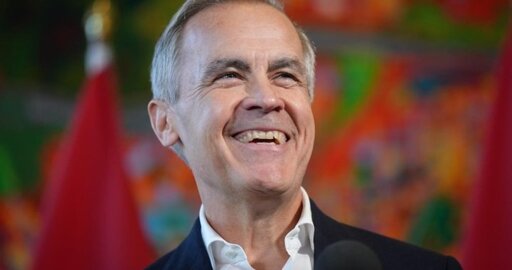

Carney said he’s propose “some big changes and some bold new ideas” in the coming weeks to address those economic issues. He vowed the Liberals “are going to win the (next) general election” despite the party’s months-long polling slump under Trudeau.

Bold. Let’s see what these new ideas will be. If he focuses on strengthening labour and mass building public housing he may as well be right about winning the election. I highly doubt that’s the direction he’ll go though.

E: And I watched his speech and while most of it didn’t raise red flags, I did hear “far left” and “we can’t redistribute what we don’t have” which are generally neolib red flags. 😂 On the other hand he did say that wages are too low and have to go up.

I have trouble imagining any politician will do anything substantial about housing. If housing becomes affordable, everyone who owns loses some huge percentage of their life’s equity. (Imagine being stuck paying a mortage for a 700k condo that is now worth 400k.)

Not saying we shouldn’t fix housing but any politician who does fix it knows they will have a substantial proportion of the populace furious at how much they’ve lost. To make it worse, the losses would be concentrated among the elderly who outvote those who would most benefit, younger voters, by a depressingly large margin.

Yes but if we’re bold, there’s a known solution to this that isn’t obvious to us people who’ve been brought up in the neolib era. Introduce strong public pensions while building / devaluing housing. Most of those people count on this equity as their retirement. They have to sell and downsize or reverse mortgage to access it. A strong public pension would allow these folks to stay in place. Heck you could even offer government reverse mortgages that serve as / pad their pensions for people with housing equity. As they pass away, redevelop the properties into affordable housing. The prices of people’s homes going up only matter if they need to profit from them. I think for the vast majority of Canadian home owners this is only the case because they don’t have a decent pension. Remove that problem and people’s homes become places to live and their prices cease to matter. Just like the price of the microwave oven they have.

I can’t imagine some scheme like this wouldn’t be popular with enough people to get a broad majority support.

There are probably other bold schemes too.

Now do I think Carney would propose anything like this? Hell no. :D

If you use pensions to pay the complete difference, that gets insanely expensive. Just some rough calculations:

Let’s just look at 10 million homes. (There’s somewhere between 14 and 16 million but let’s knock a lot out just to not quibble.)

Again, we’ll take a very modest price decrease, 200k that doesn’t make housing affordable per se but would be an impressive market correction.

That totals to 2 trillion dollars, significantly more than all the federal taxes received in the last decade (Total fed tax revenue was about 180 billion for 2023)

So, we clearly can’t afford to just offset the loss in equity with a publicly funded pension, or even half that.

People might be able to survive on a much lower amount but even giving back a mere 10% of the lost equity would be more than literally the entire Federal budget and still leave most people pretty upset about the lost 90% difference.

These ideas usually sound good until you poke around at the numbers.

One detail is that the drop in value that we’re replacing with pension is payment over time, not a one time hit, just like the home owner would draw from the equity till they pass away. So a 700K house would be eaten by 35K every year for 20 years or so.

But we don’t have to even consider that. You’re working from the inflated home values backwards. That way you’re making us pay for the speculation. We don’t have to. We’re trying to make the inflated prices irrelevant, not pay the speculators. With that, if you work from pensions forwards you get a different result.

Say we want to add $1500/mo to every person over 65’s income. Coupled with the existing government pension and supplements, this should total 2500-3000/mo. We have ~7800000 in this group (2023 numbers).

7800000 over 65 * 1500 * 12 = 140400000000 = 140.4B. Note we haven’t removed the 4.5M people with defined benefit pensions, or the 1.2M with defined contribution pensions. We can either subtract that and get to 37B or we could get employers to pay into the universal pension system instead, or we could free them from it and have wages rise proportionally or increase corporate taxes. With a universal scheme there is also 3-5% yearly compounded savings that would otherwise go through bank commissions, straight up to the 1%. If you ignore all that and divide 140.4B by the 20.7M working population, you get an additional cost of 6.7K/yr. This doesn’t look impossible and again, it will be lower since it’s double counting a lot of money that are already being contributed by DB/DC.

For cross reference - there are plenty western countries with sustainable universal pensions. We cannot be too out of the ordinary and if anything we’re in a better position to have it, given that we have better demographics and a boatload of natural resources.

We have to pay for the speculation otherwise from the homeowner’s perspective, they have again just lost all that value, regardless of how it was acquired. That’s literally the whole issue.

And it’s kind d of odd to say that if you have defined benefits, you won’t mind losing however many hundreds of thousands of dollars you lose when your home value drops. People are doing their financial planning including both their defined benefits AND the values of their assets.

You can’t just hand wave and say there’s infinite money if we just raise wages or tax corporations more. We probably could tax corps more but there’s all sorts of secondary consequences to that.

I don’t believe this is true and I speculate there are good reasons enough homeowners (like me) will sign up for such a scheme. For example that this shields them from the risk of devaluation which can happen in number of unrelated ways. Another example is that many are worried and understand their children will not be able to afford a home unless prices fall. Ultimately the only way to know for sure is to see how people vote on a proposal like that. Homeownership is around 60% so you don’t even need most homeowners to go along with this for it to have broad support. I’m just speculating enough will. Could be wrong.

I didn’t do that. I did a back-of-the-napkin feasibility calculaton like you did and I think it shows what I suggested is feasible. No more, no less. If other first world countries have such schemes and are doing alright, likely we could too.

How does your scheme protect from devaluation? If my home drops say, 200k but you’re going to offset some of that in pensions, okay, let’s put aside the lost equity, how does this stop me losing say, half the equity in my home from some random devaluation?

Providing a living pension doesn’t mean I’m no longer interested in the investment I’ve spent 20 years paying off…

This is not a napkin calculation, this is handwaving!

The value of what I proposed is 320K. If I signed up for the scheme, I will get 320K guaranteed by the government pension and I no longer care what my home is worth. If I don’t and the market crashes for whatever reason, I lose whatever the market shaves off from my property’s equity. I guess you wouldn’t like this deal. I would. ☺️