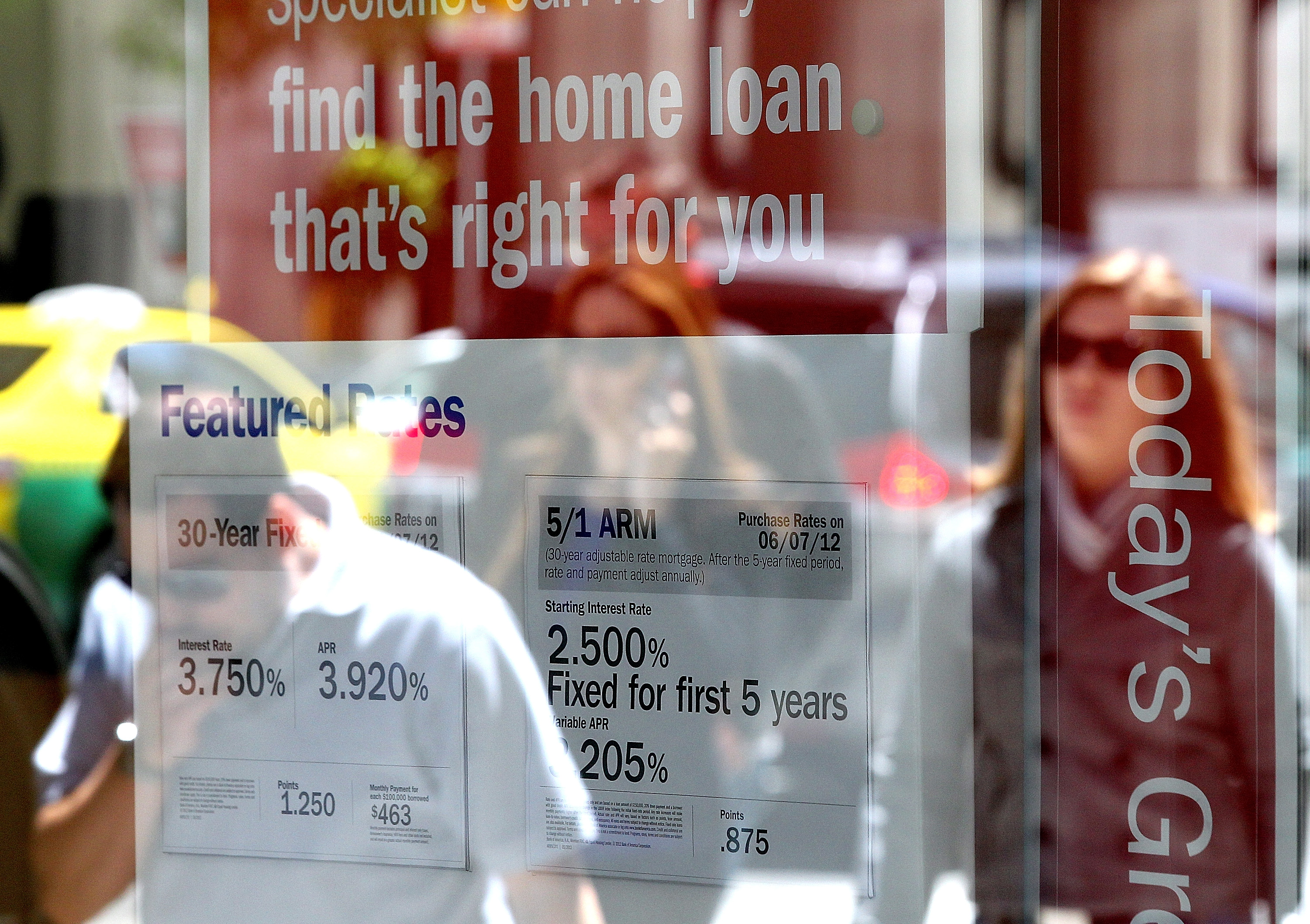

Housing economists are urging the Federal Reserve to hold back on raising rates, worried that elevated borrowing costs—that have gone up since the central bank began its hiking cycle in March 2022—have pushed mortgage rates too high and made homes unaffordable for many Americans.

Sales of homes dropped 2 percent in September to a little under 4 million, the lowest such level for more than a decade. The decline, which was a 15 percent plunge compared to a year ago, according to the National Association of Realtors (NAR), was the latest evidence that expensive mortgages are dissuading potential buyers from purchasing homes.

We own ours outright and would love a slightly bigger house. But there’s no way we’re doing >8% interest. Not at the inflated price of houses these days.

We just bought ours in June and there is almost a 3% difference in mortgage rates between then and now.

Yeah we just decided to blow the 50k we had saved for our 5 year plan and redo half the house we are in now. We’re at ~3% with less than 10k left on 475/month payment (no escrow). Well double up and pay that off next year and most likely die in this house of old age.

We’re exploring that option. The people who first owned the house when it was built must have had twins. One of the BR is double size and all the fixtures (lighting, window, etc) are mirrored. We’re just having trouble getting someone out here to see what it would take to split it.

We had six quotes all over 5k to move about 6 outlets and a 220v thermostat. Eventually we found a guy willing to come and walk me through it (I’m handy I just don’t fuck with anything not low voltage) for 800 bucks.