- cross-posted to:

- [email protected]

- news

- politics

- cross-posted to:

- [email protected]

- news

- politics

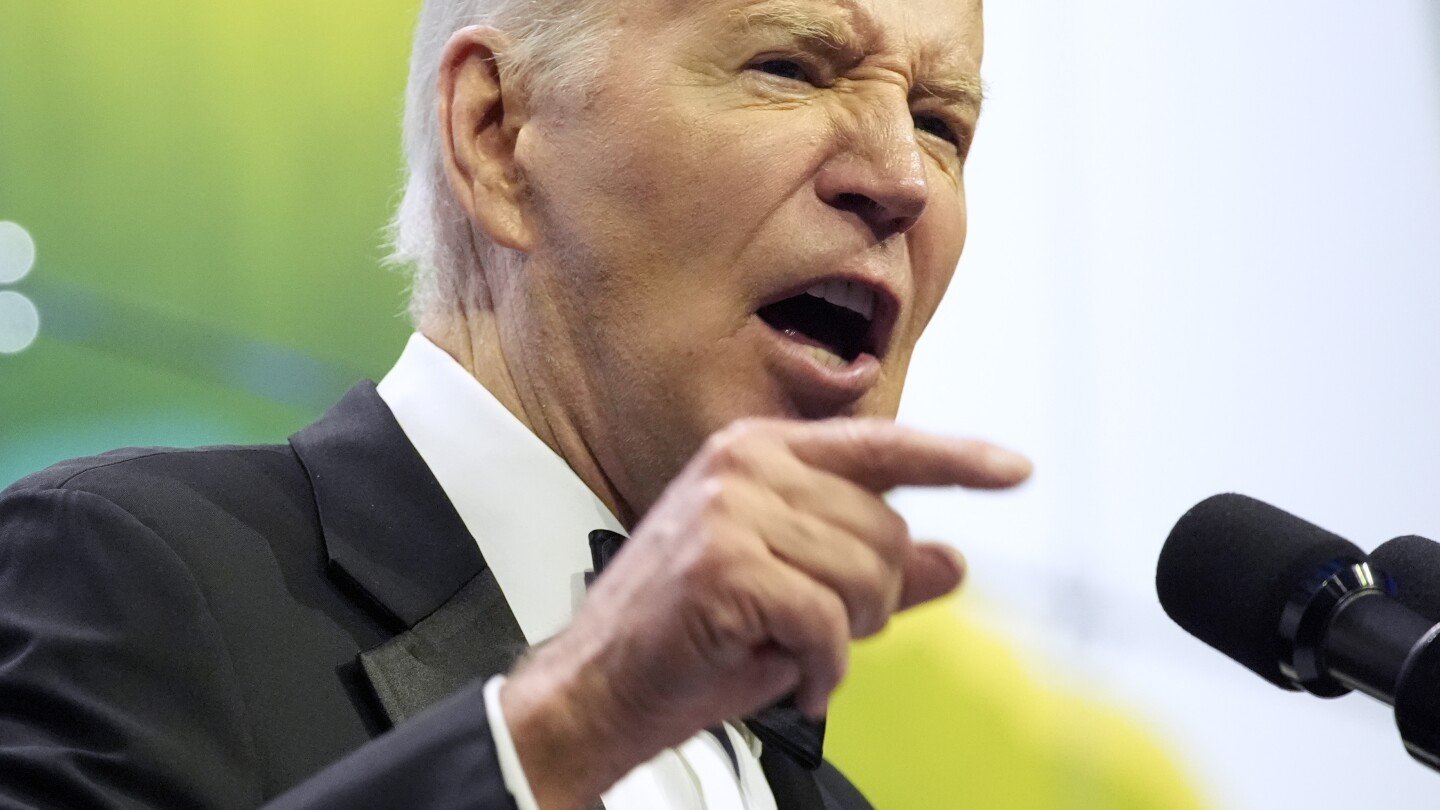

The Biden administration has told key lawmakers it is sending a new package of more than $1 billion in arms and ammunition to Israel, three congressional aides said Tuesday.

It’s the first arms shipment to Israel to be announced by the administration since it put another arms transfer — consisting of 3,500 bombs — on hold this month. The administration has said it paused that earlier transfer to keep Israel from using the bombs in its growing offensive in the crowded southern Gaza city of Rafah.

You still have to pay USA income tax abroad unless you renounce your citizenship.

Not necessarily. There is a foreign earned income exclusion, so if you pay income taxes on it in the country where you’re living you don’t pay taxes to the US.

Up to a max. So paying a little in the foreign country will not invalidate ALL taxes owed in the US. You might still owe some. Just FYI.

$126,500 per person, plus another $20,240 in housing expenses. Plus your $13,850 standard deduction (though if you’re making that much you’re probably itemizing for more). So $160,590 for an individual or $321,180 for married filing jointly. That’s assuming no kids and no other deductions or credits - which is pretty unlikely at that income level.

$160,590 is the 93rd percentile for US income distribution. So yeah, if you (AND your partner, if any) are both in the top 7% income bracket, bad at tax preparation, and don’t hire an accountant, you might still pay tax on the income over that amount. Of course, making that much while keeping the kind of ethics that let you care about anyone other than yourself is a nontrivial endeavor.

Don’t forget that your foreign employer won’t be reporting to the IRS. So if your protest extends to not voluntarily reporting that excess income …