it to this chart?

I think it’s much harder to add something like an ESPP to this kind of generic flowchart. There are too many ways to vary it, not to mention it’s a single investment in a single company. It would be hard to specify even a single category of stock to invest in that would apply to anyone at any time, let alone a single company. If you ask me about an ESPP for 10 different companies, I’d have 10 different answers.

Something like a 401k is fairly similar everywhere. You can’t recommend specific funds but nearly all 401k’s will have roughly the same options available and the vesting and matching options follow one of a handful of schemes so you can safely make a recommendation there without the specifics having a large impact on the outcome.

Ultimately, an ESPP is a taxable account and you would apply it there (at the end), if anywhere. Like any other individual stock, it should be considered as part of your overall portfolio. For example, if you work at a large cap tech firm, you may want to account for the additional risk you’re taking on by reducing your large cap investment and expanding other categories (note, this is not a perfect balance and is by no means a recommendation).

If you choose to manually build a portfolio (as opposed to a three- or four-fund portfolio) or you work with an active manager, you or your manager can fine tune it better.

an ESPP is a taxable account and you would apply it there (at the end), if anywhere

And that really depends on the terms of the ESPP. If it’s a big enough discount, you could prioritize it over some other parts earlier in the flowchart.

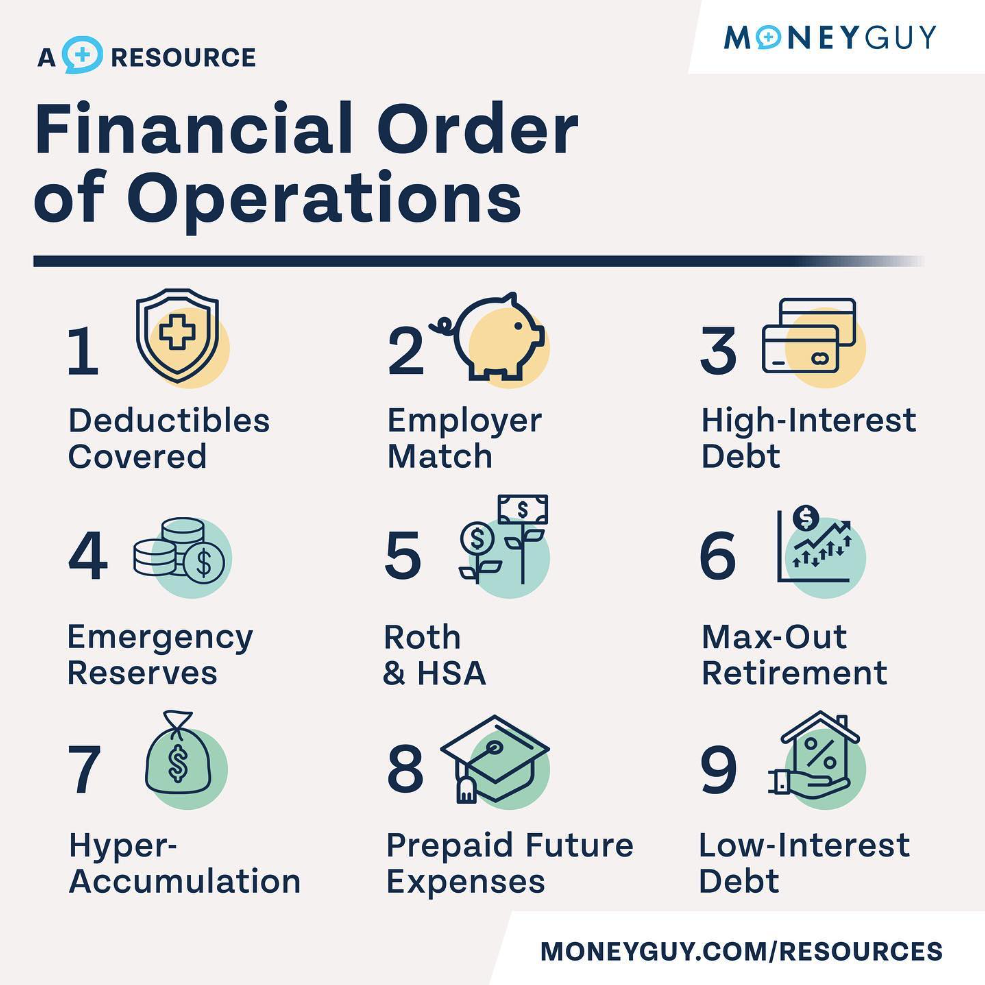

The flowchart shouldn’t try to account for every scenario, it should be a starting point for most people. I honestly think it’s too complicated and prefer things like the Money Guy’s Financial Order of Operations (FOO), because that focuses on principles instead of following a flowchart. Here it is in text, with some personal notes (image below):

- Deductibles covered - highest deductible, so you’re not screwed if something pops up

- Employer Match - free money; ESPP is also “free money,” but it locks up your money, so I’d push it off

- High Interest Debt - they have a metric for this, but generally anything other than housing >6%

- Emergency Fund - 3-6 months expenses, more if your job is sketchy, less if you’re dual income and can survive on one

- Roth & HSA - specifically talking about individual, tax-advantaged investment plans, in case you’re not in the US

- Max out retirement - bit of a misnomer, they say max 25% of income

- Hyper-accumulation - 25% of income

- Prepaid Future Expenses - fund kids’ college funds, prepay cremation/burial expenses, etc

- Low-interest debt - mostly just mortgage for most people

Even here with a simplified priority system, the ESPP could go in 2 (if it has a low max), 5 or 6 (if the discount is good enough), or 7, or even none of the above if the holding time is longer that you feel comfortable with. It really depends on the company, terms, and your personal risk tolerance. You can go above 25% of income toward retirement, but they actively discourage it because that could put you into miser territory, and recommend giving if you don’t have anything useful to spend excess on.

ESPP is only really done in huge companies, and the terms vary too widely to be added to a common calculator. When I had one, though, I could sell right away. And the purchase price had a few different ways of being calculated, and they applied whichever was lower, so sometimes my effective discount was 25% or more.

I just cranked that shit up to the max, and sold most of it right away. I kept a small portion from each purchase as a side investment, just in case they screwed me over. I considered it my own personal severance plan, built up essentially for free.

Definitely. Mine is basically min(first_day, last_day) over a 6 month period. Able to sell right away and 15% discount.

You already have so much tied to your job that I dislike adding to it.

My understanding of ESPP is that you’re just buying at a reduced rate, say ~10%, and are allowed to sell after N time, say 3 months? So you’re “guaranteed” 10% of what you’re allowed to purchase? Factor in half of that going to taxes and what if the market is down - I had a hard time rationalizing it.

Would be curious where others rank this as well.

half of that going to taxes

That’s unlikely, unless you’re making millions. Long term capital gains tax caps at 20%, and short-term capital gains are taxes as income, and most people are around the 12%-24% brackets. The IRS defaults to 22% for bonuses, so that’s a much better number to use for estimates. State taxes vary, but 10% is completely reasonable as a high estimate, so figure 1/3 going to taxes.

That said, nothing is guaranteed. If your company is reasonably stable, buying ESPPs should work out long-term, provided you get them and cash them out consistently. I’d wait a year for the LTCG rate personally, and sell them regardless of how they’ve done. If they went down, take a capital loss as a tax deduction, and if they go up, take a capital gain. If you follow that strategy as unemotionally as possible, it should work out.

That said, it really depends on the discount, required holding term (ESPPs can be locked up for 3 years), and the rest of your financial situation. I’d definitely place it after you have a basic emergency fund, but if it’s generous enough (i.e. short minimum holding time), I’d maybe consider it as an employer match if you have a fallback plan if you lose your job (e.g. can live w/ family, SO works, etc). But in general, I’d put it after your regular tax-advantaged retirement account contributions, and before regular taxable account contributions, because skew to your portfolio should be minimal long-term if you’re consistently rebalancing into a properly diversified portfolio.

Generally agree. And some employers don’t even offer much of a reduction, such as only 5% off. And only after a longer waiting period, like 6 months.

On the tax aspect, I think the most tantalizing part of ESPPs is to get a quick return by selling right after getting the discounted shares. At which point, any positive ROI after short-term taxes is still free money. So while taxes depress the potential gains, it still yields a positive return. But I agree with you that instead of taxes, market movements can easily wipe the gains entirely, and that alone is reason enough to just not bother with 5% or even 10% ESPPs.

It’s never a guarantee and anyone who believes that shouldn’t be investing in the market. But it would also be fair to say many (most?) don’t understand the nuances of an ESPP.

I took part in one when it was available to me. I just built it into my overall risk profile. It was a fairly stable company and our discount was 15%. We had to hold it for two years for the cost basis to show the discount for tax purposes to incentivize holding on to it. It would be extremely unusual for the discount to be wiped out even if you held on to it for two years or more - but as you point out, it’s not impossible. It also came out of payroll so to be honest I couldn’t cut a ton out of every paycheck anyway, at least not without sacrificing other parts of the portfolio and increasing my overall risk.

It’s not just a free bonus but I think it can be a good way to get a little boost as long as you consider your whole portfolio and how any restrictions may affect that return.