The Biden administration announced it would automatically cancel education debt for 804,000 borrowers, for a total of $39 billion in relief.

This seems to be on a much smaller scale than the initial plan, if I’m reading this correctly, and targets folks really in need. Mainly this seems to be targeting people who have decades old debt because they literally can’t afford to pay back their loans - which seems totally fair. Many students took out loans with the promise from their peers and guardians that “college will be a worthwhile investment and you’ll make your money back”. That was obviously a lie for these borrowers as the price of tuition and stagnation of wages has guaranteed that promise is dead. This will ultimately be good for the economy and is an example of government working to help the people - so Republicans will hate it.

They should just allow bankruptcy to eliminate student debt like other debt. We have debt amnesty for the needy under virtually any other circumstance except this one.

People go “but people will just go to college then declare bankruptcy!” – I mean, they could do the same for medical debt but most people want to have a credit card, a car, or a mortgage in 7 years if they’re on the path to the middle or upper class so most people try to pay their debt.

Using that process also solves the problem of taking money from the poor who work and never went to college and potentially handing it to the rich who just havent paid off their student loans yet.

I want to agree but at the same time can see a major flaw that we need to think about and fix.in a fair way.

Other loans assess the person taking it out and their ability to repay. Under that assesment who would loan to students who have no job yet (I know both sides are being promised college is good for pay). If you didn’t immediately get a job out of college then you go bankrupt and they can’t reposes the knowledge and so the price would have to go up for those that do get good job and don’t drop out and go bankrupt.

How did this get around the recent Supreme Court ruling? I’m curious about the legal mechanism being employed here.

Setting aside the fact that the SCOTUS ruling was totally out of step with the law to begin with…

This is not really debt forgiveness. This is ostensibly just correcting clerical errors that were being consistently made by the last several administrations in the DOE.

They’ve been mishandling these loans egregiously for a long time, demanding debtors pay more than they should ever have needed to and failing to properly consider appeals and reconcile issues.

I would bet this project to identify and correct issues has been going for a long time in parallel to the other debt forgiveness plans. No way it was a small amount of work or a spur-of-the-moment decision.

Announced. They can announce a lot of things they don’t ultimately do because the executive isn’t supposed to make laws and spend money they haven’t been given by Congress.

Yeah this is true but this forces the opposition to be on record being like “no fuck you” and there’s an election coming up where the young vote is very critical

You likely don’t remember the last time that happened, and when the next thing like this comes along you’ll probably completely forget this time. And by the next time, youll definitely have forgotten this time. Politicians rely on abusing this fact. Its how they continue to stay in power.

Yeah that’s pretty fair

Besides the fact that Republicans weaponize hypocrisy while Democrats try avoid it…

So no, both sides remember. One side just pretends like they forget lmfao.

They announced that they did it, not that they will be doing it. https://www.ed.gov/news/press-releases/department-education-announces-actions-fix-longstanding-failures-student-loan-programs

And the Supreme Court is supposed to be a court of law.

Sadly, as they have decided to move away from that, the least the executive can do is ensure that the law is being correctly applied in cases where it favors the people.

RTFA.

This already happened. It’s not a plan. It’s not executive action or changing the law, either. It was a clerical cleanup project to get loans off the book. Loans that already should have been properly identified as cleared, but which the DOE had previously mishandled and fucked up, forcing individuals to believe they still owed more payments than they legally should have.

Because the DOE has been an incompetent clusterfuck when it came to these loans for multiple administrations. Likely multiple decades.

Biden administration forgives $39 billion in student debt for more than 800,000 borrowers PUBLISHED FRI, JUL 14 20237:00 AM EDTUPDATED 29 MIN AGO thumbnail Annie Nova @ANNIEREPORTER WATCH LIVE KEY POINTS The Biden administration announced it would automatically cancel education debt for 804,000 borrowers, for a total of $39 billion in relief. The debt cancellation is a result of the administration’s fixes to repayment plans, which included updated counts of borrowers’ payments.

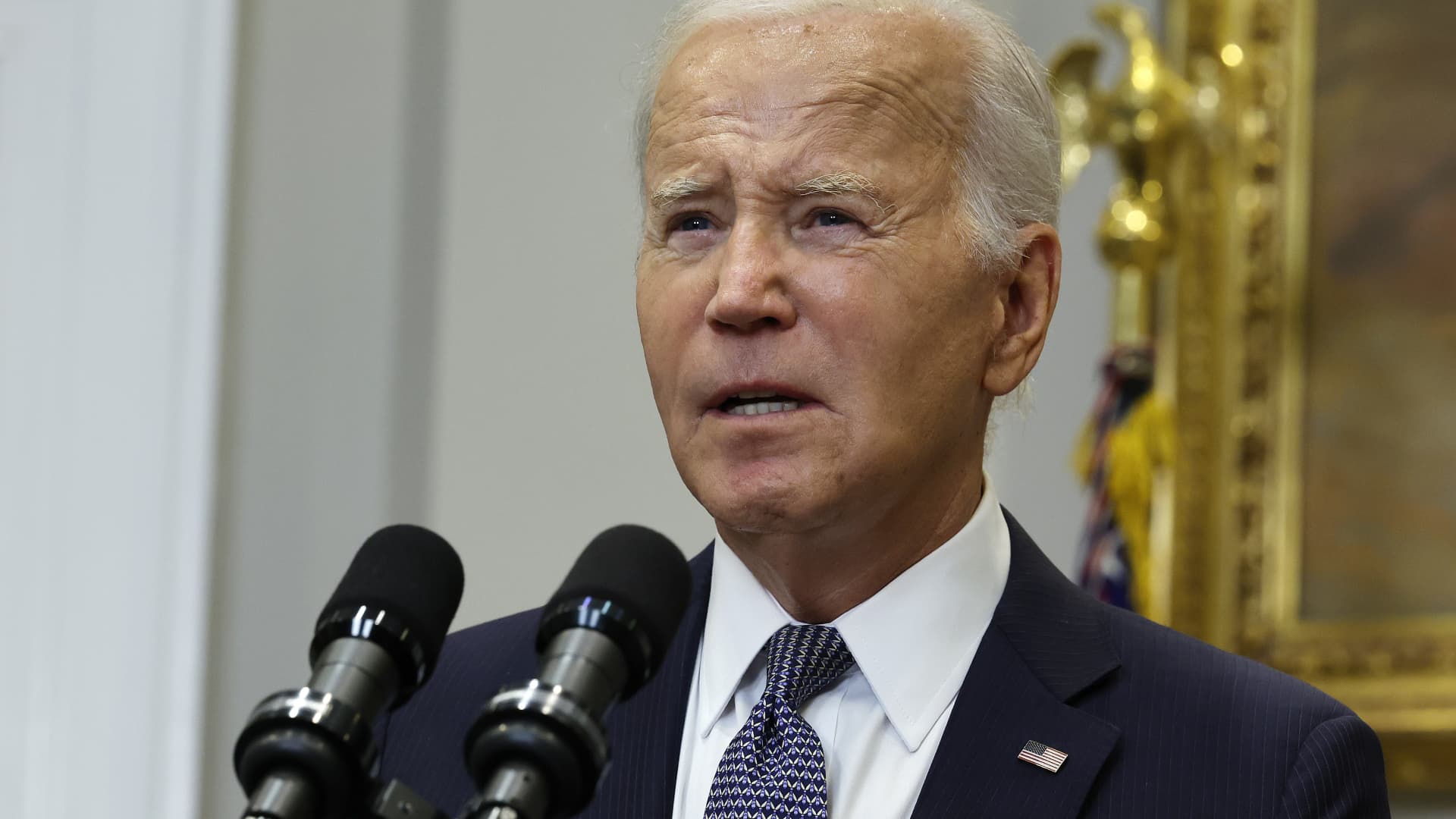

President Joe Biden announces new actions on June 30, 2023 to protect borrowers after the Supreme Court struck down his student loan forgiveness plan. President Joe Biden announces new actions on June 30, 2023 to protect borrowers after the Supreme Court struck down his student loan forgiveness plan.

The Biden administration announced Friday it would automatically forgive $39 billion in student debt for 804,000 borrowers.

The relief is a result of fixes to the student loan system’s income-driven repayment plans. Under those repayment plans, borrowers get any remaining debt canceled by the government after they have made payments for 20 years or 25 years, depending on when they borrowed, and their loan and plan type.

Just got a letter from the DoE. Had to post it here 'cause after near thirty years, Dobby is free!

Arotrios,

On April 19, 2022, the Biden-Harris Administration announced several changes that will help borrowers get closer to or achieve forgiveness under income-driven repayment (IDR) regardless of whether or not you have ever participated in an IDR plan. With these changes, you are now eligible to have some or all of your student loans forgiven because you have reached the necessary 240- or 300-months’ of payments under IDR.

The U.S. Department of Education will work with your servicer to process your IDR forgiveness over the next several months. If you would like to opt out of IDR forgiveness for any reason, contact your loan servicer no later than 08/13/2023 and tell them that you are not interested in receiving IDR forgiveness. Some reasons why you might want to consider opting out include concerns about a potential state tax liability.

If you decide to opt out of IDR forgiveness, you will be expected to continue paying your loan(s) once the student loan payment pause ends.

Loan Servicer Information

Don’t know who your loan servicer is? Log in to StudentAid.gov, find “My Aid,” and select “View loan servicer details.” You can also call us at 1-800-4-FED-AID, and we will connect you with your servicer.

If you have federal student loans with multiple servicers—or if your loan(s) is being transferred—and you want to opt out of IDR forgiveness, you should contact all your servicers with eligible loans.

If you don’t opt out, here’s what happens next:

We will send your information to your loan servicer(s) after 08/13/2023.

Your loan servicer(s) will notify you if and when your IDR forgiveness has been processed. It may take some time for your loan servicer to process your forgiveness and for your account to reflect this change.

If you have loans with multiple servicers, each servicer will notify you if and when they have applied forgiveness to your account with them.

President Biden and the U.S. Department of Education are committed to supporting borrowers and ensuring they get the credit towards loan forgiveness that they are entitled to. Learn more about IDR forgiveness and the one-time account adjustment actions the Biden-Harris Administration announced last year.

Note: This letter is not an attempt to collect a debt or a demand for any payment.

Beware of Scams

You might be contacted by a company saying they will help you get a loan discharge, forgiveness, cancellation, or debt relief for a fee. You never have to pay for help with your federal student aid. Make sure you work only with ED and our loan servicers, and never reveal your personal information or account password to anyone.

Our emails to borrowers come from [email protected], [email protected], or [email protected]. You can report scam attempts to the Federal Trade Commission by calling 1-877-382-4357 or by visiting reportfraud.ftc.gov.

Hey that’s great! As someone who paid their own way through college by working full time too I’m glad to see others are getting a break. A better educated populace is a benefit to everyone, and it’s not a zero sum game. Go pop some champaign if you haven’t already!