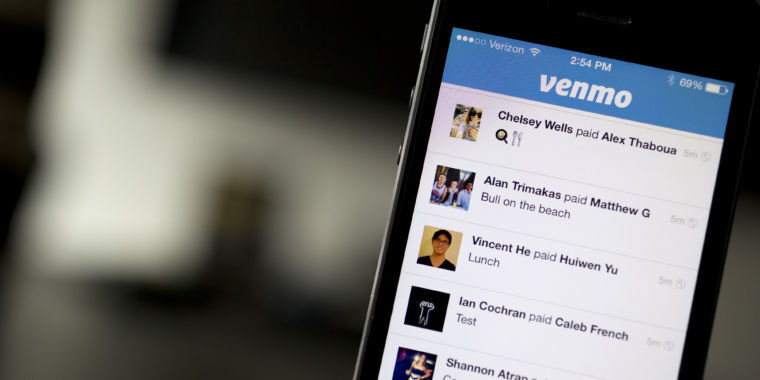

Consumer Finance Protection Bureau wants to regulate Venmo, Apple Cash like banks | Digital wallets and payment applications would be affected by move.::Digital wallets and payment applications would be affected by move.

Good. They are banks.

Anything the CFPB wants to regulate I’m 100% in favor of. The CFPB is an AMAZING tool to push back against corps with horrible customer service (to be fair Apple’s customer service has always been good for me). I’ve used the CFPB to get a corp to reply to me after brushing me off.

If money is involved at all and a business is giving you the run around I encourage you to file a complaint. They have to contact you with a few days and they actually want (or are required) to solve your issue.

The customer service might feel good, but it’s very overpriced, overreaching and thus in my opinion bad. Additionally there are close to no alternatives, thanks to apple being anti consumer.

This is the best summary I could come up with:

The proposal issued by the Consumer Financial Protection Bureau on Tuesday would subject non-bank companies that offer digital payments to a regulatory scheme similar to that for banks or credit unions.

“Today’s rule would crack down on one avenue for regulatory arbitrage by ensuring large technology firms and other nonbank payments companies are subjected to appropriate oversight.”

The CFPB said that having large non-bank companies “play by the same rules as banks and credit unions” would help “promote fair competition” between depository and non-depository institutions—an important theme for Chopra, who advocated for tougher antitrust policies in his former role at the US Federal Trade Commission.

In a speech last month, he said he feared the US was “lurching toward a consolidated market structure, like the one that has emerged in China, that blurs the lines between payments and commerce and creates the incentives for excessive surveillance and even financial censorship.”

The CFPB in 2021 requested big tech groups to turn over information on their payment systems including data harvesting, user choice, and other consumer protections.

The consumer watchdog is seeking to expand its authority even as federal agencies contend with the fallout from a US Supreme Court ruling that raised questions around their rulemaking powers.

The original article contains 539 words, the summary contains 205 words. Saved 62%. I’m a bot and I’m open source!