Depends on how they did it. If they just let it happen it would be catastrophic. Or, instead the government could seize the banks, print money until the liquidity is resolved, then take an equal amount that they printed out of circulation.

Once the crisis is over, sell or liquidate the banks. You know, like a free market would normally do, instead of corporate welfare and protectionism.

Something something privatize profits socialize losses.

Banks being unable to pay off their clients would result in a great depression-like economic crash (think about the movie, it’s a wonderful life at the end). Not to say that this wouldn’t be horrible as it would rebalance the ratio of wealth by basically taking all the money from rich people and destroying it. It would also raise the value of the dollar by increasing its scarcity. It would bankrupt companies as they would not be able to borrow money in order to stay afloat. Basically it would screw over everybody except for people that don’t use banks

It would screw over people who don’t use banks as well.

Yeah grocery stores run on pencil-thin margins, and many of them rely on lines of credit to get through their day-to-day.

Banks in this scenario would suddenly be unable to fulfill credit lines and now a grocery store is left unable to purchase goods to fill their store.

It hurts anyone who eats fucking food which is all of us.

Lines of credit are usually private net 30/60 agreements with suppliers, not through a bank.

If a grocery store is operating under debt, it needs only raise prices to cover the difference. Not paying interest to banks would become a cost savings.

The people who the bank would payout, with the 20% fractional that they hold in reserve?

Yea, that’d be the rich people. The rich might lose some money, but the rich are never going to go hungry, not even in this scenario, that’s just not how life works.

Reserve requirements have been 0% for a while now. Banks don’t actually have any money.

So if you’ve ever heard of a bank run, that, a whole lot of that.

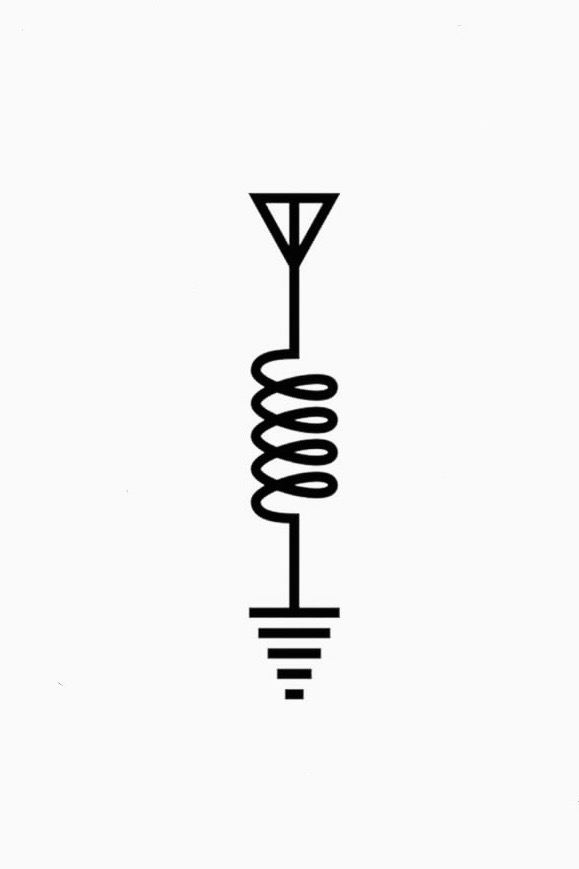

Banks “make” money by using the money in people’s accounts to make loans with the intention of being paid back with interest.

This is called fractional lending and seems like the slyest move ever until everyone learns not all their money’s in the bank anymore and everyone comes running not wanting to find out they were the account owner left holding the bag after everyone ahead of them depleted the available funds.

If in a bank crisis like there was in 2008 the government doesn’t organize a bailout, a lot of bank runs will happen.

Now for the average joe, there’s the social security system which will cover up to 100k in money lost in a bank collapse, so most folks aren’t gonna be royally fucked if this happens.

The problem is that when the crisis is big enough, the government now has the issue of there being no banks left standing to put everyone’s payouts into. Either because of their own bank runs or because they saw they wouldn’t get a bailout and either shuttered the doors or cancelled plans to open any new banks in this new state of affairs where banks can’t expect federal assistance in a random crisis event.

Now for the average joe, there’s the social security system which will cover up to 100k in money lost in a bank collapse

In the US, FDIC insurance covers up to $250,000 for most depositors.

Just adding NCUA is the credit union equivalent for protection.

Some banks would fail. The FDIC would likely step in and guarantee 100% of deposits given their last record. Some investors would lose out.

It wouldn’t be as bad as 2008. The big problem with 2008 was that mortgage backed securities were extremely popular investments and many were used as leverage for additional loans, then turned out to be potentially worthless. Realizing the loss on those securities could have triggered a massive loss across the whole market.

So most people would get their money back, eventually. The FDIC insures deposits up to $250,000 per account, and they made the dangerous precedent of securing beyond that in a failed bank recently. The reason they did this is the disruption the collapse of a bank will have in the economy.

In today’s world, companies don’t have a safe onsite with 2 weeks of payroll - we consider the banking institutions secure and further, we leave accounts in the bank for even that little bit of interest. I’m a small business owner, and my payroll is left in my revolving business account, where I remove excess income to my personal accounts (again in the bank), and I have little cash on hand. Intuit pulls the payroll every 2 weeks and drops it in… the employee bank account. The only time physical money is held is when one of us pulls out cash for some reason.

So if my bank collapses, the FDIC will pay me back, but it will take a few weeks. The money I had sitting for payroll is lost until then. The personal money I had past that is likely in the same bank and tied up as well. I will have more money coming in from revolving income… except some of those customers might use the same bank, so they “have” the money to pay me, but can’t access it. So I can’t pay my employees, or my phone company, or credit cards… until everything is fixed. I’m a small employer, so imagine a $50 million company suddenly unable to pay out anything. The economy breaks down because we trusted the bank to hold all the money - and the bank collapsed.

It can be said that banks realize they are “too big to fail” and act recklessly investing, knowing they will have to be supported if their investments fail. I support a more seamless collapse process for large banks, so disruptions are smaller and society can function smoothly as they go under. Without that threat, they have no incentive to reign in.

I just saw Betterment’s cash reserve accounts can go up to $4 million per person for FDIC.

Crypto would moon.

People might actually realize that the entire fiat money system is a giant scam and switch to using something real such as gold, silver, bitcoin, or Monero since they are actually scarce and can’t be manipulated by a central government and devalued to hell.

Yes, that’s the future. Let’s all switch to bitcoin, so only 6 people can buy things every minute, worldwide.

I actually don’t like Bitcoin particularly well because of its transparency and so I personally use Monero. which due to its dynamic block size can support more transactions per second.

Edit: Bitcoin can do seven transactions per second or 420 transactions per minute. So while I get you, six transactions per minute is an exaggeration to the downside.

20% of global gold production is in control of China and Russia. Russia can dump gold on the market whenever they want to crash the price. Like in the 1990’s when gold was $300 an oz.