- cross-posted to:

- [email protected]

- aboringdystopia

- cross-posted to:

- [email protected]

- aboringdystopia

As they’re living with their parents because they can’t afford an apartment of their own.

This is a serious point. I couldn’t afford a place until I was in a relationship. And that was a long time ago. I can’t imagine how difficult it would be with today’s rent.

For one city in Germany there was an article reporting that moving in together became the new marriage, because giving up your previous accommodation means to be stuck together in the same place for six months or longer after a breakup.

Having a roommate turned an apartment from unaffordable luxury to merely 25% of my paycheck.

I honestly think having roommates is fun, particularly if you’re old friends anyway. But its crazy that a spot at the ass end of town was eating so much of my take home pay even after we cut the bill in half.

Yup. Rent and then food right now.

Let me rephrase it.

54% of young Americans struggle to buy food.

Would help if they learned to cook.

Vast majority of my under 40 peers, do not cook. Almost everything they eat is prepared meals or meal substitutes.

We cook for a family of 4 and grocery prices have still basically doubled in our area. Doing a lot more beans and rice lately.

Look up Justin Wilson’s Louisiana cooking. They make beans and rice tasty AF

A lot of people don’t have the time nor the energy to cook these days. If you work long hours or have multiple jobs to make ends meet, things can and will fall to the wayside. It’s not always a matter of laziness like you’re implying.

Yeah, I routinely work twelves and am in graduate school. I try to cook, but when I get home at 10 pm and have a paper to write (because my career is now illegal for trans people to do where I live, and an MS is the only ticket out…), I’m eating Taco Bell.

personally I’d rather be poor yet able to cook a healthy meal rather than work long hours, be tired and unhappy with no time AND struggle to buy unhealthy food.

Everyone picks their own poison. I think the core issue is that our options are all poison.

Well I guess someone picked for me. Because I didn’t choose any of this.

The number of young people with no money, but constant deliveries from Ubereats, Deliveroo, etc, astounds me.

Like, my brother in Christ, you are sending most of your food budget to Silicon Valley billionaires. No generation has ever survived entirely on delivered takeaways.

Do we REALLY need to quiz people to know this? Ffs.

I assumed it was housing.

If we could afford housing, then that would be it.

https://www.economist.com/finance-and-economics/2024/04/16/generation-z-is-unprecedentedly-rich

Y’all are buying homes just fine compared to the last few generations.

Y’all

Rich = Full Time Employed?

You seem to mistake having a salary for having money.

America now has more than 6,000 Zoomer chief executives and 1,000 Zoomer politicians.

Also, what if you’re not a CEO or a politician? Also, plus, too, how on earth is “small town city councilman” or “part-time New Hampshire legislator” a sign of wealth?

I don’t get the point you’re trying to make with your graph. Obviously there wouldn’t be many Zoomers working full time; most are still in school.

Zoomers born after 2006 haven’t graduated high-school, and those born between 2002-2006 are in college. That’s leaves only a 5 year window of people you’d expect to be employed full time.

The line for millenials looks about the same as Zoomers.

The line for millenials looks about the same as Zoomers.

shrug

Take that up with the Economist, its their claim and their chart.

I’m trying to understand your argument against the article and what point you’re trying to make by using their chart.

That was one single indicator. I agree it’s not the best, to your point, unemployment, homeownership, and salary averages are the ones that show middle class wealth.

I don’t see any of that in the article. Is it hidden behind the paywall?

You just need an account for the first few articles.

The article doesn’t say that. It says that most arent spending above 43% on housing. It doesn’t dig into that, likely on purpose.

https://archive (dot) is/2024.05.08-164727/https://www.economist.com/finance-and-economics/2024/04/16/generation-z-is-unprecedentedly-rich

I mean, you’re not wrong there either.

People really love quizzes.

I’m food insecure and a hufflepuff! /s

Something tells me that /s should be removed.

I struggle with the addiction, and i’m a Slytherin. 😬

Don’t worry though we solved inflation. We just removed it from our calculations. If we don’t count it: it’s not there!

Investment funds stocking up on US farmland in safe-haven bet

Investment funds have become voracious buyers of U.S. farmland, amassing over a million acres as they seek a hedge against inflation and aim to benefit from the growing global demand for food, according to data reviewed by Reuters and interviews with fund executives.

The trend worries some U.S. lawmakers who fear corporate interest will make agricultural land unaffordable for the next generation of farmers. Those lawmakers are floating a bill in Congress that would impose restrictions on the industry’s purchases.

Though their acreage is a small slice of the nearly 900 million acres of U.S. farmland, the pace of acquisitions by investment firms like Manulife Investment Management and Nuveen has quickened since the 2008 global financial crisis drove firms to seek new investment vehicles, according to Reuters interviews with fund managers and an analysis of data from the National Council of Real Estate Investment Fiduciaries (NCREIF).

The number of properties owned by such firms increased 231% between 2008 and the second quarter of 2023, and the value of those holdings rose more than 800% to around $16.2 billion, according to NCREIF’s quarterly farmland index, which tracks the holdings of the seven largest firms in farmland investment.

Farmland offers steady returns even in periods of high inflation, and firms hope crop demand will remain steady as the United Nations predicts the world will need 60% more food by 2050 due to population growth.

You don’t want to confuse “inflation” with “economic growth”. One makes prices go up because the evil bad salaries are increasing. But the other makes profits go up because of the smart efficient business net revenues are increasing.

A prosperous nation needs big new investments in the future. And that means speculating in our domestic breadbasket, so we can maximize the price of inelastic commodities in an effort to optimize consumption habits. You don’t like waste, do you? Optimizing price reduces waste. Its all right here in the book Basic Economics by totally non-problematic and very smart guy Thomas Sowell.

hey rich people, ever heard the stories of what happens when the mass working class gets hungry?

In the US? I think they just die?

They eat cake? /s

They vote for the very people that aim to make them poorer?

Rephrased: 54% of young Americans live with their parents or in large communal housing and still struggle to afford food.

42% are in school or are unemployed. 28% are working part time.

Yeah, food is the only real expense when you’re at home or in a dorm and not paying those student loans yet.

It has been a long time since people only lived at home because they didn’t have real jobs or are in school. Many are also likely to need cars so they can get to work (because most places in America you need a car), there is a decent chance they are paying for some amount of healthcare out of pocket as well. Rent is unaffordable as hell.

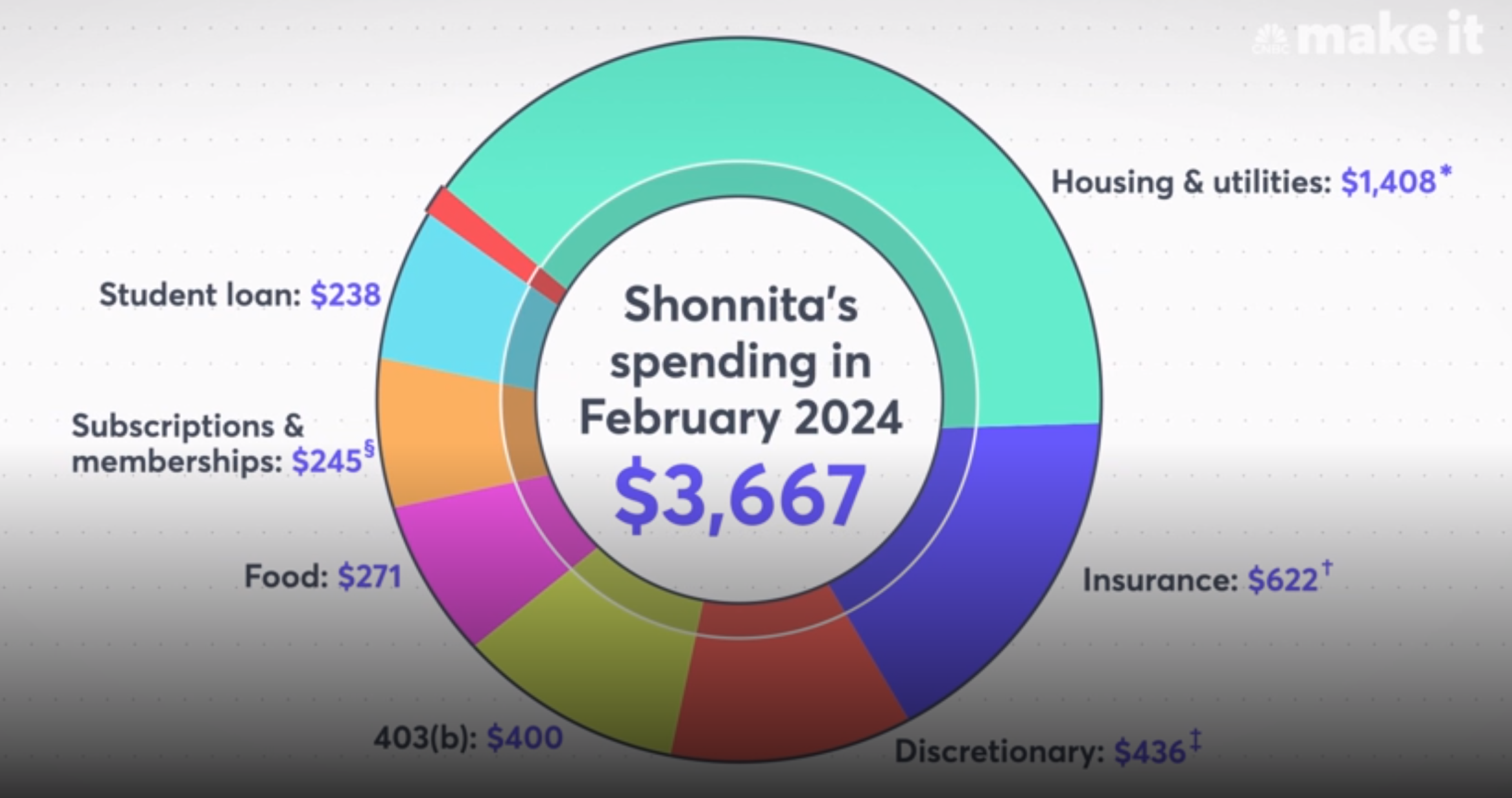

To follow up with this… they have a stupid video on their page where they break down expenditure of a girl in Houston who makes 65k. Insurance and rent takes half. Food is minimal at $271

I was a bit surprised rent wasn’t higher, but I wonder how many of the respondents haven’t moved and have rent control, so they aren’t affected by rent hikes.

Rent and health insurance definitely for me unfortunately

That’s why revolution starts with the bread

Especially burger buns, because they are round.

Shit’s bad in Canada, and our grocery store megacorps are taking us for all we’ve got. Five boneless skinless chicken breasts for $28 is insanity. Yet here we are.

I went to get chicken for some meal prep a couple of days ago (Missouri, US) and a 1lb container of just chicken breast tenders costs $13, I figured it was a “labor” cost for cutting the tenders off before the customer buys it, like how a container of diced onion costs an order of magnitude higher than just buying a whole onion, but nope, the pack of 2 breasts right next to it cost basically the same, maybe only 50 cents cheaper, and I wasn’t in anything expensive like a whole foods, just a generic lowcost midwest regional store. It’s absolutely ridiculous. Not to mention 2 orange or red bell peppers costs $5…

Chicken tenderloins are $3.94/lb at Walmart in Central KY. Where were you shopping?

This was at a Price Chopper in western central MO

Is this Schnucks?

Price Chopper actually

Also from Missouri. I got Aldi near me and their chicken is cheap.

Five boneless skinless chicken breasts for $28 is insanity. Yet here we are.

The fuck.

Here in the Netherlands we apparently have the opposite problem. Lots of complaints that meat is too cheap, mainly by animal rights organizations who oppose the conditions under which the animals for this cheap meat are held.

Monopolies are a hell of a drug.

Tyson announced several months ago that they were cutting back supply, just so that they could charge more. They’re one of, if not the largest chicken supplier (and they are fully vertically integrated) in NA, so them raising prices affects prices across the board.

Prepare for more pain as bird flu seems to be spreading in US cattle populations.

$3/lb for boneless antibiotic free chicken breasts here in Massachusetts. https://www.shopmarketbasket.com/sites/default/files/weekly-flyer/pdfs/2024-05/mb-flyer-May5-May11-2024_web.pdf

Man, I don’t know what I’d do without Aldi. Ironic that the best grocery chain in America is European, when the American Grocery Store used to be such a symbol of U.S. prosperity.

Lidl too

Same here. Aldi is the only place with affordable healthy food in my area. If it closed, then I’ll have to shop at garbage Walmart…

This fucking god awful economy is literally built out of strains on millennials finances.

Yeah no shit

Not really surprising.

yep. to anyone who is paying attention. and lives in a HCOL area.

but a lot of people aren’t/don’t.

I make way more than I did in my 30s (53 now) but I feel way poorer. Of course my mortgage payment is more than 3x what it was back then … that might be a reason.

The fact you can afford mortgage and a home blows my mind and I’m 40. I have no hope in hell of ever owning and I make decent money

If I lived in someplace like Silicon Valley California and making what I make I’d be homeless. Someplaces are better than others. But the system is definitely rigged for sure.

High COL area?

Considering only 30% of the people in this survey from ages 18-34 are working full time, i’m going to go ahead and say this isn’t an accurate representation of independent young adults.

26% are in school and 16% are unemployed for a total of 42% not really making money / are using loans for housing or are living at home.

28% are working part time and are unlikely to be living on their own - it’s rare to find a part time gig that can afford housing.

So 22% think housing is the highest cost issue… and only 30% are employed full time… sounds about right to me! I’m guessing it’s not 30% because those 8% got mortgages during the 4% or lower interest rate era.

What do you mean by independent young adult. Is that even possible to be any more? Without being born wealthy or making a huge gamble in health and safey or finances or both?

What do you mean by independent young adult. Is that even possible to be any more?

Yes

I was born into a poor family, single mom with mental illness. I never had air conditioning, we spent many years without a hot water heater lugging water boiled on the stove into a bath tub to wash up. My family drove beaters. Moved out at 14. Dropped out of high school. Spent a few years figuring out my shit. Got an associates at 25 at a community college. Got a job in IT support making 50k… ten years later at 100kish.

Today the same thing can happen but entry level pay is 10-15k higher. Renting just a room is still doable on that entry level pay. Community college costs are still effectively 0 if you have 0 expected family contribution. I did work retail while I was in community college part time, offsetting cost of living expenses only. Avoid education loans at all costs imo, you can’t declare bankruptcy and dump them if the worst case scenario happens and a degree is not a guaranteed job.

I never gambled health, safety or finances. I didn’t do drugs or get involved in something that could fuck my life too hard. I never spent a dollar I didn’t have in the bank unless it was absolutely necessary and still live that way because I grew up knowing how valuable money is, and how much it sucks when you don’t have it.

Nowadays even around Boston on public transit lines (no car expense) you can find a studio apartment for 1500/mo with nothing included. Once you’re making 60k you can squeak by living alone. You can instead save probably 1k by having roommates/a girlfriend and splitting bills. After five years and two job changes you’re gonna be able to bank a lot more money than you’d think.

People want it to be easy to live a high quality lifestyle but it just doesn’t work that way. Most people had parents struggling when they were growing up but they still managed to make it. If you get a bachelors degree in a higher quality major like analytics you can make way more money than I do.

One big mistake early and you’re fucked though. Babies, major health accidents, lack of dental maintenance all can hose you for a huge portion of your life. If you choose to live near family far away from jobs and opportunities you’re fucked. I have a ton of friends with child support payments that eat most of their take home pay.

Sure, get a job working in a construction trade, IT, sales (if you are good) and you are easily making 90-110k a year not long after. Independence isn’t difficult with 100k/year and not many obligations.