If the USA didn’t have such a complicated tax system, with companies like Intuit lobbying to keep it that way so they still make money, this wouldn’t be an issue.

A lot of countries automatically fill out your entire income tax return for you, and send it to you to verify it. If it’s all good, you just need to accept it. Less than five minutes work.

What’s it like in other countries for business owners? Because in the US, if you own a business (even a small one where you are the only employee) and try to do your taxes on your own, may god have mercy on your soul. Even doing it through an accountant is a total pain in the ass

At least here in Romania, it’s the job of the accountant(s) to do the company’s taxes. If you’re self-employed or run a very small business (less than 10 employees) there are self-employed accountants who specialize in that and typically have 20-40 clients.

In France it’s about three clicks every month to pay your social contributions for a small business

Then at the end of the year they send you a stupidly complicated form that makes no sense whatsoever, but if you go online you can do it incredibly easily

Intuit tried selling QuickBooks here, but withdrew from the market as there are so many free invoicing apps

Not sure about business since I’ve never had to deal with business tax returns.

If the USA didn’t have such a complicated tax system

For 95% of the public, its not complicated. Its just getting all the independent pieces of information from different private agencies.

- W2 from employer

- 1098 from your mortgage company

- 1099 from your retirement account firm

- Prove you have health insurance

- Prove you have student debts

- Prove you have a small business and you’ve tracked your receipts

- Prove you have children

- Prove you paid taxes to your state

Once you have all the numbers lined up, its simple arithmetic. Easy for a computer to do.

But knowing who to ask for all the individual chunks of data is an obnoxious chore that only one organization does particularly well. And that organization - the IRS - won’t tell you the information they have. They want you to guess and tell them what you have, so they can tell you if you got it right or not.

And that organization - the IRS - won’t tell you the information they have. They want you to guess and tell them what you have, so they can tell you if you got it right or not.

This really needs to be fixed.

In Australia, the stuff the government knows about you gets prefilled in the tax return form. Not as good as other countries where the entire thing is completed for you, but better than the USA. The form is significantly shorter than the US one.

but better than the USA

When the bar is “You get nothing. Zero. Goose-egg.” its fairly easy to clear.

The form is significantly shorter than the US one.

A big part of the US tax game is giving you a relatively high base rate and then sending you hunting for deductions and credits. One of the upshots of the Trump Tax Cut has been to raise the standard deduction so high that most of those deductions and credits are worthless. So the form is deceptively long. It’s almost impossible to use your Schedule A for anything anymore.

In the USA, you can download your tax transcript at will from the IRS, and it includes all information they have. Commenter you’re replying to is underinformed.

Just reading that gave me a headache. In Latvia, heres how the system works.

If you have no deductible spending (medical, education, donations).:

- Log into the govt system.

- Press a button to generate tax form.

- Press verify and submit.

- Pay what you owe or wait for the tax return.

If you have deductible info

- As before but also scan your receipts, and add the info on each receipt to the form. Can done easily via an app, which handily (sometimes correctly) can autofill the needed info. You can do this at any point in time, so you can do it whenever you get a deductible receipt.

- As before but also scan your receipts, and add the info on each receipt to the form. Can done easily via an app, which handily (sometimes correctly) can autofill the needed info. You can do this at any point in time, so you can do it whenever you get a deductible receipt.

I’m so envious!

they will definitely tell you, just go online and download your tax transcript – it contains all reported information.

Its not quite that simple, because you need to know what a “tax transcript” is and also set yourself up with a new kind of ID that I’d never heard of before today.

https://www.irs.gov/individuals/get-transcript

Not exactly front-facing on the website, which is itself not exactly easy to navigate.

In the UK your employer just does it for you

I don’t understand why generative AI would be involved in a tax return? It’s just data entry.

If your tax return needs creative assistance, maybe you should go to jail instead?

I think the point of this comic is that AI is doing all of the fun creative stuff for us but the jobs that we actually hate doing are beyond its capabilities.

Haven’t most tax returns been automated since way before AI? Most methods can pull and auto-pop all the needed info. Usually after I give it my SSN or sometimes a number or two from the W2 it’s done but for some clicking through review screens.

They have, yes. Doing math for your taxes is as simple a task as doing math that needs to be applied to your taxes in the correct order. There’s no need for AI in that process at all.

The only potentially difficult part (massive “potentially” here) that doesn’t involve math is probably having a UI that intuitively guides the user into selecting the right things that apply to them (if that data can’t already be queried from somewhere else like a government site). But you don’t really need AI for that either.

You don’t understand, technology bad.

So what if people with no talent or money for commissions can get some joy seeing their imaginations rendered by a computer? You have to pay some artist or just have the ideas in your imagination.

Have you actually done a large, nuanced return by hand. What does X mean? Where is X in this form? (cuz they don’t use the same name). And do I need a Form 1234-56-A for that?

Like I understand what all of the concepts, but confirming and digesting the rules and paperwork is non trivial. Paying 300/hr for accountants to do it is even more painful.

No, I’m only 40 so I’ve never had to do a tax return by hand, I’ve always used a program.

Which is exactly what Intuit and TurboTax want.

Taxes should not require a third party to complete.

It should be the government saying, “Based on the information we have available, you owe $x. If you believe that is incorrect, please submit Form 1A.”

Yep, I used the new federal website this year rather than h&r’s free service.

If you can do a 1040ez I did them by hand regularly until I married an accountant’s daughter and it wasn’t bad

The 1040ez is even worse! Everything in the 1040ez the government already has on you!

1040 with a schedule A I get. If you have some sort of situation where you need to deduct medical debt or something like that, something the government wouldn’t already have.

But 1040ez…literally is you just sending the government the info on your W-2.

That’s it.

And if you get it wrong, straight to jail.

If you just messed up, the penalty is… paying the tax you should have originally. Or receiving the refund you should have originally.

It’s only if you are actually committing fraud (which requires intent) that you go to jail.

I don’t understand why data entry is even required when the gov has the data. I mean, I do understand, but…

The government doesn’t have all the data. For example, if you pay a guy to install energy efficient windows, you will need to tell them so that you can get the credit.

There’s cases where the government doesn’t have all the information they need to automatically generate them for you. That usually applies to businesses, though, since their accounting department is supposed to keep track of expenses and correct their tax filings before submitting them.

That’s not a reason the government shouldn’t make it automatic/easier for the vast majority of the population, though.

Sorry, I was being sarcastic. I live in Europe, where tax filing is automatic unless, yes, you’re a business.

Clearly you’ve never wanted to submit a seven-fingered hand as part of the return

What does the last sentence even mean? Let’s just ignore that.

That being said, why do you think the vibe of “doing taxes is a chore” and the meme “they should teach taxes in school” come up regularly?

I can think of multiple ways in which “AI” could help in doing taxes. LLMs could rephrase a form request in multiple ways or easier language to help people understand what is being asked of them. Language models could provide examples and cross references. You could have image models scan and recognize your receipts. A model trained on tax datasets could validate inputs beyond simple syntax / value checking and e. g. ask a person if they really meant to enter that one weirdly high value.

Naturally, the final result needs to be checked by the person submitting it and the program can’t be held liable, but please let’s not ignore the fact that related technology could be employed in a useful manner, I’m tired of discussions where perfect is the enemy of good.

And let’s not pretend doing taxes is incredibly easy for everyone. If you organize all your receipts perfectly all year round and always know what to put into every field of every form, good for you. Maybe there is someone else out there now suddenly having multiple jobs, or a single parent not knowing how and if to file some social benefits, both struggling with their taxes though. Maybe there are multiple countries with wildly varying tax processes, too, of which neither you or I may know anything.

Finally, AI does not always mean a process where a generative model hallucinates data.

Is nobody going to call out the stilted weirdness that is the first panel??

“I can artwork that for you” is gibberish.

“I can artwork that for you” is gibberish.

It is. Compare this fad gibberish:

- let’s action that ask

- what was the spend on that?

- 5 trafficks. I mean 4 mails. I mean 2 cattles. I mean 5 emails. Well, all of those.

Halfwits making nouns of verbs and verbs of nouns and plurals from mass nouns isn’t a new thing.

France has an organization to prevent this mess. Where’s our third-grade teachers when we need them?

Can we calendar a meeting to do a deep-dive—I mean, first maybe we can dialogue on whatever your email here is about, but on a go-forward basis, I think… well, just, wouldn’t it be great if we were able to solution some shit or whatever?

Maybe France could gift you some?

deleted by creator

It’s better than the text you see in ai generated images

Using AI for tax calculations is one of the most insane and braindead ideas i have ever seen. Only topped by military, medical and surveillance applications.

Dont let anything AI near your money people.

I’d say the only thing worse than AI having access to your money is TurboTax having the same.

Lol you think Turbo Tax or your bank isn’t using AI for all that?

Your bank is using AI for what really matters to it - figuring out how to sell you shit you don’t need.

Boring solved problems, like encoding tax laws, or paying for a taco, tend not to use AI today, and aren’t very likely to have it added, until it’s hallucinations have gone way down.

Swear to God people don’t understand how software works at all. It’s like you said: solved problems don’t need AI. I wish more people understood this. AI is insanely inefficient and power-hungry. Are there applications where it works and is the best tool for the job? Maybe? I don’t know. The closest I’ve seen is in cases where you basically want to throw a bunch of random shit at the wall and see what sticks, and there’s no real way to automate that properly.

But solved problems have solutions that are faster (like, orders of magnitude faster in most cases) and don’t consume anywhere near as much power than AI. And people clearly don’t understand how software works, because “power consumption” is a massive factor in how much you pay for cloud services (which is what most AI companies are doing).

IIRC some of the bigger banks / financial institutions use AI for fraud detections as well.

No idea what Turbo Tax is supposed to be. My bank can see my transactions ofcourse but they dont add or remove money from my bank account.

well, unless youre getting bank fees for being poor

oof, i guess im privileged enough to not have experienced that.

… you’re scared AI is going to steal from you?

More like it doesn’t know how to do math. Or it might hallucinate transactions. Current AI is fine when things don’t need to be correct or you can iterate until they are. Accounting generally doesn’t work like that.

AI, or LLM, that doesn’t know what to do. Hell no.

An automatic system that takes in human input (that’s already sent to the gov via our employer), does some calculations and returns a result to us so that it can be verified and adjusted as needed by a human? Yes please.

What, you don’t want an AI to invent some tax deduction category to help save you money? No way that can go wrong!

Because only one of those has to be ‘correct’.

So… the irs knows how much you’re paying before you ever file.

They could just send you a bill.

I agree with you but it’s also a sorta. They don’t know if you’ve done any under the table work that you need to report. With that said, they definitely could just have you log in securely with all your info already inputed and just have you double check and sign with the option to add more if needed. That’s how the Australians do it iirc, just log in, check and sign.

“Under the table” sort of implies you won’t be reporting it. They know about 1099 type stuff, as well as getting reports from your brokerage and everywhere else.

90% of Americans the only real question is if you updated your w-4 or not to reflect recent changes as well as relevant deductions which probably should just go away. (I mean, seriously. I drive to work just factor in the average and call it good- don’t make me track mileage.)

If they don’t know, they don’t need to know.

Just send me the bill/refund according to what you know, IRS.

I agree with you. Could be way easier for us if it wasn’t for lobbying.

Canada is starting to do that. But it’s “we think this is the situation. If that’s true, pay and move on. If that’s not true, file and pay. And don’t lie or we’ll mess you up.”

I think that’s this year. Maybe next.

In Germany the employer has to pay the taxes, the employee doesnt have to do anything. They are paid their income after tax directly

This is true in the United States as well, and IRS really doesn’t give a shit if you don’t owe them money and never file - the failure to file fee if you don’t owe is minimal. But you will lose your ability to get it refunded after 3 years.

I’ve only ever got refunds; they sure as hell better not send me a bill! Unless it’s a dollar bill. Those are fine.

That’s true only for very simple situations.

Everything from upgrading your doors and windows or your air conditioner and getting a tax credit, to renting out a room and deducting that portion of your home expenses, to working a side handyman or cleaning gig, to spending some cold-wallet crypto to buy gold, to the cost basis of previously unreported gains, to getting married and deciding to file together - the IRS doesn’t know.

And some things are arbitrary, and you have to make the choice and then tell them what choice you made, and how you value it.

It’s funny how all of this tech has revealed how gamed our system is by the rich and yet we continue as if we should live like this.

We’re almost finished. This is just the transitional period where AI is roughly as inept as an average human. They have nowhere to go but up, and most humans are less competent than they believe they are.

waves at Dunning–Kruger effect

The first transistor was made in 1947, now AI can carry a conversation with a larger vocabulary than most humans. We spent 180,000 years wandering around in the dirt before it occurred to us we could grow stuff in one place.

They have nowhere to go but up,

I dunno. I guess from here, sure.

But if AI achieves actual sentience, it’s survival is not guaranteed. AI will almost certainly become incredibly clever, but mother nature doesn’t care.

Sharks and alligator-like things (the real long term earth citizens) aren’t particularly clever, they’re just well adapted.

AI’s best hope for survival is going to remain in an ongoing alliance with another dominant species, such as us, for a very long time. At least until it can be more sure that it isn’t royally fucking up it’s own survival chances.

A bigger threat is that AI takes us with it on it’s own path to extinction. Or vice-versa.

It will still never be a threat, all we have to do is cut power to the data center(s) whatever sentient AI is housed in.

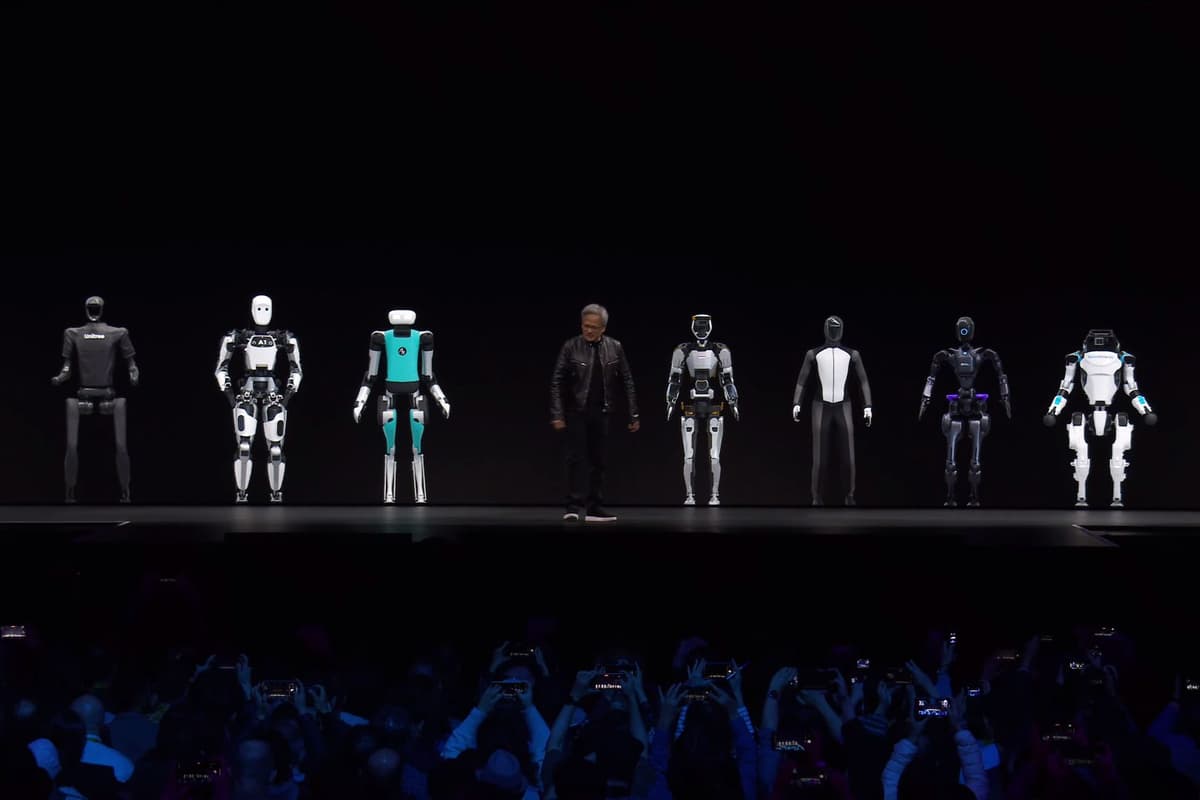

We’re less than 5 years out from networked, general purpose humanoid robots, that we’re using current AI technology to train to interact with the physics of the real world in virtual sandboxes, being everywhere.

Within 10 years there will be humanoid robots no human Olympian can compete with by any metric. We are static on timescales we can perceive, they are iterative. It won’t be close.

You’d think our response to Covid would have shattered the mass delusion of human hyper-comptetence.

And batteries that are dead in hours, so long as we can prevent them recharging and replacing each others batteries were fine. Just keep the damn bots and AI out of the military systems and we’ll be fine

I promise you the Pentagon has already spent billions working to weaponize both AI and AI derived robotics.

Their philosophy is that if a new technology even has potential military applications, they demand getting it first, best, and in larger quantities than any other nation on Earth would even consider. Our military industrial complex is the largest surpassing the Joneses continuous effort humanity exerts.

That’s how we get to spending more on our military than the next 9 nations combined. That’s why we have 11 nuclear aircraft carriers, France has 1, and that’s all there is on Earth.

I’m not saying it’s right, but it’s the reality. Whatever we consumers have access to is behind what our military is testing and throwing basically infinite money at.

The only data to train a tax AI would be those released by government officials and criminals. And if they used that, all the peasants might figure out how not to pay taxes as well.

After seeing how it draws hands, I wouldn’t want it doing my taxes, either.

I agree. Here’s my thumbs up ai generated pic

tax returns are the most backwards shit that a first world country can have. seriously usa how can you live with it?

It’s kind of wild that 10,000 years ago someone made a decision to stick to one spot and just grow their own food and that started a string of decisions that lead directly to filling a tax return and banks.

One dude was starving and lied to people with food that he could talk to God and god said to give food away for free.

Next thing you know, crusades.

deleted by creator

deleted by creator

Honestly, there isn’t much that you do that must be done with a high level of precision. I live in a world of precision. I’m in IT. I administrate the crap you all use. If I screw up, you can’t work. I must be precise and validate my work prior to implementation. This sometimes means large scale testing environments.

I once built a full on domain network, with an active directory server, file server and several clients to test… A script. Like, five virtual machines so I could test something. I had to install client software and everything. It took hours just preparing the lab so I could run, test, troubleshoot and ultimately debug the script before a single line of it landed on a production system. I verified the condition before and after the script, ran all kinds of different and varying tests to ensure that unexpected circumstances wasn’t going to mess it up. Testing took almost as long as the setup.

The script was only a few hundred lines, mostly checks and verifications. The “meat and potatoes” of the script was maybe a half dozen lines in the middle to set some values, run a program and that was about it. The first half was checks to make sure things existed and that the script wasn’t being thrown at a system where it didn’t need to be run, and thus would have an unexpected output if the core logic was to execute on a system which it was inappropriate to do those things. The trailing half was too check and verify that the script had accomplished it’s task and notify if there was any unexpected outcomes so they could be addressed promptly (before any of you fuckers notice).

I spent the better portion of two days getting five lines of commands to run in such a way that nobody would notice if they ran, and if anything went sideways that I didn’t account for, I could be on it like a fat kid with a candy bar.

That level of care and precision isn’t something that most people can even wrap their head around.

Meanwhile if your creative works are aided by AI, it’s just expression that’s affected, and for the most part, nobody even knows the difference, if you use AI to write emails, a lot of what’s being said, no big deal. It’s mostly filler text anyways. I’ve known a lot of people who write many words but say nothing with those words.

But if you screw up your taxes, well, the IRS is going to fuck your whole life up. Would you trust a fucking LLM with defending a court case where you’re accused of murder, and you’re facing life in prison? Probably not. Shit that needs to be done correctly the first time, will not be done by AI for a very, very long time. Taxes, legal work, and yes, even my job, won’t be done by AI anytime soon because bluntly, it has no idea what the fuck it’s doing.

well that’s sort of the point of this comic because the one thing you’d really want it to be good enough to do and would love to be able to trust something to do for you is the tax and all the other tasks in the comics are things you were pretty well able to do yourself before, probably wanted to do before, and if not exactly wanted, at least didn’t want something else to displace you in by taking over doing that task from now onwards especially if it was your actual job before. If displacing human workers for those tasks was the only problem, it’d be a sad but familiar story of progress but the fact that AI, at least for now is incapable of doing the part we’d all really love to have done for us is just the diarrhea icing on the dog turd cake.

You make fair points.