- cross-posted to:

- [email protected]

- cross-posted to:

- [email protected]

It’s weird how in one of the richest countries in the world, many people even couples with 2 full time incomes can’t afford a house?

It’s extra weird, since it seems to me many American homes are built with rather cheap materials compared to Denmark where I live.

What makes even weirder, is that USA is a country with a lot of room on average for building and expanding living spaces.

Seems to me this may be a case of lacking political planning.It’s weird how in one of the richest countries in the world

Not that weird when most of the riches are held by a handful of people. The rest of us are just trying to get by.

Yes that’s a problem, still Americans have higher average pay than most countries. With lots of room and cheap materials, it should be relatively easy to afford a house. And AFAIK it used to be that way. People could afford a house, car, children and health insurance on one income.

It’s a mix of outdated zoning laws, investment firms buying up all the available housing and car centric infrastructure

Items #1 and #3 are restatements of the same issue, and #2 is a red herring.

The problem really is just car-centric zoning.

No there’s other things that aren’t specifically car centric but are definitely a cause for undue expenditure.

You don’t think that the firms looking to earn passive income and controlling a significant amount of the supply is an adding additional expense by adding an unneeded middleman?

Don’t get me wrong car centric infrastructure can get fucked but I think it’s important we work on the problem from all angles.

You don’t think that the firms looking to earn passive income and controlling a significant amount of the supply is an adding additional expense by adding an unneeded middleman?

I think the ridiculous protectionist (for NIMBYs and the rich) laws restricting supply are the main reason their business model is so lucrative.

If you hate big landlords and REITs, working to abolish zoning density restrictions is the best thing you can do in order to drive them to bankruptcy.

I can guarantee you they would still find a way of profit on it and extract as much value as possible, that’s just capitalism’s end game.

The firms thing is very real. In a local small town, the majority of rented homes are owned by the same company.

With lots of room

Country size is irrelevant. People like clustering together in cities.

True, but there is still generally better possibility to expand those cities outwards. But that requires that new building plots are developed, and made available at fair prices.

If new legal building plots aren’t made available as needed, prices will increase on existing homes.

But that just means people are commuting in. There is cheaper housing spread out from the cities, but few people actually want to live there, and those who do will commute hours into the city for work. It’s often more prudent to rent in a city…

We need density, not spreading out.

Continuing to sprawl outward is the worst thing we can possibly do. It is literally omnicidal.

It’s not a lack of political planning, it’s a lack of political power for the working class.

It’s done by design to drive people into poverty and subservience.

Can you expand on the superior Danish building materials? Genuinely curious.

Not the person you’re asking this from but as a Finn who watches a lot of construction related videos on YouTube I too get the feeling that houses in the US are built to a lower standard than here. It’s not so much that the materials are worse quality but more that the building code is much stricter here.

I’m a plumber by trade so my area of expertise is quite narrow but couple things that come to mind is how copper pipes are often soldered in the US where as here they’re always brazed which is a much stronger joint. We also don’t allow any connections to be made inside walls but in the US they’re common. Toilets there also tend to clog up quite often because of the way they operate which almost never happens here. Another thing I’ve noticed is that in the US they use a lot of wood and plywood even on bigger structures which poses a fire hazard as well as there doesn’t seem to be as much thought put into the insulation and vapor barriers.

in the US they use a lot of wood and plywood even on bigger structures which poses a fire hazard

they are a HUGE fire hazard and are nominally illegal except for a convenient loophole, as long as you claim you’ll be adding automatic sprinklers, you can sidestep a lot of the fire safety permitting – now they just burn down during construction before the fire systems have been installed …

Basically that many houses in USA are made of wood, we can’t do that here, because the climate is too wet. So wood doesn’t last very long. That means we need to make brick houses. Brick houses are way more expensive to build than wood.

Also many places in USA don’t require the same level of isolation.

In large parts of Sweden they can make wood houses too, and their house prices are way lower than here.

I’m not saying American houses are bad, but the climate in large parts of USA allows for more and cheaper options.not op but i find it weird how you guys build houses mostly out of wood instead of brick and mortar. why is that?

It’s because all that money is just being funneled to a select few people.

It’s why “making more money” isn’t the solution. As soon as renters make more money, rent goes up. It’s why they’re also so gung-ho about making more money. They’re not making more money for themselves; they’re making it for their landlords.

I truly believe most people in this generation are too stupid to spend their money wisely. They just do what everyone around them is doing.

The other 60% have already accepted it and aren’t worrying about it anymore.

Thanks for confirming I won’t be having any original thoughts today :D

the other 60% are just delusional about their chances

I’m about to buy a home, but it’s taking 4 employed adults combined to afford a 3 bedroom house. It’s insane.

Have you tried pulling yourself up by the bootstraps, surviving on the interest of your invested wealth, and forgoing toast with healthy yet expensive toppings? /s

Ah shit you know what? That’s a great idea. I was actually just throwing that interest money away because I wasn’t sure what to do with it.

Have you tried asking your rich dad to buy it for you?

He actually is helping (but not rich) he is taking out a personal loan to gift me some money, enough for a portion of the down payment. Even with that, (and I am very grateful and priveliged to receive it) it’s still almost unaffordable. (I’m still not actually sure we can afford it.) Which, considering most people aren’t so lucky, is fucking insane.

Just buy some money.

I bought my 1,200 sqft house in a town of 80,000 people for $60,000.

:)

You gotta be willing to look at the whole country instead of just major cities. But most people complaining about not having enough money think they’re entitled to live in expensive areas.

If someone is being paid to work in those expensive areas, the pay should be sufficient to live in or near those expensive areas. It’s entitlement for the employer class that this isn’t the case. The implications of it not being the case (the existence of a class of people in these areas that struggle to afford basic necessities, the extension of psyche-degrading and environmentally destructive commutes, the tearing apart of our societal fabric that comes from isolated suburban commuting living) are all horrificly negative at scale. You may live and work in a situation that is independent of those negatives (you found a good enough paying job in a low cost of living area, or maybe even you work remote, or you don’t mind the isolation and destructive nature of the exurban commute) and that is good for you, but to imply that the whole nation needs to follow your example or stop complaining shows a sore lack of awareness about how scalable the solution you personally found is.

Heyo! It’s me!

I figure that since every single house costs the same, I might as well just jump into a new-build for the same price and move on with my life.

I’m 100% certain that once I get really going with this process, I’ll find out that it’s still out of realistic reach range, but it’s fun to dream for a bit. 🥹

You’d be surprised, it depends entirely on where you’re willing to live.

I used to live in the Denver Metro Area in Colorado and houses were going for like $400k-650k in the area.

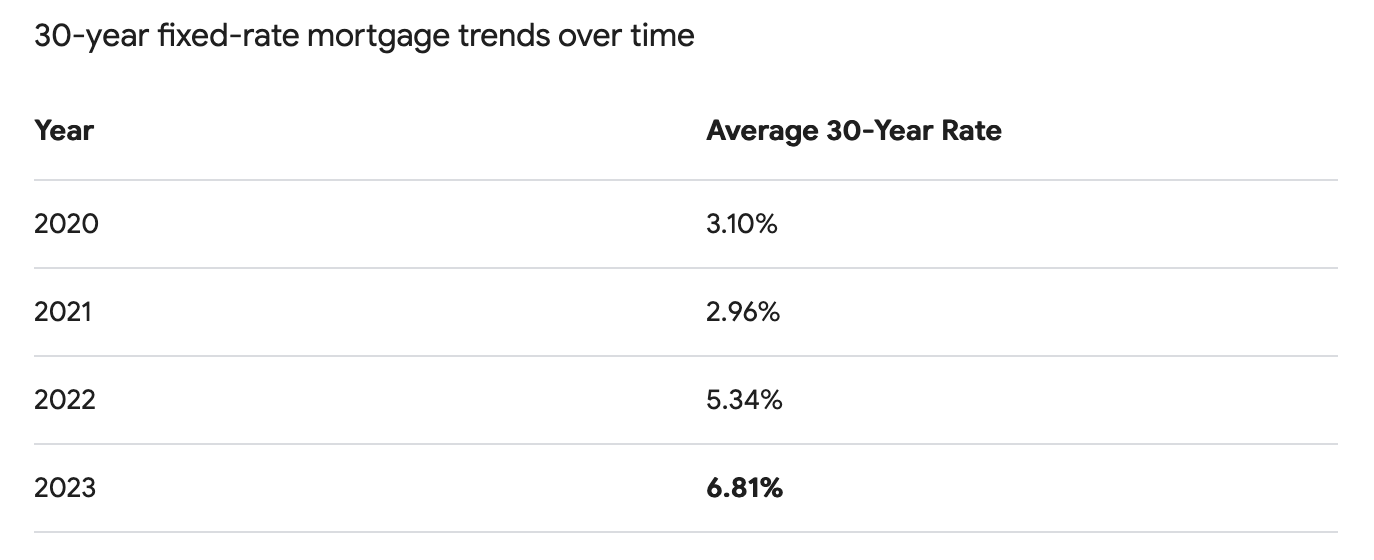

Ended up moving to a smaller town ex-urban/rural area since my work is remote anyway. Had my home built in 2021. 1050 sq/ft 2 bed 2 bath for $210k. And even better, I snuck in before rates climbed. With $6k in points at closing, I got it at 2.25%.

Even after doing a full solar and battery installation and insuring the place for an additional $50k to accommodate that and value increase, my mortgage (including insurance and tax escrow) only comes to $1215 a month. I’ve been paying extra on principle every month to reduce interest amortization, and hope to pay it off within the next decade most likely. Retirement won’t be easy, but actually seems like a possibility now.

And bonus, I’m near a ton of nature, get to enjoy deer chilling outside the house, and the night sky out here is beautiful.

Oh it’s not a worry, it’s a reality.

How does this compare to renters in previous decades? Are there similar surveys from those eras?

The “you don’t want to own anyway” crowd in shambles.

I used to worry too, then I did it.

You don’t need 20% down. I did it with just 7.5% ($30,000).

This was in 2021 though with 3.25% fixed 30 year interest.

Your anecdote doesn’t disprove the fact that homebuying is more unaffordable than ever. I made a comment about this earlier today, but I’ve got enough cash for a 20% down-payment on a modest house in my area but still can’t get a loan because ~55% of my monthly income is obligated towards rent. You’ve escaped the rat race, congratulations, but quite a bit has changed between 2021 and 2024, even if it doesn’t feel like it was that long ago.

Then include rent in the income-to-expenses measurements for home loans? Getting rid of that portion is the whole point! Hell, someone paying stupid high rent is the best evidence they could have that you’ll be able to pay back their loan since you have 55% of your income already dedicated to housing that will be freed up and available without changing your lifestyle. They should worry more the smaller that percentage is.

Your argument makes perfect sense. If the entire loan industry weren’t a racket, it would be persuasive.

That was my thing, even though my rent was $1,800 a month, between my wife and myself, our combined income was $9K a month. So rent was 20%.

My guy… do you not understand how extraordinary your situation was? $9k a month “then I just did it” ffs

The 9K a month had less to do with it than the $30K down, which, again, was only 7.5%, not the 20% people expect.

than the $30K down,

Which you had because of that 9k/month

not the 20% people expect.

Again, because of the high income

The 30K was more because I had been working from home, not buying gas, and not eating out for 3 years. ;)

… While making $9k a month.

Jesus fucking Christ dude your situation is exceptional because you make a fuck-ton more money than most people, it’s not a difficult reality to accept.

In 2000 we did a zero down, 8% first on 80% and 9.5% second on 20%, at 2.5x our combined salary. Terrible loans and it was really really hard, but it was what we had to do to buy - network tv, one picked-up pizza per week, vacations were driving the kids to see their grandparents, constantly scrambled to pay taxes and insurance, and we just prayed that nothing broke. We know that we were really lucky.

https://themortgagereports.com/61853/30-year-mortgage-rates-chart

It’s really bad and it’s getting worse.

Allegedly rates are set to go back down later this year and people with shit rates should be able to refinance. Prices are absolutely sickening all around whether you rent or are paying off a mortgage.

really? I read somewhere that the Fed has no plans to change rates.

Rate cuts are alleged by people addicted to cheap debt, wanting to pump up asset prices. They alleged that there would be six rate cuts and have since revised that to three, but seem like they’re going to revise that down to one. Eventually they’ll understand that there will likely be zero rate cuts this year since the federal reserve that actually sets the rate hasn’t indicated that they will cut rates because inflation hasn’t settled down yet (and would likely shoot back up the second rates are cut).

Being able to put $30k into anything is not remotely achievable for a ton of people and your wording comes across as very dismissive

I bought my home with absolutely zero cash in hand. That’s what first time home buyer assistance programs and grants are for.

Sure, no problem. Zero down at 7.125% on a home that now costs $350k, but only cost $150k about 5 years ago. I’m sure that’s affordable for a family right now.

How much is the same family throwing away to rent that same home? How much will their rent be in 10 years? Locking into a mortgage ($2650/mo in your example) is the best way to go, even if the home prices are disgusting compared to 5 years ago.

The guy who says he and his partner make $175k/year should be able to afford it.

?

I had zero savings when I bought my house. My parents backed the loan which was good enough for the bank. Also I set the budget first and then looked what I could get with that. Well it turns out not much but not nothing either. My house is old and ridiculously small on modern standards but it’s a house nevertheless and comes with a nice yard too. I paid 105k€ for it. It’s 10km from the city centre on a quiet suburban area within 50 meters from a bus stop and it’s a 20min trip to the city with a bus or 12minutes with a car.

They won’t.

Most people renting are going to be renting until they die.

They’re just too stupid with their money and think they’re entitled to more than they can afford.

Edit: And they get mad whenever anyone calls it out.

AvOcAdO tOaSt!!!1!!

You were right with the first two sentences, and wrong with the last two. Incredible.

Your post reeks of “just buy a house lol”

What do you suggest people do with their money instead? It’s not like you can stop paying rent to save up for a down payment. And with rent on the rise everywhere, it’s not necessarily an option for most to find something cheaper.

If they really want to get out of their situation, they will have to live frugally while saving money.

This means doing things like finding the cheapest place to rent (probably with roommates) and always cooking your own meals. If you really are struggling, then make sure you also get the government benefits that you are eligible for.

But most people think they’re “too good for that” while complaining they don’t have enough money, which is where entitlement comes in.

Please don’t pretend that most renters are doing everything they can to save money. They aren’t. Every renter I know that complains about not having enough money isn’t living in the cheapest spot, orders food all the time, and subscribes to things they can be getting for free.

It’s overwhelmingly people who are bad with money and think they’re entitled to more before others have less.

First, you’re assuming that renters are people who “want to get out of their situation.” Lots of people rent their whole lives by choice for the flexibility and choose to do other types of investments instead. That’s a perfectly viable financial strategy.

Second, you assume that people who want to be homeowners aren’t already doing everything they can and are entitled. That’s not necessarily true in a system that’s stacked in favor of those who already have much and against those who have little. It’s the typical “got mine” attitude.

Not good enough.

So your solution is that poor people should never have joy, entertainment, experience life. They need to get in that hamster wheel and grind till they die?

Honestly you people who think life is all about grind, are the saddest people on earth. It’s like you have Stockholm syndrome for capitalism and billionaires

Wait the renters you know have the nerve to order food?!? What scumbags! I bet they expect to be able to eat it too. Disgusting. Next thing you know they will be trying to drink water too.

Found the guy who was born to wealthy parents

That’s not fair, they could just be stupid - that is to say, they likely just struggle with acquiring readily-available info/knowledge and applying it in their decision making.

stupid (adj.): Marked by a lack of intelligence or care

intelligence (n.): The ability to acquire, understand, and use knowledge

I’m always absolutely fascinated by the confidence displayed by the willfully ignorant. That bliss must be really addicting or something