Yes, go on, let NVIDIA buy intel. Let them buy AMD too. What could go wrong. I love monopolies! /s

I wonder how this guy feels when he watches everyone in the streets trying to make ends meet.

Probably feels he deserves it. :)

He’s being doing nothing but selling his Nvidia stock so I’m pretty sure he knows it is overvalued

He buys another leather jacket, as a treat

I know he’s in a very extreme level of this but all of us can look at people with less than us and decide how we feel about them. It’s never even occurred to me to wonder if I deserve my paycheck - it’s just mine.

Before you say it’s not the same, you don’t have his extreme, extreme wealth, remember that some people have to start their days walking several miles to fill some plastic bottles with bad water so they can wash the underwear of the guy who rapes them.

If I’m reading this right, you’re saying you’d understand if Huang sleeps soundly at night despite his wealth. I’ve made more money every year for 5-7 years, and I’ve never worried that I’ve become an out-of-touch rich person. For most people, becoming wealthy is gradual. And like you said, we can probably all look back at our past hardships and feel confident that we earned our paycheck.

Yeah I only mean to point out that we don’t really need to scratch our head and wonder what it must be like for him. He might never have thought about it. Maybe he has and feels bad. Maybe he has and thinks he deserves every penny. I don’t know.

I do a fair amount of charitable giving myself, and I have one rule: if you’re not giving until it hurts a little bit, you’re not giving enough. I personally don’t think the world is fair and I have obvious advantages and good luck so while I don’t agonize over every paycheck I do feel some responsibility to help others. I hope Huang does the same. If anyone has info on his charitable works or lack thereof, I’d love to hear more.

Oh but surely the second such an all-powerful monopoly appears, someone will start a competing company in their garage and go on to restore equilibrium /s

This is all so normal and sustainable.

Which means they’re in a bubble because Nvidia’s total assets (85B$) value is less than half of Intel’s (205B$). I refuse to believe that the “potential for growth” of Nvidia is worth anywhere close to 120B$ in actual value even in the next 5 years. I see only two things here: either Intel is undervalued, or Nvidia is overvalued. I think it’s both. When that bubble bursts it’s going to hit very hard for a lot of people because it’s the same thing as the other big tech companies (apple google meta etc) are all valued based on predictions and magic when the companies that have an actual intrinsic value are worth less

Seems the strategy is clear mega short nvidia to buy super leveraged intel and hope you can stay solvent longer than the market is irrationnal

I agree this is an obvious market failure because finance bros have become detached from reality even more than usual.

AI boom is starting to smell like DOT COM 2.0.

We have not seen that much improvement since gpt4, mostly cost reduction and UI convenience.

Current AI hype is not cashable, and I say that as an enthusiast who is building 15 kilowatt inference cluster in his living room.

We already have the major improvements already and we are nowhere close to done disgesting then.

Strategy unclear, I’ll still Bogle HODL.

Nana would be proud

The problem with shorting is that it’s not clear when the crash will happen. If it happens next week, yes, you’ll make a giant fortune doing that. If it happens in a year, you’ll be fucked. Shorting is essentially a loan, and like any other loan, you have to pay in a little something for as long as you’re holding it. That can sap away all profit before you ever see it, if not sap away your entire savings.

There’s a saying around the stock market: the market can be irrational longer than you can stay solvent.

That said, I do think this crash is happening sooner rather than later. I’m just not confident enough to put money on it.

OK, what about this, implement the strategy and then, trigger war between Taïwan and China. They already want ont so bad, if for instance some Chinese war ship got its bridge blown up by a missile full of western electronic components while they were harrassing some fishermen in the straight. Since they’re already looking for an excuse, they might not need any further explanations to do what they were already going to do. It worked with the Maine and the Maddox and many other times in history.

Nvidia would probably cease existing without cheap Taiwanese labour to do all theoretical work for them so those shorts could be free money. A free trillion dollar just ready to be picked for one false flag attack, which, these things already happen all the time so, no big deal.

You’re way off base to the point where I’m not sure if you’re serious or not.

Nvidia would probably cease existing without cheap Taiwanese labour to do all theoretical work for them so those shorts could be free money

Nvidia uses TSMC, and it isn’t because of price. It’s a very expensive fab because it’s the best one in the world. If war blocked it from functioning, Nvidia would switch to some other fab. What they put out would be worse than what they had before, but nobody else would be able to make anything better, either.

But more likely, open war over Taiwan would tank the economy worldwide. Shorting Nvidia would only be a technical victory for yourself.

Cripple the global economy and erase trillions of gdp?

But then make a few millions off of it ?

Maybe even just 1 million of equivalent pre war purchasing power ?

Yeah I’d be absolutely all over that, awesome !

I mean, even if this snowballs into a worldwide failure cascade that kills billions, totally absolutely worth, it’s not even close to the alternative of having to work until I die.

Could even do it remotely with one of those remote operated jetski with starlink on them and a 500kg cargo capacity

Intel is lagging behind AMD and NVidia with no sign of catching up. Meanwhile NVIDIA has a monopoly on AI.

It’s no wonder NVIDIA is worth far more now.

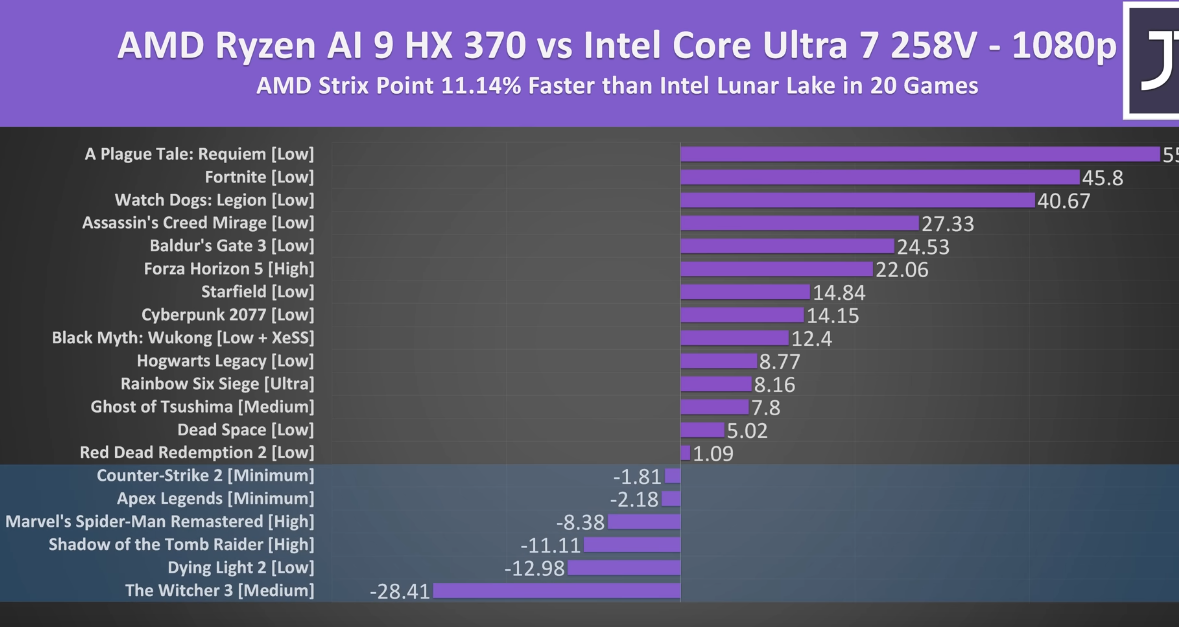

Intel have shown signs of catching up by putting out a better iGPU than AMD’s latest and greatest for laptop chips in certain games and most compute tasks. They’ve also put out one of the best laptop chips last month, they consume next to nothing while still having decent performance but go on I guess

Aren’t the best handhelds using AMD iGPU’s? The MSI Claw didn’t exactly leave a great mark. The new Radeon 890m looks pretty killer for its power efficiency.

The cpus I’m talking about have released about a month ago, but until very recently AMD were the only good options for handhelds

Just checked the new release, you’re right it’s looking pretty good. The AMD variant is still ~11% ahead in many games but it’s certainly much much closer than before. https://www.youtube.com/watch?v=IZkSoXPNBpA

This is mostly down to the drivers, and I am sure they will be much improved in the next few months, their driver is still very young and hopefully has lots of room for further improvement

Being best in one aspect of the laptop market is not going to save Intel. They are losing their grip on the server market. That’s where the real money is, and once those customers go AMD, they are likely to stay there for the foreseeable future.

How is Intel’s market cap less than their total assets?

Debt, both on-the-books and anticipated.

Intel’s investments in the Titanium chipset have effectively dead-ended. They can’t get below 7nm efficiently. Meanwhile, you’ve got companies in Taiwan, Korea, China, and Japan breaking into the 3nm and 2nm scales. To catch up, they’re looking at hundreds of billions if not trillions of dollars in technical debt.

Yes, they can keep churning out existing processors at huge profits in the moment. But the face value of these processors plummets with every new step in Moore’s Law. This amounts to asset depreciation, which means Intel’s value is heavily overstated on the basis of asset cost alone.

I won’t argue that NVIDIA is overvalued. But I think the degree to which they are overvalued is often misattributed to speculation and avoids the real specter haunting the company… competition. NVIDIA’s market dominance and the escalating demand for their technology means the sky really should be the limit for their growth. Demand for AI processing is at the forefront of these expectations. But a rival manufacturer capable of cutting into demand for their units would dramatically undermine their profitability.

Its the same with firms like Microsoft and Facebook and Boeing. So much of their dominance is predicated on the theory that people will never leave these walled gardens and their margins being enormous purely because they controlled a critical commodity/patch of technical real estate.

There was - incidentally - another enormous company that seemed to have the market cornered in its industry and got complacent with its R&D and long-term investment strategies… Intel.

Meanwhile, you’ve got companies in Taiwan, Korea, China, and Japan breaking into the 3nm and 2nm scales.

The mainland Chinese SMIC is doing everything they can without access to ASML’s EUV machines, and have gotten further than anyone else has on DUV. It remains to be seen just how far they can get without plateauing on the limits of that tech. Most doubted that they could get past 10nm, but some of their recent chips appear to be comparable to 7nm, and there are rumors that they have a low yield 5nm process that isn’t economically feasible but can be a strong political statement.

TSMC is delaying the transition to Gate All Around, announcing that they won’t be trying it on the 3nm processes, and waiting until 2nm to roll that out. They’re the undisputed leader today, so they’re milking their current finFET advantage for as long as it will sustain them.

Samsung has already switched to Gate All Around for their 3nm process, so they might get the jump on everyone else (even if they struggled with the previous paradigm of finFET). But they’re not lining up external customers, as their yields still can’t compete with TSMC’s. It’s entirely possible though that as the industry moves from finFETs to GAAFETs, Samsung could take a lead.

Intel basically couldn’t get finFETs to work, and are already trying to skip ahead to GAAFETs (which they call RibbonFET). Plus Intel (like the others) is trying to introduce backside power delivery, which, if it can be commercialized and mass produced, would achieve huge gains in power efficiency. Intel did introduce both technologies in its 20A process (supposedly 2nm class), but then canceled it due to low yield. So they’re basically betting the company on their 18A process, and hoping they can get that to market before TSMC and Samsung hit their stride on 2nm.

The mainland Chinese SMIC is doing everything they can without access to ASML’s EUV machines, and have gotten further than anyone else has on DUV.

You can’t say that, though, because it implies Chinese engineers and information technology scientists are trailblazers rather than plagarists and IP thieves.

Intel did introduce both technologies in its 20A process (supposedly 2nm class), but then canceled it due to low yield. So they’re basically betting the company on their 18A process, and hoping they can get that to market before TSMC and Samsung hit their stride on 2nm.

And I’ve got a few shares in my retirement account riding on that success. But its more a hedge against my own cynicism than a sincere expectation. Intel, like Boeing, seems far more interested in rewarding investors in the short term than maintaining a foothold in the market long term.

You can’t say that, though, because it implies Chinese engineers and information technology scientists are trailblazers rather than plagarists and IP thieves.

I mean, I said what I said and I meant it. The Chinese are trailblazing a path nobody has tried before: DUV only for sub-10nm processes. It’s not ideal, and the reason why nobody did it before is because they already had EUV by the time they got there.

But I wouldn’t sleep on the ability of anyone to be able to solve problems using the tools at their disposal.

Especially since there’s nothing stopping the mainland Chinese companies from hiring Taiwanese engineers.

Not a ton of people believed that Taiwan could surpass Japan, either, but that happened in the 90’s. Not a ton of people believe that Japan can get back in the game, but Rapidus is making a play for 2nm.

Nothing is forever, and things are always changing. I’m somewhat optimistic that western sanctions will keep China from competing on the world stage at semiconductor fabrication, but I don’t think it’s a guarantee or in any way inevitable.

Right. Liabilities. Frick. Thank you.

Fear mongering articles making it seem like they are doomed and will go bankrupt after bad quarterly results were announced. Articles were probably sponsored by rich people wanting to buy Intel stock for cheap. But they won’t go bankrupt because the US gov./army need Intel to stay relevant against China, and Intel is basically the only American company that both designs and fabs their own processors and that is still relevant.

That and the fact that Nvidia is over valued (they are valued at 30x the value of their assets).

But they won’t go bankrupt because the US gov./army need Intel to stay relevant against China, and Intel is basically the only American company that both designs and fabs their own processors and that is still relevant.

That’s never stopped anyone from going bankrupt and wiping out shareholders. If the tech is that critical, the US government might engineer a bailout of the company, but will make the shares worthless in the process.

They did it with GM and Chrysler in 2009, they did it with Iridium in 2000.

thirty times???

Yup. I wager the vast majority of that is AI hype. Nvidia is the king there and in datacenter GPU compute in general, and investors are betting that Nvidia will continue to dominate and that market will continue to be relevant and grow.

I have my doubts, but as a famous economist once said:

Markets can remain irrational a lot longer than you and I can remain solvent.

So I’m not putting my money where my mouth is just yet.

That is an excelent quote.

In the same way that a normal person can have a net worth less than the value of the house they own: debt and illiquidity.

Well, while outstanding in current (we are living in a 20++ year bubble without much correction - no, when market values/indexes/cap rebound within a year, or month, with mostly the same main players) times, and especially for a successful company in the tech sector, having more assets than market cap isn’t that weird.

As long as market value is above book value, it’s fine.

And when it’s not, it’s prob a bank after 2012 (tho prices are generally way closer to book than they were before) :D.

Intel has made some major strategic errors and may not be able to bounce back. At least, they won’t bounce back with the company looking the same as it did. Their fabs need to be spun off to an independent subsidiary–which is apparently already underway–which will eventually be spun off entirely like AMD did with Global Foundries. The remaining company focuses on engineering. The resulting company won’t have the same assets, but could potentially get them back to doing good work.

AMD’s chiplet design has proven to be the way to go, and Intel has been struggling to replicate it across their entire lineup. I can get into the details of how genius it is, but suffice it to say that it lets AMD be extremely responsive to changes in the market in ways that were never possible before.

So is Intel undervalued? I don’t think so. The market has decided their problems are so negative that it drags down the company below what their direct assets are actually worth, and the market is probably right. However, this is not a death sentence, and there are ways that the company can go on.

Is that why AMD is able to bring out those new amd4 chips for gaming even though they’d moved onto am5?

Or was that just amd having some am4 capacity left?

A little of both. The node that those am4 chips are running on is cheap, so why not?

If this is all Nvidia stock let him try to cash out and see what happens.

The thing that bothers me when people say “oh its unrealized gains, it’s not real money” is that they use those unrealized gains as collateral for loans of real money. They effectively ARE that rich.

It’s BS that you can borrow against it. If he did sell it the valuation would drop.

As far as I’m concerned, that’s the point at which unrealized gains should be taxed: as soon as you’re using it as leverage

deleted by creator

With money they loan from a bank, using whatever they bought with the previous loan as collateral.

It’s credit all the way down.And that ends when they die, at which point the stocks get stepped up in basis so the taxes are almost completely avoided. Or they structure their debts in such a way that certain entities can be bankrupted without impacting the actual assets.

Things get wild when you’re in the 0.1% and above.

structure their debts in such a way that certain entities can be bankrupted without impacting the actual assets.

I can’t imagine how this isn’t fraud

It’s just playing by the rules as stated, and we have decided that limiting the liability of corporations is desired.

If you start a business, banks loan a lot to that business, and then the business goes under, you don’t lose your house. That’s the way it’s supposed to work, and the intention is to help small business owners not lose their shirts if things go sideways.

But it also ends up benefiting wealthy people because they can use these legal entities to shelter funds. A common real estate strategy is to have a corporation own your properties, leverage them like crazy, then if the market drops and you’re underwater, bankrupt the company. You’ll lose the properties, sure, but you’ll also lose the debt, so you can end up net-positive.

I think we absolutely need to reform how corporations work and remove liability as the value of the company increases. But in most cases, these wealthy people are just playing by the rules that have been agreed upon. IMO, the solution here is generally fewer rules to let things like fraud laws work, not to create more and more exceptions (because who has the resources to find loopholes? The uber-rich).

Banks don’t take this into consideration when assessing collateral?

Lol, who downvotes a question?

There are completely different rules when you are that rich. Look at Trump, he bankrupted how many businesses and banks STILL lined up to loan him money. At the very top, your trading favors and power.

Take what into account? They basically look at current valuations and offer loans up to some fraction of that amount.

And that’s generally the way the ultra-rich operate, they don’t actually sell anything, they just borrow against their assets. They punt the can down the road until they die, at which point those unrealized gains get stepped up in basis for those who inherit it. If you have enough stock assets, you can service the debt with the capital gains you’re forced to realize (i.e. dividends).

So the bank sees someone with $100B in assets asking for a $10M loan or whatever, and they’re completely happy to offer that, because even if the stock gets cut in half, he can still pay the debt.

You dont need to sell your stocks to access that wealth. You can use that as collateral to take loans or exchange stocks.

“unrealized gains” that you can somehow live off of indefinitely.

Elons everything comes from having overpriced tesla stock as collateral

LOL

In case anyone was curious - the avg daily turnover of nvda is 300 to 350 million moneys.

I’m so excited for the AI crash

“AI” technologies (in case of complex “universal” models, and not ML for narrow applications) suck for the same reason oil product based technologies suck. And that’s not global warming and microplastics. That’s power centralization and globalization the wrong way.

Both those enormous datasets and dedicated hardware for them are points of centralization.

Crazy how quickly NVIDIA went up. I wonder if they’ll crash down just as fast should the AI hype either die off or shift to other manufacturers (Intel, AMD etc.) or in-house solutions (ex. Apple Intelligence).

I just want to get a graphics card for less than the rest of a rig combined… shits ridiculous, and AMD doesn’t seem to be even trying to compete anymore

they do compete, its just users weigh DLSS and Raytracing far more than they should, and devalue VRam in long term situations

for example a 7900 GRE cost about the same as a 4070, but more people will buy the 4070 regardless

I definitely do like raytracing, sadly. I’m more interested in graphics and immersion in a setting/story in a game than competitiveness or ultra-high FPS. Water reflections and mirrors just look absolutely gorgeous to me.

I’m definitely strongly considering AMD regardless for my next build, as I’d like to switch to Linux fully at some point.

Eh, I got an AMD GPU somewhat recently and it meets all my expectations. I’m not too interested in RTX or compute, and they have a really good value on raster performance.

I’m coping for RDNA4.

They said the same when the crypto hype came along. If AI dies off there will be other trends in computing that require cutting edge silicon. AI may or may not continue surging but hardware will be needed no matter what. NVIDIA is selling shovels, not panning for gold.

Apple is not there yet, its models were trained on Google hardware. Though I am surprised it wasn’t Nvidia hardware.

What’s “Google hardware”? Likely just NVIDIA hardware running in Google’s cloud?

No no, Google does actually have its own custom proprietary AI hardware - https://en.wikipedia.org/wiki/Tensor_processing_unit

Ah, TIL.

Fuck you, Huang.

No, he’s not. It’s only his inflated market value.

He can turn a significant chunk of this value into actual dollars, even without selling the stock. This line of reasoning that execs’ worth is not what it seems to be because it’s based on share value is constantly used to discount their wealth and argue against acting on wealth inequality.

Exactly. At the very least, he could go get a margin loan at relatively low cost (like 5%) compared to the tax burden of cashing out (20% or more). And that’s just using publicly available numbers, a billionaire can get a lot cheaper loans than that.

Both numbers are based off market value, though

Nobodies care but okay…

(Not talking about your post, but the money of Huang)

It would be an epic double-down if he spent his entire personal fortune to acquire Intel, taking on a large amount of stock ownership in the combined company. As if he had so much confidence in the future that he was willing to bet everything on “we’re just getting started here.”