There were 4,664 new listings of detached, attached and apartment properties last month, a 15.4 per cent increase from a year earlier, as new listings were 4.8 per cent above the 10-year seasonal average.

Yea, 6-7% interest rates will drop demand at the current prices.

Not seeing much progress on prices dropping though, they’ve levelled out, but we’ll have to see if this is just a plateau or if they will actually start decreasing at some point.

If they just level out for a long while, it will give wages a chance to catch up… it should only take a couple of centuries, right?

But honestly, I am curious what the math would look like on house prices holding steady, with inflation still acting on everything else, until housing is again affordable.

Did some quick math based on a CTV article. The article claims $347,000 is what would constitute “affordable” with Vancouver’s 2021 median household income. Applying inflation the the “affordable house figure” based on the assumption that all the factors that are used to calculate that figure are being effected proportionally, works out to 60 years for the median house for sale in Vancouver to be considered affordable to the household with the median income.

I actually did the math on this a while back.

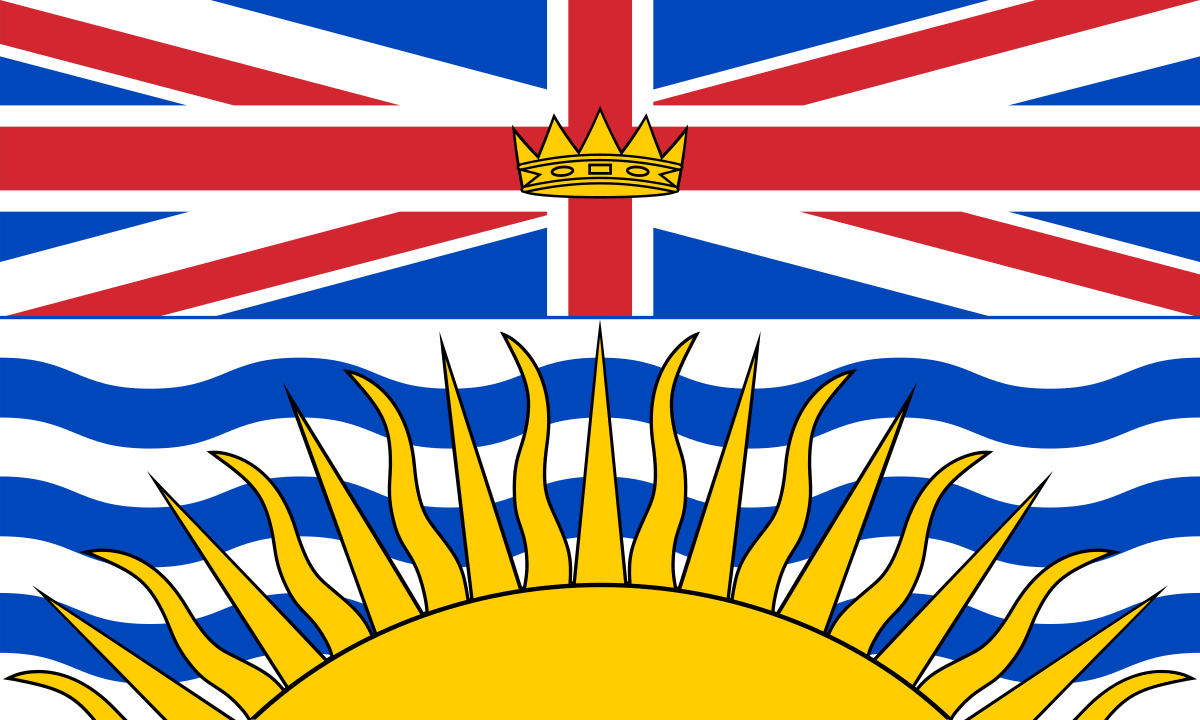

Wage inflation is slower than CPI inflation, so if you used the average wage inflation rate from the last 30 years it came out to reaching Affordable* housing in Victoria, BC in around 80-90 years assuming housing prices stay fixed.

*Affordable is using the government definition of 3x median family income.

Essentially everyone currently alive needs to be dead…

Prices are sticky, they’ll take some time to drop. But when they do, I don’t imagine it’ll be a slow linear thing. Add in the new rules about short term rentals (which should deter speculators who have until now been able to weather interest rate hikes) and I’ll be stunned if there isn’t a major correction before too long.

People will take a long ass time before they finally admit they can’t sell their house for the price it would have sold for last year.

They will probably keep them listed at the inflated prices until they finally realize the amount of taxes theyre paying on a house they don’t need to hold on to.

Um, I’d like “unbelievable made-up statements by people looking to profit off it” for $200, Alex.