- cross-posted to:

- economics

- cross-posted to:

- economics

Claire*, 42, was always told: “Follow your dreams and the money will follow.” So that’s what she did. At 24, she opened a retail store with a friend in downtown Ottawa, Canada. She’d managed to save enough from a part-time government job during university to start the business without taking out a loan.

For many years, the store did well – they even opened a second location. Claire started to feel financially secure. “A few years ago I was like, wow, I actually might be able to do this until I retire,” she told me. “I’ll never be rich, but I have a really wonderful work-life balance and I’ll have enough.”

But in midlife, she can’t afford to buy a house, and she’s increasingly worried about what retirement would look like, or if it would even be possible. “Was I foolish to think this could work?” she now wonders.

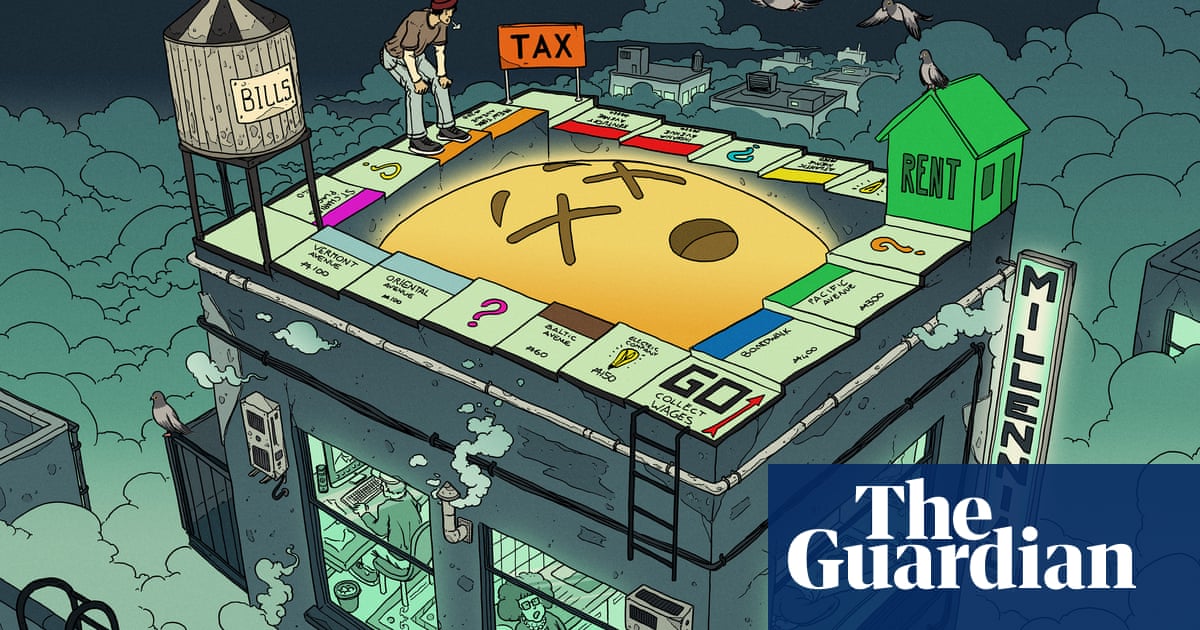

She’s one of many millennials who, in their 40s, are panicking about the realities of midlife: financial precarity, housing insecurity, job instability and difficulty saving for the future. It’s a different kind of midlife crisis – less impulsive sports car purchase and more “will I ever retire?” In fact, a new survey of 1,000 millennials showed that 81% feel they can’t afford to have a midlife crisis. Our generation is the first to be downwardly mobile, at least in the US, and do less well than our parents financially. What will the next 40 years will look like?

Of course I’ll retire, when I can no longer get a job, and that time is coming up fast. I only hope it’s not until I get my teens through college and off to a running start. I don’t see how I can afford to keep my house or even continue to live in this town, though

I’m not sure I agree with the narrative about being worse off by generation, though, because it is so tied to what you do. I’m a little sad about my older son starting adult life “in hard mode”: i’m proud that he wants to teach, and we live in an area with generally better teacher pay, but he’ll never earn much. It has certainly made my life easier to be paid better as a software engineer, even if circumstances mean I’m not financially able to retire. He’ll almost certainly live with less, have fewer opportunities, purely by choice of career, and without regard to his generation. Tack on the excessive housing inflation and his desire to stay in a hcol state, and I can’t help but worry for him

On the plus side, your son will likely have an amazing pension. His retirement is probably more guaranteed than yours!

Plus social security. OUr effing politicians keep procrastinating on fixing social security, so the biggest impact will be when they are forced to at the last minute, when I need it most. My kids will have lived through that, seen social security fixed, and live in better demographics for it to stay fixed

It doesn’t need to be fixed they just need to fund it. The open secret is they’ve stolen money from ss for years.

Social security is funded by government bonds.

Bonds are just a promise the government makes to pay a certain amount of money at a certain amount of interest after a certain time has passed.

They aren’t stacking gold bars in fort Knox.

(They might or might not be stacking gold, they just aren’t paying for social security that way.)

SS has always been a funded by the promise to pay it. I don’t understand what you mean by “stealing”

No one has been paid less than they are owed just because SS ran a surplus for 60 years.