Did trump just set the new speed run for a Republican ruining the economy after a Democrat fixed it?

Sorry to anyone having to retire right now

Well two thirds or more of their portfolio should be in bond markets if they are close to retirement.

Everyone here mentioning billionaires and missing the point that the Russian agent in charge is just doing his best to deliver any and all assets to Russia. Sanctions getting lifted just as the fire sale on American assets begins right before the civil unrest. If you’re a Russian dictator you could not have planned it better. Republicans are seriously the dumbest mother/sister fuckers on the planet. I can’t even believe how fucking stupid you’d have to be to hold “conservative views”. Like it does not compute how you can be that dumb

Like it does not compute how you can be that dumb

Easy, lack of education (or even actively detrimental ‘education’), courtesy of decades of Republican sabotage of the education system

But I thought Trump was going to make the economy great again /s 🤣

He’ll issue an executive order establishing that the market can only go up

Change to down color to green.

He disbanded the US government agency that develops the annual GDP numbers. Guess how they’ll figure those out next year?

If you guessed “we’ll make some up that are higher than last year” then you’re spot on.

The numbers will go up. Nobody knew they could go up. It’s unheard of.

Remember, immigration is down by over 100%!

Signing those with his big-boy Sharpie is about al he knows about actually governing lol

I mean for the longest time it only has gone up… And that’s not sustainable

https://www.macrotrends.net/1319/dow-jones-100-year-historical-chart

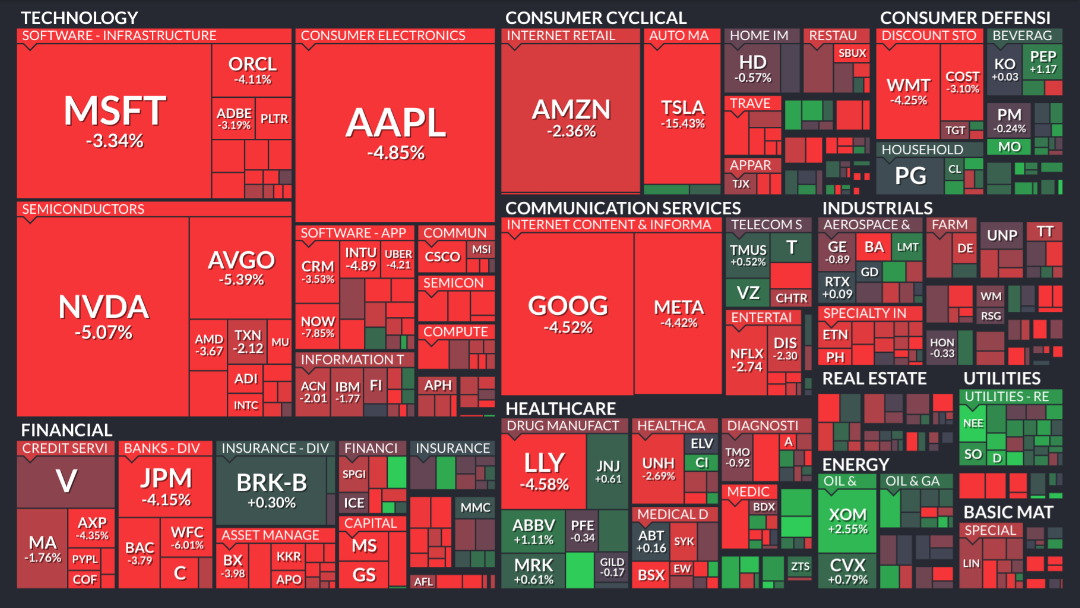

Perfect time to buy

He will. But not for us.

iT BiDeN’S EcoNMY! /j

He didn’t tell us how bad it was, so we added tariffs on everything.

I think he’s doing this deliberately. Encourage people to sell, so his buddies can scoop up stocks at low prices.

it’s so much more than stocks. stocks are mostly vibes and short term get rich schemes for already wealthy people. they’re Pokemon cards for the finance class, creating almost nothing tangibly beneficial to society. hype and FUD in an endless cycle.

you can’t eat stocks. you can’t warm your house with stocks. you can’t manufacture solar panels with stocks.

real wealth, the serious fuck you Big Money, depends on the ownership and distribution of real resources: real estate, agricultural land, factories, pipelines, commerical buildings, capital infrastructure. these are what the ultra wealthy buy up during recessions and then charge rents and leases for everyone else to pay, forever. forget about owning land or a home, your kids can’t compete with someone paying cash on a 600k house or snatching up entire portfolios of hundreds of rentals in a single purchase.

bailouts and blank checks given out as PPP loans to “business owners” during Covid redistributed wealth from the taxpayers (government) into the hands of the wealthiest people in the world. they can then convert their Pokemon collections into real wealth generating resources. government bailouts to corporations become an engine for not just making the rich richer but the types of assets they then acquire using that money cements them at the top of the wealth generation food chain forever.

Trump 2.0 is engineering another massive redistribution, even bigger and more focused on real estate than before. he made his fake reputation on real estate. loyalist oligarchs who bank rolled dark maga will be handsomely rewarded with the newly emptied government office buildings and public lands.

and your kids and grandkids will be homeless.

I used “stocks” as shorthand. I agree with what you wrote.

yup, I’d buy apple or microsoft or nvidia because they are going down now but will go up certainly in 1 or 2 days or even weeks/months. Except tesla, this one will go down and down and down for days/weeks/months, tesla stock is super toxic, dump all of it.

I agree and I bought Nvidia. There will be a bounce up soon.

The problem is, nobody else knows how low the prices would be.

One of the things almost no one talks about is how the prices of luxuries has totally outstripped inflation.

In 1960, minimum wage was $1.00/hour, the average US home was $11,000.00 and a big night on the town was $20.00 for dinner and a show for two people, with drinks and car fare thrown in. Pizza and beer at home was $1.00. A ticket to the first Super Bowl was under $20.00.

It’s crazy that with a tariff on energy, utilities and energy are up lmao.

Welcome to inelastic demand. They take a percentage of what they charge, and they have to charge more because of the tariffs, so they basically get to take more for free because you have to pay more for it, and you have no choice in the matter.

Oil companies were the biggest contributions to the project 25

This is intentional. The billionaires are salivating waiting in the wings to buy up as much as possible when the prices are low.

Billionaries just short the stocks and make tons on the way down as well.

Recession speed run.

Only if we’re on the any%, this is looking like a 100% run so more like ‘Depression’

This is going to be the second Great Depression.

It is going to impact the entire world.

Notable differences from the last Great Depression:

Many countries have many nuclear weapons.

Something like 6 billion more people exist.

Climate change is accelerating, and this will make food more expensive everywhere, as opposed to a regionalized Dust Bowl, as well as causing more frequent and more severe natural disasters basically everywhere… and the more time passes, the more expensive it will be to mitigate this.

Perhaps also worth noting:

Japan argued the US’s oil embargo on it as functionally a declaration of economic war.

History is replete with examples of embargoes and massive tariffs being considered a justification for escalating a trade war… to an actual war.

Rip my year-old IRA…

From the article:

“We see some irony in the recent outperformance by foreign markets over the U.S. markets. In our view, foreign companies in Europe, Asia, and Latin America are likely to suffer even more from deployment of tariffs than companies in the U.S.”

I think they are overestimating the amount of trade flowing into the US. Tariffs will directly impacg US companies and customers, but they’ll also decrease the demand for foreign products. That will cause a challenge, if not outright recession worldwide, but I still think that foreign companies would be able to mitigate the drop in demand from the US better than US companies coping with supply shortages and higher prices.

Economic downturns are WHAT REPUBLICANS DO 👏 crab cakes and football 👏

We should create a WallStreetBets Lemmy community here to discuss our possible trades.

bUt doNaLd is a gREat bUSinESs mAN! /s

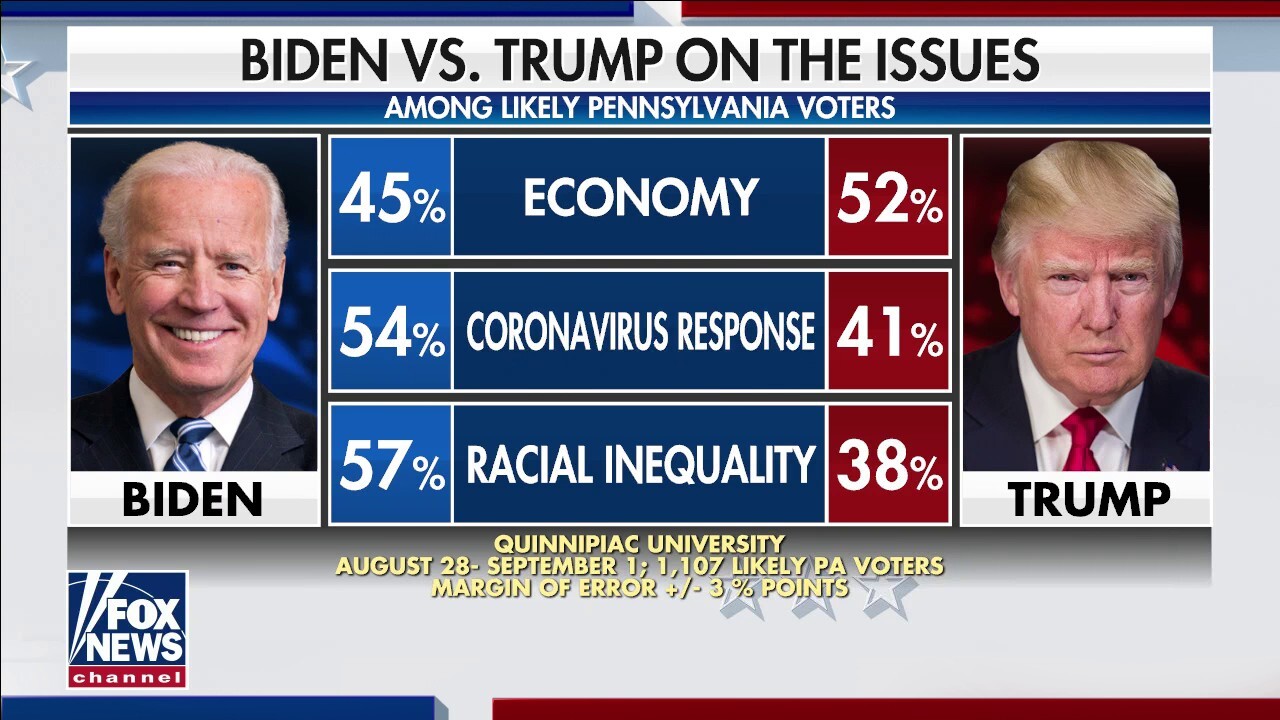

The people have spoken! Trump is so much better for the economy! /s

Damn the people are dumb as fuck

So. Fucking. Dumb.

Margin of error +/-52%.

Every time I see these two side by side I think of the smiler and the beast from transmetropolitan

Recent recessions have shown that the top 1% get richer after the recession. It makes sense when you think about the super rich having the cash to invest is now much cheaper stocks and property while everyone else is struggling to make ends meet.

So I wonder how much the Nazi and the monkey want to avoid a recession. The monkey does not have to worry about reelection and the Nazi is a psychopath.

It only happens because WE bail them out. The biggest lesson I got from 2008 was that we should have let most of those big companies fail. Instead, they got to walk away with a fat check from us, and we got fuck all for it. Now they’re trying to cut the regulations that stop them from doing the exact same thing again.