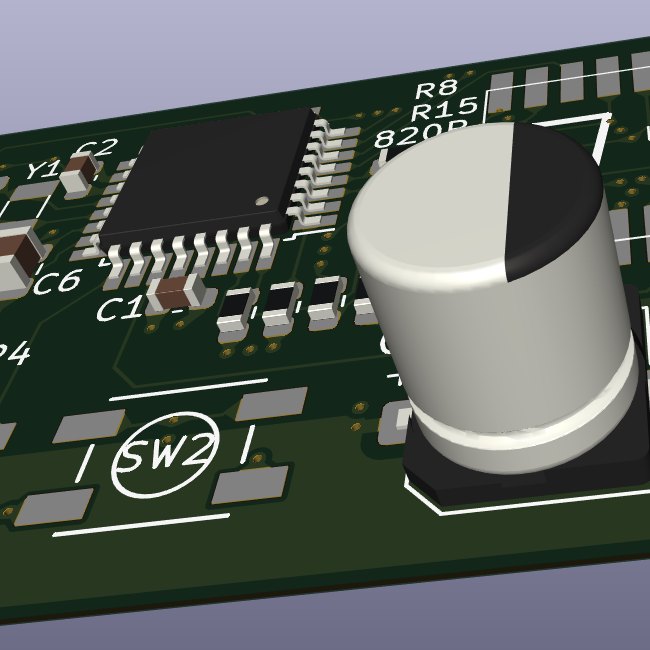

This here is a USB charger. It uses a CPU to figure out if you connected a Samsung Phone for 50W charging, or if it should do the default 2.5W charging profile.

It’s processing power? Uhhh, about 4Million clocks/sec with 640,000 bytes of memory. Oh yeah I guess about 5-million bits.

Oh this other thing? That’s a mouse. It tells the computer if my hand moved forward or backwards or left or right. It runs a fourier transform over an infrared image and memorizes the desk. It performs a full image process / fourier transform 100 times a second to accurately track our hands and clicks. The USB connection is also a network of networks consisting of a ReedSolomon error correction code for reliable transmission at a bit over 10-million baud transfer rate.

Our real computers are doing… Porn. AI generated porn.

Fun fact: USB Chargers have more processing power and RAM than fucking the Lunar Lander / Apollo Space Program. Figuring out if Samsung phone or not-samsung Phone has so much processing power allocated to the task it’s kind of hilarious

You’ve got equities, debt and derivatives.

Equities are ownership into shares. These are the simplest to understand. You own a share of a company and thus are entitled to a % of the profits (though most companies today choose 0% as their decision).

Debt means funding… debt. SLABs (student loan backed securities), MBS (mortgage backed securities), bonds (government debt), bank loans etc. etc. These are surprisingly complex in practice but perhaps easiest to understand. There’s lots of different details to debt (callable, puttable, tax free, convertible, coupons, notes, bills, bonds, I-bonds, EBonds, 10Y, 3M, overnight repos). But in all cases, you lend money to someone, and later they try to return it to you + a little extra.

Derivatives (usually options but there are many kinds) are new inventions that are more complex. Ignore these as they are very very complex.

That’s about it.

The general recommendation is to buy an ETF for equities and an ETF for Bonds. ETF is just a combination of simpler investments that you pay 0.04% to 2% a year for convenience.

VOO takes the 500 biggest companies in the USA (aka the S&P 500) and buys mostly the biggest company and a very little bit of #500.

BND is a similar idea except it’s a whole bunch of different debts from across the entire economy.

So buy some equities (mostly equities), some bonds, and leave some cash in a high yield savings account. Done.

Stocks (aka VOO) make the most money on the average, but also loses money the most often.

Bonds (aka BND) makes middle amount of money but rarely loses money.

Cash / savings accounts never lose money (except inflation). But makes very very little. It’s still worthwhile to keep necessarily amounts as cash and this you should always be considering how much cash to keep.