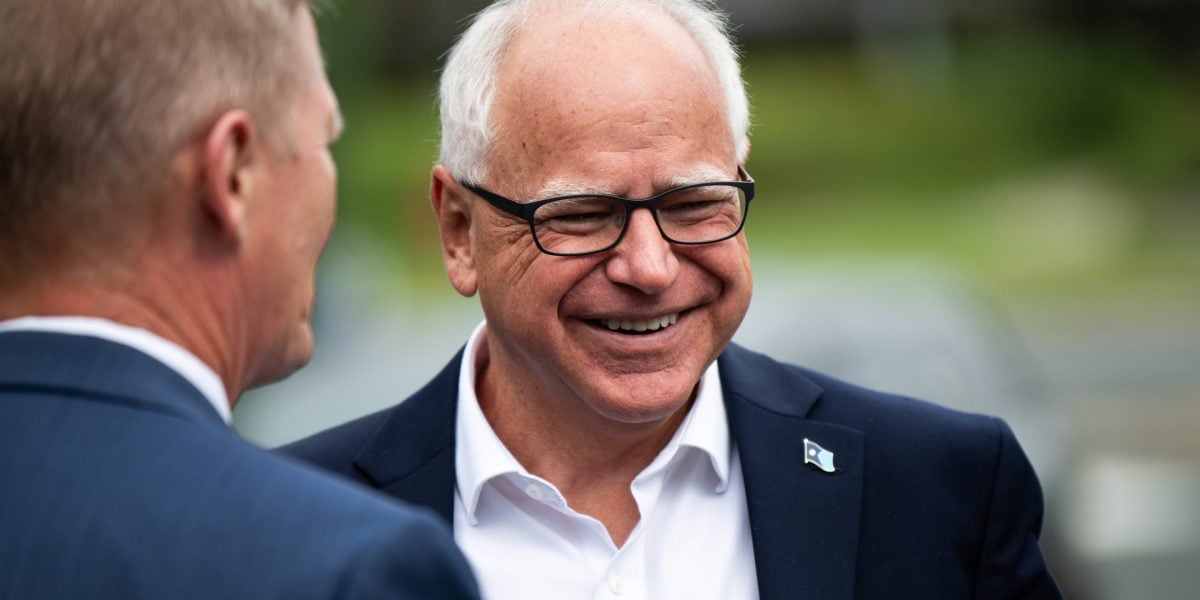

The all-American working man demeanor of Tim Walz—Kamala Harris’s new running mate—looks like it’s not just an act.

Financial disclosures show Tim Walz barely has any assets to his name. No stocks, bonds, or even property to call his own. Together with his wife, Gwen, his net worth is $330,000, according to a report by the Wall Street Journal citing financial disclosures from 2019, the year after he became Minnesota governor.

With that kind of meager nest egg, he would be more or less in line with the median figure for Americans his age (he’s 60), and even poorer than the average. One in 15 Americans is a millionaire, a recent UBS wealth report discovered.

Meanwhile, the gross annual income of Walz and his wife, Gwen, amounted to $166,719 before tax in 2022, according to their joint return filed that same year. Walz is even entitled to earn more than the $127,629 salary he receives as state governor, but he has elected not to receive the roughly $22,000 difference.

“Walz represents the stable middle class,” tax lawyer Megan Gorman, who authored a book on the personal finances of U.S. presidents, told the paper.

deleted by creator

Yeah…that doesn’t answer my question. That only answers how the IRS treats income from the pension.

You can derive income from assets can you not? Am I misunderstanding assets? I would view rental property as an asset and you can get income from that. I would view a 401k as an asset and you can get income from that.

If I say I’m worth $500k more because of my pension. How does that have anything to do with the IRS?

deleted by creator

Maybe if I put this another way I can get some clarification on your position?

You have two people. Person A and Person B. Both have emergency funds in savings of $20,000. Person A has a 401k currently worth $500,000. Person B has a pension currently with a cash lump sum value of $500,000. Neither has any real estate, nor other investment accounts, but neither has any debt either. I would say they have the same net worth of $520,000. If I’m understanding you correctly, you would say Person A has a net worth of $520,000 but Person B has a net worth of $20,000. And it would be illegal and against accounting rules to include Person B’s pension in net worth calculations.

I’m seeing plenty of resources online that even go so far as to include instructions for finding a value of the pension for calculating net worth.

https://livewell.com/finance/how-to-calculate-value-of-pension-for-net-worth/

https://www.sapling.com/12011834/factor-pension-net-worth

https://networthcalculator.io/calculate-pension-in-net-worth/

https://www.lazymanandmoney.com/pension-net-worth/

And then this article finally showed up on my third page of results when searching for “do you include pension in net worth” and it at least mentions that it’s debatable whether to include it or not. And this article is for Canada. https://www.moneysense.ca/columns/ask-moneysense/should-you-include-your-pension-in-your-net-worth/

This is why I’m so confused. And you’ve been the most adament that it’s a big no-no. I’m not trying to argue with you. I’m seriously confused and trying to understand what I’m missing.