The great baby-boomer retirement wave is upon us. According to Census Bureau data, 44% of boomers are at retirement age and millions more are soon to join them. By 2030, the largest generation to enter retirement will all be older than 65.

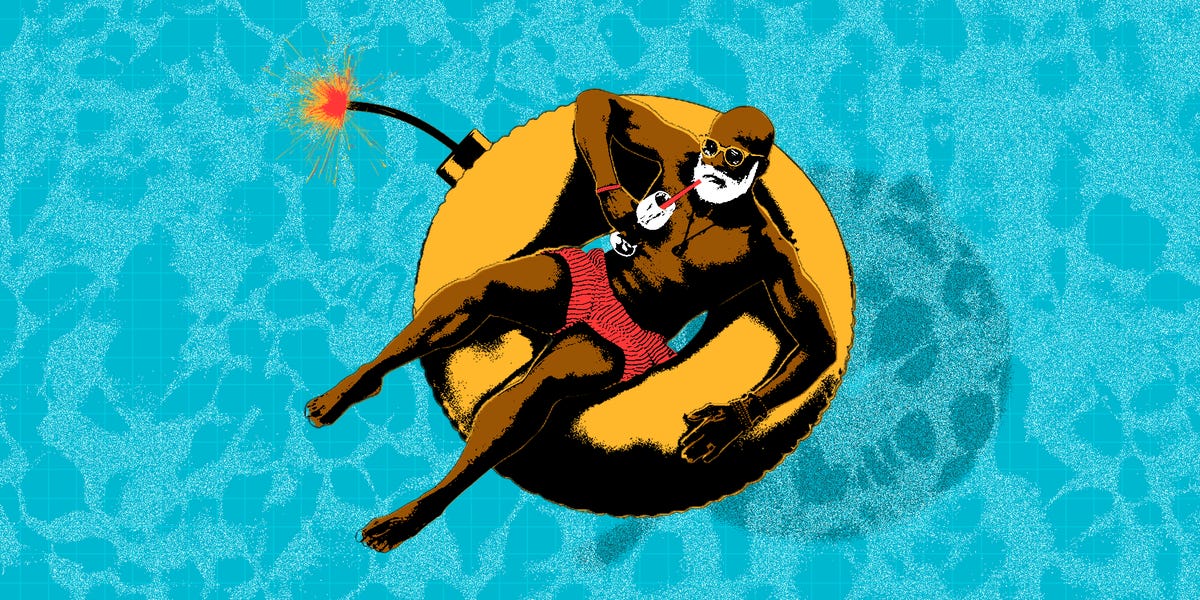

The general assumption is that boomers will have a comfortable retirement. Coasting on their accumulated wealth from three decades as America’s dominant economic force, boomers will sail off into their golden years to sip on margaritas on cruises and luxuriate in their well-appointed homes. After all, Federal Reserve data shows that while the 56 million Americans over 65 make up just 17% of the population, they hold more than half of America’s wealth — $96.4 trillion.

But there’s a flaw in the narrative of a sunny boomer retirement: A lot of older Americans are not set up for their later years. Yes, many members of the generation are loaded, but many more are not. Like every age cohort, there’s significant wealth inequality among retirees — and it’s gotten worse in the past decade. Despite holding more than half of the nation’s wealth, many boomers don’t have enough money to cover the costs of long-term care, and 43% of 55- to 64-year-olds had no retirement savings at all in 2022. That year, 30% of people over 65 were economically insecure, meaning they made less than $27,180 for a single person. And since younger boomers are less financially prepared for retirement than their older boomer siblings, the problem is bound to get worse.

As boomers continue to age out of the workforce, it’s going to put strain on the healthcare system, government programs, and the economy. That means more young people are going to be financially responsible for their parents, more government spending will be allocated to older folks, and economic growth could slow.

You don’t need an excuse to not be retired. Plenty of people just don’t have the means to retire so are still working. Or plenty of boomers are housing or at least helping their millennial kids with bills and therefore don’t retire. Why should a 69 year old who is still totally active leave their job, which puts their mental and physical health at risk all while moving to a smaller, fixed income at a time of crazy price increases just to make room for other people to make more? They’re getting screwed by grocery prices and insurance spikes too

Because their job is as an executive and they just play with their own buttholes all day.

If some executive retired, do you really think you’d just step into their shoes? That is not opening a job for a millennial.

Before anyone says that will let everyone shuffle up a bit, letting each level improve, I also wanted to point out the number of executives is very small, relative to the entire cohort. Even if they all stepped aside, that’s just not opening many spaces

Exactly. My generation needs our shot at fucking things up first!

Of course I wouldn’t. I’m totally understand qualified and uninterested. But I’m telling you most of the corporations around here are run by old guys going on “business trips” in mexico who got their job through their golf buddy. And they don’t do much aside from wander around chatting all day, collecting a salary equal to 4 of the people actually producing value.