I was horrified by the contents of one of my Finnish mutual funds when I looked into it after years of disinterest. I’m especially disgusted by UnitedHealth Group Inc - the health insurance company whose mass murderer CEO got shot recently, sparking nationwide cheers.

As a passive investor, you’ll forget your money into the wrong hands when the bank won’t remind you of developments in the political situation.

Ålandsbanken promises:

“socially sustainable”

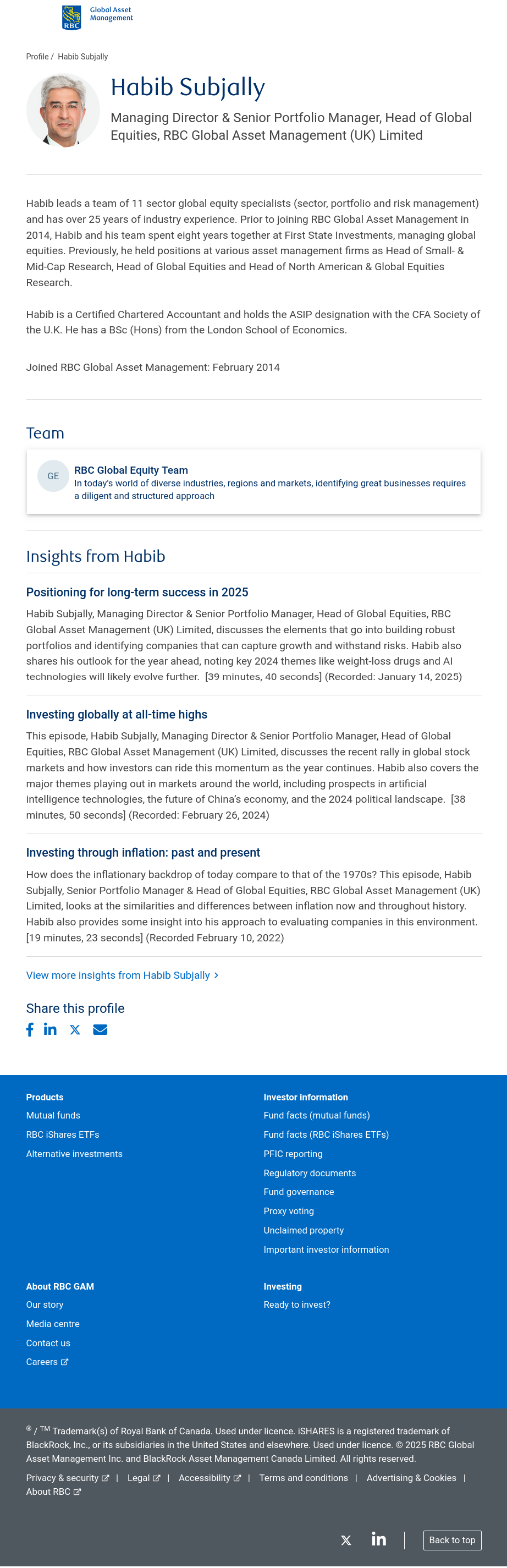

You may assume your bank is civilised, but you should have a closer look. I’m a customer of S-bank in Finland. In this case, the fund ended up under a different Finnish bank twice due to buyouts, and the management of the fund ended up in a Canadian bank branch in the UK.

My other bank didn’t recommend selling my Russian investment when Putin’s reign had started going overdue after his full term as a president. Luckily I was awake and sold everything.

Investments drift out of balance over time. Within mutual funds, there are limits, but the funds grow at different rates. You should re-balance your diversification once in a while to avoid excessive country risk.

I don’t know if fund managers are bribed to distort the balance within the fund’s limits for the benefit of a third party.

My fund is managed by that guy. I sold everything. Will reinvest in Europe.

You need a fiduciary. Mine handles things like this, and gives me a yearly update on what I’m invested in. The two investment strategies I have her employing are primarily investments that help transition society to an ebviromentally sustainable model, and businesses that will have to clean up disasters waiting to happen.

Congratulations, you are invested in DISASTER CAPITALISM.