Summary

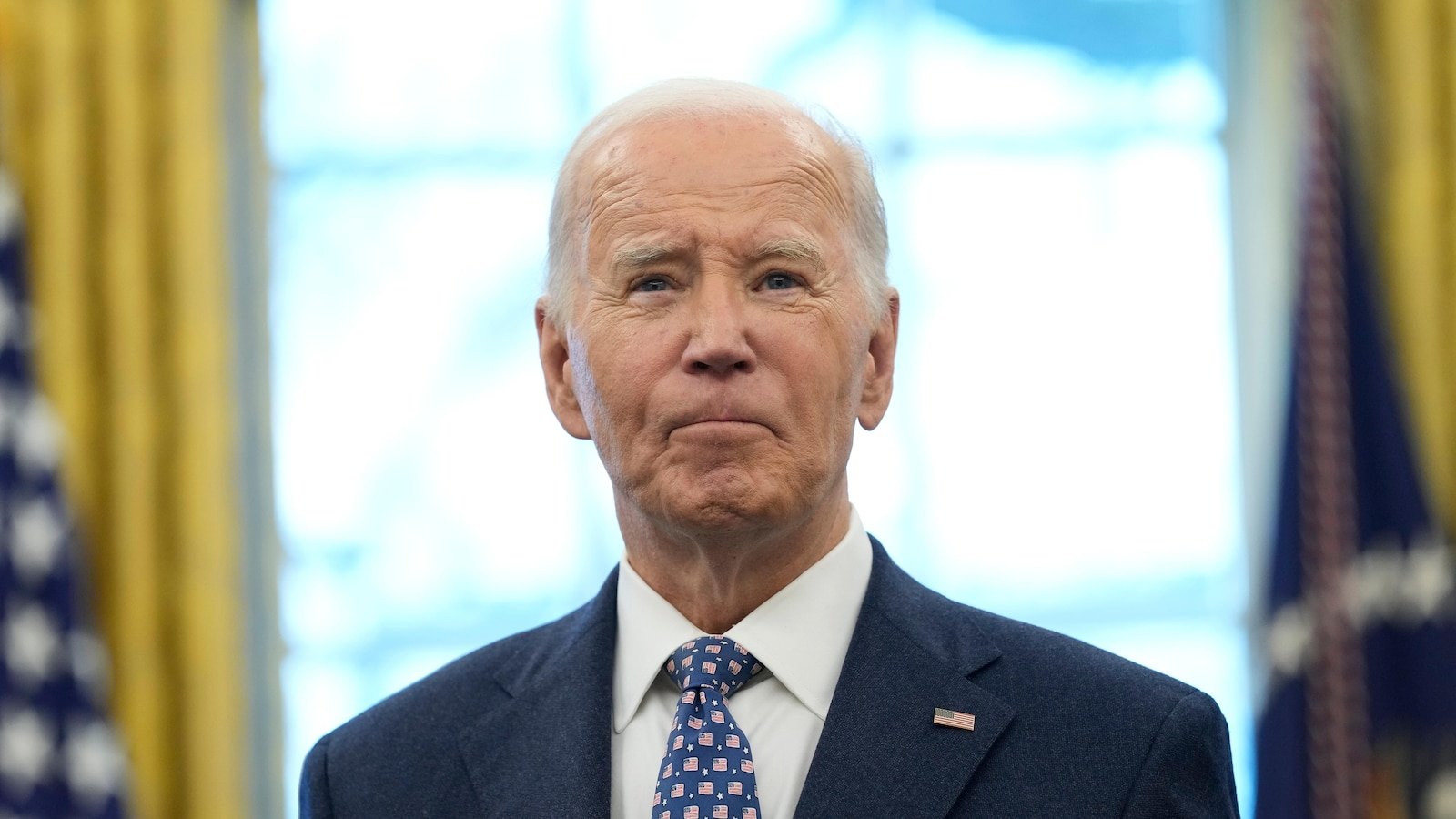

President Biden will sign the Social Security Fairness Act, boosting payments for nearly 3 million public service retirees by eliminating the Windfall Elimination Provision and Government Pension Offset.

The changes will increase benefits by an average of $360–$1,190 monthly, including backdated payments starting January 2024.

Advocates call it a historic victory for educators, firefighters, and others, correcting a 40-year inequity.

While some Republicans supported the legislation, others argued it was unsustainable and would hasten the program’s insolvency.

Thank goodness these boomers are getting more money. They never had the opportunity to plan for their retirement like the newer generations!

And younger generations are swimming in cash so they’re happy to pay for the boomers.

I actually donate extra to social security since I’m so grateful for the world the boomers made for us!

Anyone who believes a country that spends $1.4T/year on national security is strapped for cash is lying to themselves. Anyone who believes their paycheck is what’s making or breaking the SST in a $30T/year economy is beyond foolish.

Younger generations are paying lower tax rates than at any point in the last century. What they’re absorbing now, more than ever, is the cost of private debts and private profit-seeking.

Thank goodness these boomers are getting more money.

My mother-in-law worked 20 years as a teacher, then got her pension plundered by the state of Texas. She moved to another job, but because she was enrolled in the teacher’s pension, SS wouldn’t fully recognize her contributions for the rest of her career. I’m actually really happy she’s getting full SS benefits now, because it means she’s not suddenly bankrupt in her 70s or 80s and fully reliant on our family for her financial survival.

Just in time to not even realize Biden did it and vote Republican again because they made my check get moar

Removed by mod

Luigooigi

So if a government is going to print money, might as well print it for the citizens who are going to pay more in taxes. And wildly and sadly, citizens receiving social security will pay more in taxes if they have more to spend (and also get taxed on it as income, oddly enough). Modern Monetary Theory states this, giving tax breaks to corporations increases inflation further and only puts the burden on the workers

While some Republicans supported the legislation, others argued it was unsustainable and would hasten the program’s insolvency.

There is a very simple solution to the so-called “insolvency”, but the qons will fight it tooth and nail, thanks to the owner-donors.

Yup. Raise the income cap. That’s all you have to do.

The last time Social Security was majorly reformed was back in the 1980s. They did it specifically to handle the pressures the Baby Boomers would be putting on the system. They set it on a path then, that while not as progressive as anyone on the left would like, was financially sustainable. But when planning something like that, it’s a big demographic puzzle. When trying to plan a system for decades into the future, you have to assume a certain population pyramid and income distribution. They set the income cap then at a level where 90% of the income earned in the country would be subject to Social Security tax. We’ve had similar economic growth to what they estimated; we’re not poorer, in terms of raw GDP, than we should be. What’s changed is the income distribution. More of the nation’s income is earned by those at the top. So now only 80% of the income or so earned is subject to the tax. In reality, we should just eliminate it entirely. Let all income be subject to it. If that ends up with billionaires paying a fortune in to Social Security and receiving a relative pittance of benefit in return, so be it.

To paraphrase Bernie, let them survive on mere billions.

Billionaires - especially ones like Elon - should be thankful that they were permitted to accrue so much wealth on the backs of so many others. Paying it forward by paying their fair share into SS is the very least they could do.

Social Security has (a) no debt and (b) a perpetual source of revenue. Therefore, it can never go bankrupt or become insolvent.

The only question is if it will be forced to reduce its expenses by up to 30%.

It also has a perpetual source of expenses and it’s growing faster than the source of income.

But unlike debtors, Social Security can unilaterally reduce its expenses at any time. That’s precisely why it cannot go bankrupt or become insolvent.

Are you saying by “reducing” you mean pay out less?

Yes. It’s projected that if nothing else changes, in 2033 they will reduce payouts by 23% and thus continue operating for the foreseeable future.

it’s growing faster than the source of income

Not since COVID.

Meanwhile, the qons:

“SS is going to go bankrupt at some point in the future! I can think of no other option but to dismantle the whole thing!”