F that. Shave then down to a few million, tops. There needs to be a wealth cap.

A wealth cap and a maximum wage in my opinion. The idea of a minimum wage without a maximum wage is odd to me to begin with.

The idea of a minimum wage without a maximum wage is odd to me to begin with.

What the ultrarich just heard: “So you’re okay with us getting rid of minimum wage, then!”

You’re probably right, sadly.

Sorry guys, I checked the legislative schedule and they said they don’t have anything for a maximum wage or wealth cap.

But they did say if we can get 200 million to sign a petition they will ignore it indefinitely. Hope that helps.

Don’t forget to protest vote in November ensuring nothing ever changes.

The other option is a lefty Jan 6. You forget these are our alternative avenues rather than violence. But violence seems like the only bell that makes any noise these days sense the rest is drowned out by the massive amounts of free speech pouring into politicians’ pockets.

They’ll just claim aren’t paid in wages, see it’s a performance bonus. Totally not a wage. That’s for the poors.

We also need to end bullshit loopholes like that. Bonuses, benefits, stocks, everything and anything in-between needs to be counted as income.

Doesn’t matter if your employer pays you in bananas or bitcoin, everything the employer does to reward an employee must be counted.

They are counted as income. When company grants stock, it appears in W2, for example.

The rub is when their extrapolated value changes, and this would be fine if they sold, as there is a tax system for handling that too, but there are gaps with borrowing where they can game the system by borrowing against the value instead of selling. By needlessly living in debt, they can manage their tax burden in ways unavailable to mere mortals.

That’s the exact kind of shit we need to end.

Well, sure. Just have to accurately describe what to stop. Usually calls to action don’t understand the actual scheme in play, so folks ask for things that either don’t make sense or already exist. Within that context hard to fight when you don’t even know what to fight

I agree that the specifics are important, but it is honestly just tiring trying to keep track of the countless loopholes that the rich use. The end result is that I know there is horseshit going on, but I just don’t have the time to always give a thoroughly researched answer every time.

It gets tricky when you get paid once and then never get paid again, but the original thing you were paid with (i.e. company stocks) goes up in value over time, effectively replacing wages. Do we count that value increase as well? What if you get paid in cash, you buy something with that cash (could be the same company stocks), and that thing goes up in value? Or you buy another asset that your company has a lot of influence over?

Seems to be another good reason to abolish the stock market. The difficulty of tracking that stuff vanishes if it doesn’t exist in the first place.

The company exists without the stock market. People will still own portions of that company. The value will just be harder for the general public to determine and can be more easily obfuscated for tax purposes.

People will still own portions of that company. The value will just be harder for the general public to determine and can be more easily obfuscated for tax purposes.

Companies shouldn’t have values placed on them. They shouldn’t be bought or sold. They should all be employee owned.

That’s why it’s a wealth cap. That’s net worth, not income.

You exceed the 20m cap, you have to pay the excess to taxes. If it’s locked in company shares, you have to sell them and pay that in taxes.

The tricky part is that has implications for business control. Other people speculate the market cap into 50m and then they take over control of your company, because you are forced to sell off your stake. So an arbitrary coalition of 3 rich dudes can just take over your company on a whim, if it is vaguely important enough. A coalition of rich people is not likely going to treat the customers or employees better.

I think that’s a solvable problem. Theoretical value of a private company’s shares would need to be more flexible because the real worth won’t be known until selling your stake, or the company going public where there is a concrete value.

Thankfully bonuses are already taxed very highly.

That’s so missing the point, I can’t help but think you’re a cheerleader for the billionaire class.

If there is a maximum wage but no maximum bonus their income would be all bonus to get around the maximum. The thing we’re discussing.

Sorry my intention was to convey my agreement with you but also point out a funny attribute of this avenue which could be interpreted to align with the overarching “tax the rich” theme of the OP

Yeah. Every bonus that I’ve ever seen has been raced at something like 40%. We really need to both make capital gains equally taxed to earned income and have a wealth tax.

We really need to both make capital gains equally taxed to earned income

The capital gains tax isn’t lower than income tax just because. There are very specific reasons:

(TL;DR: a low capital gains rate has historically raised more in tax revenue, so if the goal is more taxes being paid, your suggestion is counter-productive)

The justification for a lower tax rate on capital gains relative to ordinary income is threefold: it is not indexed for inflation, it is a double tax, and it encourages present consumption over future consumption.

First, the tax is not adjusted for inflation, so any appreciation of assets is taxed at the nominal instead of the real value. This means investors must pay tax not only on the real return but also on the inflation created by the Federal Reserve.

Second, the capital gains tax is merely part of a long line of federal taxation of the same dollar of income. Wages are first taxed by payroll and personal income taxes, then again by the corporate income tax if one chooses to invest in corporate equities, and then again when those investments pay off in the form of dividends and capital gains. This puts corporations at a disadvantage relative to pass through business entities, whose owners pay personal income tax on distributed profits, instead of taxes on corporate income, capital gains, and dividends. One way corporations mitigate this excessive taxation is through debt rather than equity financing, since interest is deductible. This creates perverse incentives to over leverage, contributing to the boom and bust cycle.

Finally, a capital gains tax, like nearly all of the federal tax code, is a tax on future consumption. Future personal consumption, in the form of savings, is taxed, while present consumption is not. By favoring present over future consumption, savings are discouraged, which decreases future available capital and lowers long term growth.

Not only has a low capital gains tax rate worked to encourage savings and increase economic growth, a low capital gains rate has historically raised more in tax revenue.

The goal in my mind is not to necessarily increase total revenue but to erode the capacity to hoard wealth. The lower rates are gamed to increase wealth disparity, giving a distinct advantage to those who are already wealthy, over those who are not.

- The wealthiest’s wealth is all invested in the economy, literally the opposite of “hoarding”.

- “The lower rates are gamed to increase wealth disparity” is false–they are that way to encourage entrepreneurship and the like, the things that keep the economy strong. The fact that those who create the things that strengthen the economy become wealthy faster than those who don’t is a feature, not a bug. A rising tide lifts all ships. And make no mistake, one’s assets appreciating in value takes nothing away from those who haven’t invested–the latter group’s level of wealth is not affected by the former’s. In other words, the wage my job pays me does not change based on how wealthy other people’s assets are, from the billionaires, down to even a neighbor whose house has appreciated in value.

Wealth disparity is not inherently a bad thing–a century ago, the ‘gap’ was much smaller, as was the number of billionaires, but the average person’s wealth was also MUCH lower.

Bonuses don’t get taxed any differently. What happens if your employers payroll software sees additional income above your wages and without any tax-exempt lines (like health insurance) subtracting from taxable income. It ends up calculating a higher tax withholding rate. Or it doesn’t and just calculates the maximum marginal rate by default because it’s a stupid program.

Come tax time a dollar of income is a dollar of income. Your tax burden is calculated in total income and bonuses are treated no differently than wages.

Your tax return is just leveling out with the government. You’re paying the same amount of tax over the whole course of the year, and when you file the taxes, any refund or payment is a surplus or deficit of what you paid versus what you owed.

Doesn’t Section 31.3402(g)-1(a)(1)(i) state otherwise?

Bonuses are supplemental wages and are taxed at 25% unless you net over 1 million.

Section 904(b) of the American Jobs Creation Act of 2004 (Public Law 108-357, 118 Stat. 1418)

While I have nothing against a “maximum wage”, the wealth tax is much more important.

Not a maximum wage, a maximum controled assets. On the board of 100 billion dollar company, no one can own more than 1% of the voting shares.

Find yourself with more assets than you can split among owners? Better start reinvesting it into the company and your employees.

Not a max wage. A max multiple of minimum wage.

You can only ever make more than 5x/10x/etc… the minimum wage. They want more money? Then everyone needs to make more money.

They can feel free to increase their riches, but tie it exclusively to the rest of the population.

What does a maximum wage and wealth cap even mean? What happens when you start a company and it gets too successful?

Probably a bit extreme but taxes could scale up in a way that the more you earn, the harder it is to earn even more, so your wealth reaches a plateau

or maybe minimum wage has to scale to the wealth of a company

But wealth isn’t a wage. The value of the company goes up, do you have to sell the company?

There are many options for a company that hits performance metrics. The big ones would be re-inveermemt back into the company after the employee and shareholder compensation reaches the limit. A company with several departments that see a growth in their budgets will improve the value of the company and at the same time will see improvements to quality of life for the employees.

More ideas for excise wealth:

spinning off functions from the parent company to become other companies a flat, one time bonus for all employees expansion of employee benefits social program investments, like parks, schools, recreation centers, local sports teams, libraries, etc. community improvement projects (which are constantly underfunded)

If the extra wealth was actually allowed to trickle throughout the people, it would be an explosion of improvements to community health and well being. Businesses would directly help the people who patronize it, leading to more recognition (ie free advertising) for the companies who contribute the most.

There are many, many options for how to weigh the value the of a company, the performance of its books, and find a way to keep the business thriving while not sucking out the money of its customers.

re-inveermemt

I don’t know what that means- but how do these options not still increase the wealth of the company and therefore increase the wealth of the owners of the company

Re-investment. I figured a typo like that would be safe to assume but oh well.

Measuring the value of a company would be valuations just like now with shares equaling the value of the company. The owner would be divested from the company as it increased in value to separate the two. The value of the company would then be independent of the owner’s share in it.

I’m gonna be completely honest I don’t know enough about economics to answer that question

i mean technically your maximum wage is what you earn - number of employees * minimum wage

The loophole is that they aren’t paid that amount in maximum wage anyway. The actual wage is some degree of modest. They just get paid in bonuses and stock options, which don’t count for one reason or another.

If there’s a minimum wage, there should be a maximum wage

Billionaires: ok no more minimum wage then. /s kinda

Billionaires don’t have wages.

agreed but good luck enforcing it without a literal revolution

$100m can even be fine. Let them have their Bugatti and mansion. There’s big toys aplenty to have them motivated without being complacent and not milking the rest of the world for all it’s worth.

Even capping it at 1 billion would do wonders. That means, for example, Elon would have to pay more than 200 billions to the government. Imagine what we could do with 200 billions.

And yes, they could split it with family and friends, but I find it hard to believe he (or anyone actually) knows 200 people he can trust with 1 billion each.

Hell, I’d be okay with 100 million total in both liquid and non-liquid assets as a wealth cap. We could even tie it to inflation, so long as we also tie the minimum wage to inflation (let’s say, starting at $30/hr federally, then increasing as needed locally).

F that. Shave them down to a loincloth and a bouncing ball

Wealth is there to motivate people to do something more than dwell and ruminate. If there was a wealth cap or maximum amount of money you can have no one would have motivation to do all these things we have like companies and such.

It’s not so black and white.

Currently probably the best bleeding edge system is doughnut economy where power of capitalism is constrained to non essentials from one side and planet health from another. https://www.kateraworth.com/doughnut/

Netherlands if I remember correctly currently is doing something in that direction and generally eu capitalism is somewhat constrained

Cap it at 20m. That’s a great fucking motivation to me. That’s a couple nice houses, a boat or two, several over the top cars, and pretty much any possession you can think of within reason. You could lead a very comfortable life on 20m net worth.

Humanity does not need private jets, mega yachts, mega mansions, etc.

There would be no personal motivation to siphon every penny away from your employees if you’re at your wealth cap. Employees who should be sharing in the company’s success in meaningful terms.

There would be no motivation for enshitification to reduce costs to the bare minimum for every last penny.

Etc.

The extreme greed that “motivates innovation” is such a crock. Yeah, obscene wealth does fuel venture capitalism atm, but those investors are also who twist the knife on CEOs to make short term decisions that end up destroying companies at the detriment of employees and customers alike.

CEOs aren’t in it for the long haul. Investors aren’t in it for the long haul. It’s all rape and pillage under the current system.

But if you cap it there is no reason to improve things, make them more efficient etc. The world runs on greed, ambition and it’s very important for progress as long as it can be directed and constrained in a sensible manner.

Regulations need to constrain capitalism and make sure it stays within reasonable boundaries where it is a power of building things and not destructive.

Wealthy serve as a goal to the ambitious and as long as wealth can not be inherited (that needs to change) and everyone has equal opportunity to become one, it is fair.

Ok. Let’s do a little exercise, then.

Assuming you’re a working class person, are you motivated by the hope of becoming a billionaire? Is that what drives you to go to work or take a chance at starting a business of your own?

If that dream was capped at 20m, would that stop you from trying to be successful? Is there anything in the world that you covet that exceeds 20m? Or even 10m.

I won’t wait for your personal answer. I don’t think it’d far fetched to say that for most people, their answer would be that it doesn’t make a difference. Achieving 20m would be a dream and give them a far more comfortable life than they have now.

And if they reached that 20m, they’d either retire and give the next generation a chance at the reins, or keep working but necessarily focus more on their employee/customer happiness, because there’s no reason to be exceedingly greedy except as a ego scoreboard thing.

That doesn’t stop innovation, it just means that more will innovate and thrive because fewer will clutch onto their throne and kick others down.

deleted by creator

Very selective reading you have there.

And if they reached that 20m, they’d either retire and give the next generation a chance at the reins, or keep working but necessarily focus more on their employee/customer happiness, because there’s no reason to be exceedingly greedy except as a ego scoreboard thing.

I’ll end the conversation here though, it’s obvious you’re not interested in intelligent discourse if you’re cherrypicking like that. Enjoy your billionaire idolatry while you file your w-2

deleted by creator

If it’s such great motivation, what is stopping you now? The potential to earn that is there for you, right now but from what I gather you’re not doing it. Why would you have MORE motivation to make 20M if it was capped but have no motivation in the current environment?

I think you’re missing the point. I am asserting that 20m cap or capless, people including myself are motivated to try to be monetarily successful. The American dream is everyone is a future million/billionaire.

The current wealth distribution and lobbying only serves to make the rich richer and kick the ladder out from behind them.

A wealth cap changes that. It means there’s little point for the rich to keep clutching to power for more money, because you can’t keep it. But the goal of 20m is still very appetizing to the working class, where they could retire in comfort for the rest of their lives.

Netherlands if I remember correctly currently is doing something in that direction

It’s not. Nothing remotely like that is going on here.

In April 2020, during the first wave of COVID-19, Amsterdam’s city government announced it would recover from the crisis, and avoid future ones, by embracing the theory of “doughnut economics.”

Amsterdam’s ambition is to bring all 872,000 residents inside the doughnut, ensuring everyone has access to a good quality of life, but without putting more pressure on the planet than is sustainable. Guided by Raworth’s organization, the Doughnut Economics Action Lab (DEAL), the city is introducing massive infrastructure projects, employment schemes and new policies for government contracts to that end. Meanwhile, some 400 local people and organizations have set up a network called the Amsterdam Doughnut Coalition—managed by Drouin— to run their own programs at a grassroots level.

So it was Amsterdam only

How? Most people this rich have next to nothing in their bank accounts. The ridiculous numbers you see are not bank account balances or sports cars and yachts. Its primarily shares of the companies they manage. E.g. if you tax them conventionally, you force them to close the factories and everyone becomes poorer. If you just confiscate the company (shares), now the government owns companies, and we saw how that goes plenty of times: USSR, North Korea, Cuba, … Or you give the shares to people, but the company would still need to be managed by someone who no longer has a proportional incentive to make it succeed, causing the same result as if it was government run.

…or you have the workers communally run the factory and elect the person to run it and if they don’t do a good job, they lose the position. Which seems like a pretty good incentive to succeed. In fact, “do this right or you’re fired” rarely seems to apply to the person at the top.

Lets pretend they would not become corrupt. What about unpopular decisions, such as layoffs? As much as people hate them, they are sometimes necessary to keep peoples work productive.

Again, if they do a bad job, they can be taken out of office by the other workers. If they handle layoffs the right way, they won’t be taken out of office.

Where does the corruption enter into it?

First off, if you think people will vote for unpopular things because they are handled correctly and the right thing to do, you are not paying attention to any elections.

Second of all, lets say I am elected to run this company. I have two options:

- Operate the company to the best of my abilities and in the best case scenario, I will get a bit above average wage. More likely something out of my control will happen that I will be balmed for by the next guy who wants to run the company.

- I give way overpriced contracts to people who will give something of value to me. Of course vaguely enough that you can’t prove it in court. Then I just lose my job in a year or two, when people figure it out. Of course by then, I gained more in that year than I would gain in my entire life working honestly.

What do you think the kind of people thick skinned enough to win a company election would do?

And if your solution is to lower the burden of proof in court, who would take normal salaried job with high chance of being falsely imprisoned? Not the honest ones…Lower the burden of proof in court? What?

Ignore that last part, just me writing ahead too much. I was trying to say this kind of corruption is incredibly hard to prove, so courts are not helpful.

Where does the corruption enter into it?

Money.

Guy want companies to become the government

No, guy wants companies to be owned and run by workers rather than just be wealth machines for the investor class.

I agree a wealth tax is difficult to implement, but that alone is not a reason to dismiss the idea. Also, for shares, you can always sell shares to pay the taxes that are due. The point of wealth tax is to wealth, not income. Much like a property tax. I don’t understand why they would be forced to limit their own income potential (by closing factories or decreasing production) in order to pay taxes on wealth they own.

Better than a wealth tax is a land value tax. Key properties are that it doesn’t cause capital flight (you can’t move land), it’s almost impossible to evade (you can’t hide land), it’s economically efficient (it literally doesn’t even harm the economy in the slightest to implement it), it can’t be passed on to tenants (both in economic theory and in observed practice), and it’s progressive.

Plus, it incentives denser, transit-oriented city development and disincentivizes wastage of prime real estate (which contributes to the housing crisis). All in all, a terrific policy that people aren’t talking nearly enough about imo.

At least in the US, most people already pay local and state property taxes that are higher in high population density areas. The problem with this tax is that it still disproportionately affects middle class home owners instead of only affecting the billionaire class. Also, land is just 1 aspect of wealth. Most of the wealthy in the US don’t keep any significant part of their wealth in land.

Most of the wealthy in the US don’t keep any significant part of their wealth in land.

This is really key. If it was 100 years ago, this would make more sense, but the vast majority of measured wealth created in the world today is in intangible assets, like stock prices.

Sell them to whom? You are taxing everyone rich enough to buy them.

They would close factories to sell them for parts and blow the cash on whatever before paying taxes: casinos, yachts, moving to a country without such taxes, …

You make it sound like factories don’t actually net them profit LMAO. Even after paying taxes they’re still making money. If they weren’t, it would be a terrible business. Also what do you mean sell them to whom? Other billionaires that still exist even with a wealth tax, non billionaire investors, international investors. If they can’t find someone to sell their shares to, then clearly their shares are overvalued and that’ll take care of some of the problem in itself.

Also shutting down factories won’t affect their wealth, which is actually what’s being taxed. And it won’t matter weather they sell $1 billion of whatever to buy $1 billion of something else. You’re taxing their wealth, not their business or cash in hand. If they’re holding on to $1 billion in one form or another, then they’re holding on to $1 billion that can be taxed.

Once again, billionaires don’t have large sums of money in their banks. It is all invested. So if all of them in the country have no money and need to sell to pay these massive taxes, who are they selling to?

And sorry to say this, but if you genuinely think selling a significant portion of a countries industry/businesses to foreign investors could be good for the people of the country, than I am wasting my time here.

I agree a wealth tax is difficult to implement, but that alone is not a reason to dismiss the idea.

What about the fact that it’s been tried and failed a ton of times already in a bunch of countries? That’s a pretty good reason, I think.

In the only countries that still have a ‘wealth tax’, the thresholds are so broad that they are primarily a burden of the middle and lower classes, making it effectively no different than a more conventional/mundane tax, versus what everyone talking about a “wealth tax” in these kinds of discussions invariably expects; namely, a tax that only/primarily targets the wealthiest.

Before the income tax was implemented, there were promises it’d only be aimed at the rich, too.

Youre right about income tax and to some degree income tax does primarily effect the wealthy except the brackets haven’t been updated to reflect inflation and the new ultra wealthy class appropriately. The other thing is, many of the wealthy don’t have incomes in the traditional sense, and it makes no sense to differentiate capital gains from regular income. The argument that you don’t want retirement investment income taxed as regular income tax is a little moot since that’s why we have tax advantaged retirement accounts. If those accounts aren’t enough for all retirement investments, maybe those limits need to be increased or the way the tax advantage works for them needs to be changed.

Past failed attempts are also a good point, but to me they sound more like administrative failures rather than a failure of that type of policy. In the US we already have some wealth taxes on the value of homes and cars. Some of these failed European policies seemed to define wealth poorly and as a result either weren’t fully taxing wealth or spending more resources on administration than collections. But banks already do a great job of assessing an individual’s wealth. This is how the ultra rich are able to get huge lines of credit to play with rather than having to use their own capital directly. I don’t see how the government can’t use similar systems to calculate an individual’s total wealth. And the argument about the wealthy fleaing the country are also a little moot in the US. The wealthy in the US make money off of American tax dollars. Amazon/Bezos is rich because the US government started using AWS. Tesla is successful because the US uses their influence in South America to cost effectively obtain raw materials for batteries (not to mention those tax credits on EVs). There are all the military industrial companies, and the insurance companies. If the government had the backbone to say Americans who got wealthy using the American market have to pay taxes in America or they lose their right to sell to the American market (government or to the public), no one is going anywhere.

Or you give the shares to people, but the company would still need to be managed by someone who no longer has a proportional incentive to make it succeed, causing the same result as if it was government run.

Would it? Give the shares to the workers and they have a huge incentive to run a company well. Right now a CEO’s only priority is to maximise shareholders return. A workers led company would maximise both shareholder return AND have an incentive and pride in doing a job properly instead of the low morale and poorly built crap we have today.

History has shown anytime control is in the hands of the few, it’s run into the ground in order to maximise the wealth for the few so giving control to the masses of workers in companies would lead to more compromises and might sound bad at first but would likely work better the more people required to make drastic changes.

And as said many times, no billionaire has ever ‘earned’ that. They’ve all gained it through exploitation and wage theft either directly or indirectly!

Winco

So how do the workers run the company? A vote on every little decision? If not, you have to still have a CEO, for whom it is now far more profitable to make decisions that profit them rather than the company. And even if you vote on every decision, could most workers really understand what they are voting for.

Also, what about layoffs? While everyone loves to hate layoffs, they are part of keeping peoples work productive. Are the workers going to vote/approve them?

And even if you vote on every decision, could most workers really understand what they are voting for.

Yeah because 32hrs would become 40 and we would discard another 8. 6hrsx4. When that happens we are no longer deprived of time edilucate and discuss the matter with the relevant folks.

And even if you vote on every decision, could most workers really understand what they are voting for.

Yes. Because of the above.

Also, what about layoffs? While everyone loves to hate layoffs, they are part of keeping peoples work productive

No. They aren’t. They actually doing the exact opposite. Your statement to contrary of the obvious is a sucker delusion. Stop consuming sugar to begin with and finish by stopping to listen to money.

Are the workers going to vote/approve them?

Yup. Your delusion is thinking that mass is any kind of importance. Its not when it is compared to life because shit might come from the magick of people but there will never be life as a part of them unless they were to begin with and in that case, you were never the creator. Workers MUST have the right to make decision where they work or the entire planet will die. No fucking exceptions with any financial delusions because ALL of it is doing and being exactly that.

then that’s for the workers to decide on. If 51% of the workforce agrees, thats the decision! If that doesn’t ‘fit’ with the workers, make it 60% or 75%, or whatever number the majority agree on!

It really isn’t that difficult. There are plenty of voting systems, the issue comes down to people and a change of thinking how companies are run.

You can make any argument why it wouldn’t work when you don’t want something to work but given the current system is working soooo well… new ideas are better than no ideas! 😎

You say that ironically, but average people in developed nations have arguably better lifestyle and more resources than kings used to. And living standard in developing nations have been steadily improving. The system is incredibly flawed because the humans it is made of are incredibly flawed. Considering how flawed it is, it is working astonishingly well.

Thankfully, workers are deciding every day they would rather work in the current system, then stop working based on some hopeless dreams of flying castles.

then that’s for the workers to decide on. If 51% of the workforce agrees, thats the decision!

But the vast majority of workers don’t have the slightest idea how to run a business effectively. A very large proportion of them mismanage their own finances, let alone a larger responsibility like that.

Bro what.

Are you saying we need to lay off workers to scare the rest into line?

No, I am saying that often, company may need to downsize to remain productive. For example, lets say we have a company that makes headphone jacks. For obvious reasons, they are no longer able to sell as many as they used to, but maybe half.

The company now needs to layoff half the workers. Is the elected CEO going to promptly do it? Or will he delay it and causing both financial damage to the company and productivity damage to the economy?

And also, do the fired employees still get to vote? Is just firing malcontents the tyrant CEOs weapon?

Production should be run by the workers via a democratically run and accountable worker-government.

The government owning companies is not a bad thing. The US Postal Service and Fire Department are state-run and operated, and are highly popular. Why do you think a profit-motive is necessary when it’s the source of enshittification?

Why should we have a stock market in the first place? Seems like all it does is act as a means for the rich to shuffle their wealth around, funnel it to the top and claim they have next to no liquidity.

If you think that, you obviously don’t know what the stock market was created to do. Just google it. No point for me to write it here.

Original intention isn’t relevant when the current purpose is to fuck over anybody who isn’t the rich.

First of all, it matters if the stock market is fulfilling its original intention. Which it obviously is. Second of all, some of the biggest traders on the stock market are pension funds of common workers, appreciating their retirement money. Fuck over how exactly?

And third, let’s say none of what I wrote is true. Why are we somehow better of not having a stock market at all instead of fixing it to fulfill its purpose? Or making a new one if it is easier? Do you regularly throw away things without getting a replacement when they stop working? Never replaced your car and phone after they got old and broke?

Second of all, some of the biggest traders on the stock market are pension funds of common workers, appreciating their retirement money.

“The rich now own a record share of stocks,” Axios reported on January 10, noting that the top 10 percent hold about 93 percent of U.S. households stock market wealth.

https://ips-dc.org/the-richest-1-percent-own-a-greater-share-of-the-stock-market-than-ever-before/

You’re being misleading, or have been misleading about the allocation of wealth within the stock market.

Retirement should be a public service, not a form of gambling within a system set up for the rich.

Why are we somehow better of not having a stock market at all instead of fixing it to fulfill its purpose?

Because it would be one less way for the rich to obfuscate their wealth growth, because the original purpose of distributing ownership through shares is an inherently flawed idea.

Do you regularly throw away things without getting a replacement when they stop working?

“Why would we get rid of the orphan killing machine!?!?!? We would have to replace it with a new one.”

Ok, lets do some math. The GDP of the US is $28 trillion. The population of 15 years and above is about 273.85 million. That gives about $102,000 annually per person in this category. The median personal income is about $40,500 annually. So almost 40% of the entire economy goes to wages and other income of normal people alone. And yes, it is median (not average) so we are talking normal people wages, not CEO wages. According to wikipedia, about 17.3% of the GDP is government consumption and 17.2% is capital investment. That leaves little over 25% unaccounted for. This will include everything not accounted above. Charities, rich people wages, lottery winnings, … and of course, stock market gains and dividends.

I can’t account for more of the 25% right now (it is late, maybe someday), but even if it all went to the filthily rich along with a proportional part of government consumption and capital investment, then the normal people still get 61% of the economy. In the absolute worst case. Seems to me like lot of the “ultra-wealthy own most of america” is just misinformation.

Someone accused me of dehumanizing rich people here yesterday. They do a pretty good job of that on their own.

They should not get the privilege of being humanised. They have too many other.

But it’s not real money in their bank accounts! They can barely go by as is!

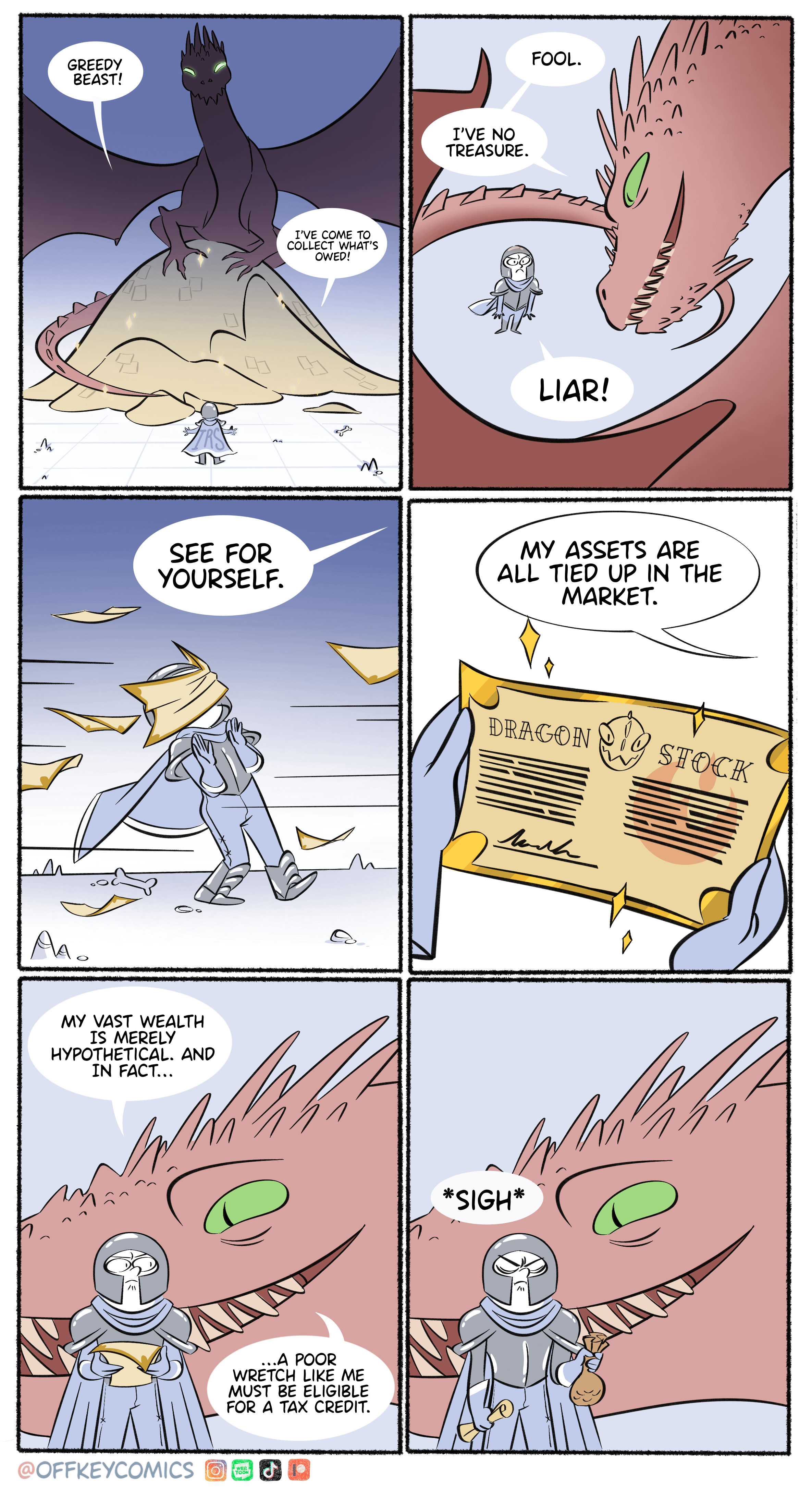

Aren’t they using that to get loans? They can easily buy anything they want using that as a collateral. So it is real money.

Pretty much yeah. It’s virtually unlimited money.

Look at Trump. Doesn’t matter that all of his wealth is on paper and he’s in massive debt. Unless he’s in prison, he will die in the lap of luxury.

That’s only because they let him do it, in a less corrupt country his ass would be in jail already.

Seriously, I saw some of besoz finances (which is a tiny sliver of the big pie) and he got a loan at 0.1% for $2m. Imagine that, and then he doesn’t even have to repay the loan. It’s just as long as he’d pay interest he’s A okay.

That’s why they play a whole different game than us. He isn’t worried about paying back that interest or loan, he’s trying to find a way to make that $2m pay him back 1% or more per interest period. They never have to consider the loan amount, because those interest and payments will be done in 10 years while the profits from that loan will explode into hundreds of millions.

See? Anyone can do it, it’s honestly really fucking easy to come up with a million dollar idea. The hard part is that first couple million dollars. If you aren’t born with it, you will literally never have access to that type of wealth.

You could write this in stone and metal on everything on earth; carve it into the very DNA of humanity. And still…

A big subset of these leeching fucks and their admirers would still be on “but he’s so smart and if it so easy how come not every blah blah blah”.

They really do mistake financial Inertia with intelligence; billionaires don’t actually need finance degrees the stupid fucks.

You have to pay loans back. Do you think lenders are in the business of handing out free money? They lend because they get a return–if they didn’t, there would be literally zero motivation to lend.

Obviously they pay it back, but the assets used as collateral usually grow faster than the interests they have to pay back. Which is pretty much free money.

Yes, Musk easily found $44 billion to buy out one of the largest social media platform in existence but there’s absolutely no possible way for him to pay a $6.6 billion dollar tax bill because he doesn’t have that kind of liquidity!

Make them take out loans against their portfolios to pay the wealth tax.

Lol … That’s the game every rich person plays and we all accept.

They’re super rich so they can use their imaginary wealth to get even more rich.

When you ask to tax them, the money doesn’t exist or it isn’t what you think it is so you can’t tax them.

Beautiful

We all accept it because these people and their friends own most of the media, so it’s easy for them to make us turn a blind eye to it.

That and they also own enough representatives that there is barely any wiggle room to get out of this mess.

break up their monopolies then.

Go for it and then expand it. Being a billionaire should not be legal.

Do you think that it wont get expand to the point where it harms you too? Do you think the government would do good things with the increased revenue (if it actually got increased revenue)?

Government is as good or as bad as we make it. Pretending like it can’t be good while actively sabotaging it is conservative’s entire playbook.

And yes, increase my taxes. I’m happy to pay more if we can improve the lives of everyone. If we can pay for things like universal healthcare, good infrastructure, public transit, and decent public housing, double my taxes.

I agree a little bit, but the government tend to be a mechanism to take from one person and give to another. And in regards to america, the money goes directly to killing people all around the world.

If you want to give more money in taxes, why dont you give it away to charity instead?

It is as good at you make it. And at least there is objective accountability from people not using it for passive income. I loath the argument that government is slow or ineffective. It is an intellectually lazy argument, if not dishonest. Why do you think that private business is any different? Having experience with a company that was small and nimble that grew to a behemoth, the difference was vast. There are simply many, many more stakeholders. Effectiveness and nimbleness is a problem at scale. Yes. Having friends and acquaintances in places big and small, private and government, you see this at play everywhere. You have to accept moving slower at scale, especially at government scale. Doesn’t mean we throw the baby out with the bathwater. Public accountability is taxation. Your money isn’t made in a vacuum. It is the labor of those who have basic needs that aren’t being met while billionaires buy islands and yachts and seek tax shelters off their exploitation of labor.

Exactly this. Any random billionaire has the same Good vs bad argument against them, but without transparency and without accountability… It shouldn’t be 1 white rich guy’s decision how to spend billions of wealth, how society’s wealth is spent should be the result of democratic process, because creating the wealth is an effort in which (nearly) everyone participates too!

When did I say the government is slow? The government is just the most inefficient by nature of how business works. Large corporations are also inefficient, but they tend to be propped up by the government so they dont need to be efficient.

Your proposed billionaire tax would still leave them ahead. My proposed tax would leave them a head.

So how does this wealth tax work? Are stock holdings taxed? Stock quantity doesn’t magically go up unlike fiat currency which governments just print more of.

None of these numbers make any sense in terms of how capital actually works. Is the government meant to take the profit in stocks? Because these billionaires aren’t selling that much stock each year and aren’t earning that much from CEO paychecks.

Not to say CEO paychecks aren’t obscene…

And what do you do when they pack up and move themselves and their companies to tax havens?

The rich aren’t fleeing Massachusetts despite a wealth tax.

Turns out there are disadvantages to living in tax havens over living in Boston and Cape Cod.

https://www.wbur.org/news/2023/12/28/mass-fair-share-millionaires-tax-anniversary-revenue

But you can save so much tax money by moving to the middle of a desert in India!

Even a nicer place like the Cayman Islands.

Good luck shopping at a high-end fashion boutique or going to the opera there.

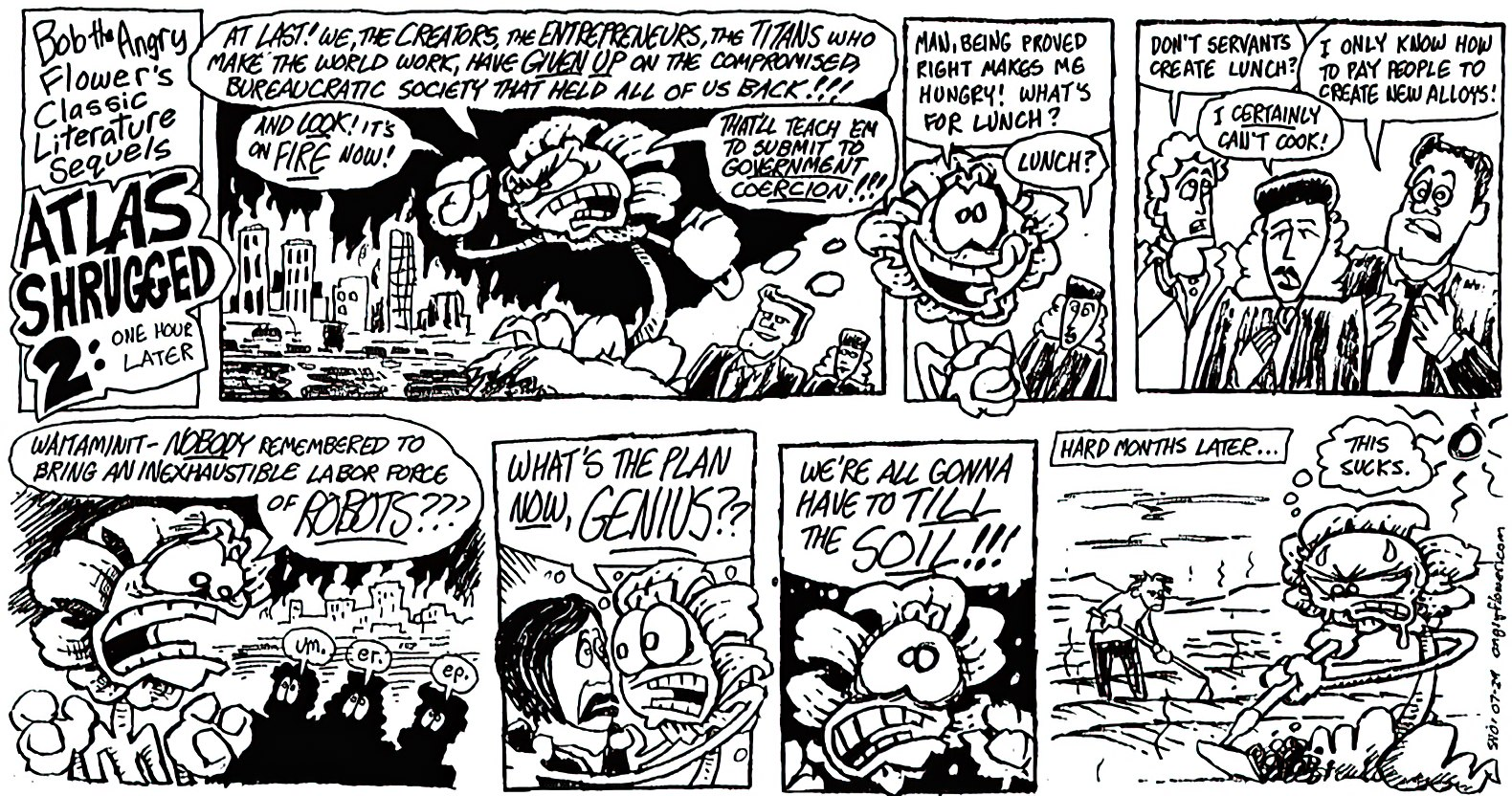

But John Galt did it…in the libertarians’ imagination.

We would be so screwed if all the billionaires went and lived in some secret mountain location. They should totally go do that.

Tap for spoiler

It will make tracking them down for dinner so much easier

That’s not a wealth tax, that is an income tax (+4% for the 1M+ tax bracket).

Countries that have a general wealth tax are Norway, Spain, and Switzerland. Countries with a selective wealth tax (beyond property taxes) are Belgium, Italy, and the Netherlands. Source: https://www.pgpf.org/blog/2023/10/what-is-a-wealth-tax-and-should-the-united-states-have-one (under the heading “How have wealth taxes worked in other countries”)

a 4% surtax on incomes over $1 million

Musk isn’t earning $220 billion a year, so clearly as I asked, this appears to be based on stock valuation.

People spruiking and sharing absolute nonsense with zero idea of what is income, what is capital and how a “wealth tax” would actually work.

This is why your opponents laugh at you.

Who are my opponents?

Also, the question was:

And what do you do when they pack up and move themselves and their companies to tax havens?

The answer is, they generally don’t leave.

Also, the question was:

The question was

So how does this wealth tax work?

I know because I asked it and not a single one of you has had a coherent response.

Oh like the tax in Massachusetts?

The tax that would only see Musk pay $575 million and not the ass-pulled $6.6 billion?

Who are my opponents?

Apparently the ultra wealthy but you seem a bit confused.

I copied and pasted the question I answered. I’m sorry you didn’t care for the answer, but don’t ask a question if you don’t want it answered.

As for the ultra wealthy laughing at me, why should I give a shit?

In fact, why should I give a shit if anyone I don’t care about is laughing at me?

Well, maybe not the laughing, but if the wealthy can play in the nuance more confidently and accurately, even if you are right broadly you’ll have a more uphill battle trying to win. If they point to the rhetoric and are and to highlight incorrect details, they say “see, they just don’t understand things, so clearly ignore them”. Or if you “win” they play in the nuance to stack the deck in a different way so they win again, despite you ostensibly getting what you drive for.

However if you have on point critiques and suggestions to consider, maybe it’s easier to drive for a system that reigns then in better, and is less likely to just let them move the loopholes.

As SunTzu wrote: If you know the enemy and know yourself, you need not fear the result of a hundred battles. If you know yourself but not the enemy, for every victory gained you will also suffer a defeat.

So how does this wealth tax work?

Answer found in less than 10 seconds on the web. https://taxfoundation.org/taxedu/glossary/wealth-tax/

Who are my opponents?

It’s not really the ultra wealthy, it’s the ironically impoverished sycophantic masses repeating pro-kleptocrat-capitalist drivel on the behalf of billionaires.

So are you arguing that stock valuations mean nothing?

billionaires make it difficult to judge their worth… because as pointed out they are trying to not pay taxes.

I’m arguing that by FlyingSquid’s own assertion that the Mass. wealth tax could be copied that the numbers make zero sense.

What’s not to get here? Read what he claimed and read the link he provided.

Stock evaluations have value, and they’re already taxed upon realization of gains. The meme says we should take away Billions of Elon Musk’s stock shares every year, but idk that sounds like a pretty vague and unsustainable plan. Maybe it could work? Most companies would probably just go private and do a series of offerings to lower evaluations. We need to at least clearly define a bracket of who it effects, is it any stock shares amounting above 1 Billion? 1 Million? Also, why is the rate in the meme a 2.98%?

It’s just not a plan. It’s the opposite of a plan, it’s a desired end result with no details at all.

I have a house. I say have because while I have the title to the house, the bank has a lien that basically means they own it. Like a stock, my house increases in value. The government in my state then taxes me on the value of the house. Taxing me on unrealized gains in the house (I have not sold it) is like taxing a rich person on the unrealized gains of stock (that they have not sold).

It is possible to come up with ways to tax stock. It will be imperfect like all tax systems are. It will be better than what we have now.

Indeed, property taxes should just be extended to also cover stocks and bonds.

That should be the basic premise.

Is the government meant to take the profit in stocks?

Yes.

There is no need for the billionaire to liquidate their stock in order to pay a tax in dollars. The IRS just confiscates an equal percentage of every position they hold, and liquidates it over time, selling no more than 1% of each position’s total traded volume per month, so as to not radically impact the stock price.

When they pack up and move, we say “mission accomplished”. Let them leech off an adversary’s economy.

The IRS just confiscates an equal percentage of every position they hold

Congrats there are now 3 men who can collaborate to collapse the government by shorting an insane position, have a portion of it seized, and wipe out all government revenue for a year. Sure they’d also be infinitely broke but you just gave them the lever to kill a country.

How would that possibly wipe out all government revenue for a year? The government didn’t have to buy the stock. There is no way they’d be worse off revenue wise than the current situation where there is no tax taken on these held stocks.

Position vs stock. Learn to read.

So the IRS seizes an option on the shorted position rather than the position itself, which comes due when the position is realized. Or, any liability for a position is assessed back to the investor rather than the government. Or any number of other rules are established to keep the IRS from assuming liability for losses and return them to the investor.

And, of course, the three men who collaborated are charged with securities fraud and conspiracy.

Liquidators would also have rules allowing them to react to market manipulation and other artificial market influences.

I think you’re confusing a wealth tax with an income tax. They’re different. As for how these wealthy people pay, it’s not up to the government to figure out how someone pays their taxes. The onus is on the taxpayer.

This entire thread is people who don’t understand how the system works.

That or they understand the system is broken

You can understand something is broken without knowing how to fix it. But you can’t fix something without knowing how it works or being extremely lucky.

The systems not broken it was built this way.

The system was built broken.

Naa I think a large chunk just think most of these guys have that in cash laying around. Someones liquid worth is a lot less than what they have. Everyone of these guys has their money tied to a company. If you make them sell the stock to cover the tax you’re going to watch these companies go under.

I’m not saying it’s a good system, just that it doesn’t work the way these memes act like they do.

Would you like to have the gov tax you on your entire worth? Probably not.

“Finance and economics is too complex for the poors to understand. Just trust us; we know what’s best doe everyone.” -The not-poors

Sounds funny you trying to tax these billionaires and are failing to find any obvious way… which is what these billionaires do to hide from tax and paying their fair share.

The billionaire parasite class cannot pay their “fair share.”

Even their very lives cannot make up for the disaster they and their ilk has perpetrated against the world.

Tac billionaires until billionaires don’t exist.

Seriously this.

That’s 480 million

I like to describe it as, you could live off of $1M a year… for 1000 years.

10 million a year for 100 years is probably a better way for people to understand that kind of wealth. Because even 1000 years is almost too long for our brains to comprehend.

To each their own. I can’t imagine what I would do with anything more than a million dollars a year. 1,000 years ago America had just barely been discovered by Erik the Red, so fast forward 1,000 years where we’ve cured all cancer, no one burns gas anymore, we’ve colonized two other planets, and made contact with three alien species. My $1 billion hoard (inflation adjusted) just ran out.

Thanks to compound interest, you can live off anything more than $4M for infinity years

That’s assuming your interest rate is higher than inflation, which it typically is not. Even when it is, like (debatably) now, it’s not that much higher. Over time, you’re losing money without spending a cent.

Now, if you invest in some ETFs you might be able to keep going for a while, but there’s the chance that the market crashes and stays down long enough that you run out. That’s pretty unlikely though, especially if you get a few good years to grow that egg before any crash happens.

It wouldn’t be that difficult to live off that investment, but a savings account and interest would not suffice.

Compound interest doesn’t exclusively refer to bank interest. Investments beat inflation regularly.

Did you mean tax or tactical nuke? Either way

The wealth tax seems to small. Everything above 999 million should be taxed 100%

I’m perfectly fine with 99% tax over 999 million.

Everything above 20 million per year should be taxed 80% and everything below should be untaxed.

Capitalism should not exist, period. Democratically direct production.

Explain.

Planned economy like in the Soviet Union.

Which part?

I’m all for taxing the rich. But this image should explain that this would be an annual due, not a one-time thing. Don’t pull your punches.

They have a psychological problem. They are mentally unsound and need to be locked up. They are destroying lives just so they can win the game of capitalism and hold all the fake money, all the fake power. They want to be demigods, worshiped by the “lessers” at how wonderful and great they are because they are winning the game of capitalism.

And they are succeeding.

If a family has two dogs and a cat, some might think that’s a little much but as long as the animals are healthy and happy it’s fine…

Billionaires are like animal hoarders that go around stealing every dog they see in someone’s backyard and never getting them spayed/neutered or even acknowledging they exist once they have possession.

Billionaires are hoarders, plain and simple.

It’s just in a hyper capitalist society, that’s encouraged instead of viewed as a mental illness.

The great news is even if we tax them, they can still compete for who has the most money.

Major problem with this analogy is if you don’t have a cat or dog you won’t starve to death. These people are trying to hoard resources that are life supporting. They are hoarders, and should be treated as such. The public as a whole needs to have this view and turn our backs on them, just not give them that power or influence over our lives.

Also citizens united needs to be repealed. Corporations are not people.

The power is sadly not “fake”, but very real.

Anyone working in e.g. public infrastructure will be very much able to assure you, how much power money brings and it gets worse with rising levels of political structures.

I don’t really understand what is being advocated for, here. Are we taking away their stock shares? Because 214.8 Bn is absolutely not the liquid assets of Elon Musk.

You can’t buy a house or car with unrealized gains. Are we going to start taxing everybody’s unrealized gains annually or what is the effective bracket?

Ya’ll gotta be more specific and shit. Let’s just tax realized gains, and any loan collaterals based on the stocks, at exceptionally high rates? Or maybe have a very high bracket to justify taking unrealized gain stocks. That feels like it would be way easier than some vague bullshit that could harm consumers more than billionaires.

Speaking of that house to buy, I’m getting taxed on my “unrealized gains” in my home value being estimated higher, despite it being where I live and not really primarily intended as an “investment vehicle”.

So if property tax can apply to stuff I’m not using as “money”, then I have a hard time objecting to the same general principle applied to stocks. The same arguments that can be made about stocks can apply to any property tax.

Are you asking for reform of Real Estate and Property Taxes or are you asking to Tax all unrealized gains?

BTW property taxes are like 0.32%-2.32% and when you sell your home then you have to pay big boy capital gains taxes unless you’ve listed it as your primary residence for more than 3 years.

I think an unrealized gains tax could work if we set the bar high enough that poor people won’t be negatively affected by it. I would also be fine with taxing only realized gains at a much higher rate and leaving unrealized gains alone.

In the Netherlands we have wealth tax so if you have more than 50k€ in cash/stock you start getting progressively taxed on it. No capital gains tax though so don’t get taxed for profits on stocks or when selling your house, these profits are all yours.

I’m assuming pensioning or retirement have some separate system? Because it would be hard to retire on 50k Euro alone. Actually, I assume they don’t have medical costs, so maybe that would be enough…?

I’m saying that we already have the concept of small tax rates against unrealized “gains” for the common folk, so it’s not crazy to think that unrealized gains for the rich folk could be some sort of fair game, on a roughly analogous scale. Mostly the same concerns about unrealized stock value apply to real estate property. The exceptions that I can conceive of would be:

-

Housing already has the typical property tax priced in. So whatever the effects of the wealth tax would be, it would be novel and thus some sort of adjustment would occur.

-

Housing has some intrinsic use and is not just a financial vehicle. People want to be in a house and most don’t even want to think of it as an ‘asset’ if they don’t have to. So one’s desire to reside in a primary residence is not dissuaded if you had reason to think you could “earn more” elsewhere. Stock is a more purely speculative financial instrument, so behaviors could be different. If a 3% tax across the board were levied, suddenly the effect is that investment vehicle is handicapped by 3%. So the average S&P return is 10% today, and thus would be effectively 7%, which might trigger some moves. Or if you say ‘3% over 10m’, then you get a shift where relatively less moneyed investors become an advantaged class, which might be interesting.

The small tax rates against unrealized gains are not only for the common folk, rich people own real estate too. Sometimes up to a dozen homes worth dozens of times more than a small family home each.

The unrealized gains tax on investments would also impact the vast majority of “common folk.”

Indiscriminate taxation will not fix our system. We need to tax the rich, not the rich and the poor equally. If anything we should have a negative income tax on the poor.

small tax rates against unrealized gains are not only for the common folk, rich people own real estate too

Then let me rephrase it.

Common folk are taxed on unrealized gains for their two most valuable properties, their house and car. Why shouldn’t wealthy people pay analogous tax on their most valuable properties, regardless of what those are?

They should be, who the fuck said otherwise?

-

You’re mostly right here, except stocks are an asset you can take a loan against with a margin loan or a line of credit. I suggest if you are doing that it SHOULD count as realized gains because you absolutely can use such a loan to buy a house, a car, a yacht, an island in the South Pacific, or an aircraft carrier.

Okay but if you take out a loan then you need to repay the loan with income which is taxed, so…

It’s already being taxed…

That said it’s probably being taxed at a lower rate due to the 2016 reform adding tax breaks for said circumstances and being able to have a lower annual income over the duration of the loan, so I definitely advocate for tax reform that undoes the damage by the GOP at least.

Yeah it’s taxed at a much lower rate. Short term capital gains is a real bitch. Long term isn’t so bad unless you’re liquidating a lot… Like enough to buy a house or car or something we are discussing now. Over 450k ish is taxed 20%, but you can get a margin loan for 3 to 12 percent AND it’s tax deductible lol.

Really, if you aren’t rich with stock you are getting F-ed in the A…

Sorry I misread your comment before I responded.

NBD, I saw this first actually.

Edit: I misread, I though it was saying “if you aren’t rich with stock you aren’t going to be F-ed in the A by an unrealized gains tax” but it was actually saying “If you’re not rich with stocks then you’re currently being F-ed in the A by our tax system”

If a hypothetical unrealized gains taxed passed today then there is a chance of poor people getting F-ed in the A, especially people with retirement funds or Vanguard share/portfolios. There is even a chance it hurts the poorer 80% more than the richer 20%.

The 2016 Tax Reform is a great example of that, it got tons of support from poor people and middle class and in the end it fucked them all in the A.

Depends on the structure. If it’s 3% on value over 5 million, then the bottom 95% will not even have a dent. If it is paid by even average retirement funds, but funds more expensive Medicaid or your kids college education, you still win. It all depends on the details.

I suppose there might be some sell off to cover the tax bills if the wealthy, but it probably wouldn’t shake the markets too much.

You can repay a loan with money from a different loan. And they only just need enough money to cover the interest. For most of them the repayment doesn’t come until they die and even then they pull as many tricks as possible to make it look like their estate is worth less than it is. Either way the amount of money these guys live off of is a tiny percentage of their entire wealth. 100M loan for a new mansion? That’s not even 0.05% of Elon’s wealth. Even $1 billion is a lot of fucking money. I don’t care how illiquid your wealth is, if it’s over $10B you’re just hoarding it and it’s doing fuck all for the economy.

Okay but that doesn’t justify taxing all unrealized gains for everyone, does it? Just tax the rich, or add laws against perpetual refinance without income.

Sidenote: If Elon Musk could do such a convoluted scheme then he wouldn’t have sold Billions of Tesla stock a couple of years ago and paid Capital Gains taxes in the billions. I believe with all my heart that Elon is such a POS that he would have absolutely wormed his way out of that sort of requirement if it were so easy.

Listen, Jim - how much do you realistically own in unrealized gains? It doesn’t even matter to be honest - since you’re shit posting on the Internet, I wouldn’t put your net worth much higher than $10-20 million - and that’s me being an absolute philanthropist, in terms of how much “benefit of the doubt” I’m willing to afford an Internet shit poster.

Even if you were somehow blessed to have more than that - you still wouldn’t qualify as one who needs to pay this kind of wealth tax.

Where’d you get the idea that it would “tax all unrealized gains”?

For just stocks mine is a pretty lowly $6,198 USD right now, National Average according to Federal Reserve Data says $87,000 Median and $333,945 Mean.

You said:

Even if you were somehow blessed to have more than that - you still wouldn’t qualify as one who needs to pay this kind of wealth tax.

But that’s not what the meme says at all. The meme says nothing except that unrealized gains should be taxed. That’s not good enough, you need to be more specific.

The Vast Majority of US Citizens do not have adequate retirement savings, and we’ve got this Meme saying a 2.98% annual unrealized gains tax is a solution to problems? We need to be a lot more specific about when and how this tax works if we want to avoid harm.

I don’t care how illiquid your wealth is, if it’s over $10B you’re just hoarding it and it’s doing fuck all for the economy.

That wealth is primarily invested in businesses that function within the economy, so “doing fuck all for the economy” is literally a lie, and this act is literally the opposite of “hoarding”.

The business can survive just fine having more owners, each with a smaller piece of the pie. Yes, you lose majority control but boo hoo on still being filthy rich.

You, uh, don’t think maybe more of those unrealized gains should go to the actual workers? What the fuck?

Do the “actual workers” also pay up if the business suffers losses, then?

Can’t have it both ways.

Yeah, they tend to get laid off. That’s having it both ways.

Okay but if you take out a loan then you need to repay the loan with income which is taxed, so…

Part of the problem is there are shell games around the repayment. I thought this could be handled by any use of the stock as collateral should count as a ‘sale’ for tax purposes, and any taxes on those proceeds that would be “double taxed” as folks are so afraid of can be offset by tax credits if the loan is ‘properly’ repaid in a normal way. So if you loan but repay normally, ok, you gave the government a ‘0% loan’, but you are still “fairly” taxed other than that, and the 0% loan is a small price to pay for access to your wealth.

They can do what they already do and use their unrealized gains as collateral for a loan and use that to pay the tax of they don’t want to realize the gains. This is already how they spend their money without realizing gains. I don’t see the issue with them doing the same for taxes as they do for their yachts and private jets.

You’re late Bjornir, like 5 people in this comment thread have said the same thing.

If Elon Musk can immediately liquefy $50 billion to buy a social media website, these parasites can liquefy $5 billion to pay for the roads their services rely on

Alright but the meme doesn’t say that. The meme just says they have unrealized gains and that we should take them. That’s poorly thought out, the bracket should be clearly defined before we even think about making an unrealized gains tax, because I guarantee you there are some GOP reps who salivate at the idea of taxing grandmothers of their inadequate retirement funds.

read the room dude

No, I will be semantic and overly technical until the day I die.

It’s already a thing and has been for quite some time. It’s called mark to market. Most people and companies use it to enjoy unrealized losses, but unrealized gains are in play. It’s not a new concept. It’s just that it’s an election at the individual level rather than a requirement.

You can’t buy a house or car with unrealized gains

Yes you absolutely can.

Go to the bank. Show them your balance sheet. Loan money. Pay for stuff.

We manage not tax things like houses and cars on unrealized gains. Why should stock or art, or anything be different?

We tax houses with unrealized gains when they sell, also.

Umm… when they sell… they are realized?

Taxing these billionares this way would equate to taxing you for your houses value going up even though your not selling. Just like how proprty tax works in most states.

The more wealthy should be paying higher taxes, but im not sure wealth tax directly is the way to do it. But this isnt my area of expertise, so im not against it either.

Yeah sorry, I ended up giving a low effort nonsense reply to an equally nonsensical reply. Perpetual cycle of stupidity over here.

I meant to say we do tax unrealized gains with property but we also tax capital gains upon realization. The user before me said we “manage not tax things like houses and cars”.

Umm. My brain is broken. Somone on the internet just admitted they were wrong.

Faith in humanity +10.

Why is Bill Gates paying a smaller proportional share than the other two?

Has he been paying taxes already?

That also seemed odd to me.

I think they are confusing a wealth tax with fair taxation.

The shown numbers seem to roughly correspond with what would be owed if they had paid fair capital gains tax over the past years. In other words, if all the tax loopholes were closed.

Bill Gates just didn’t have nearly the same amount of capital gains over the past few years compared to Elon and Jeff.

A wealth tax would tax then proportionally similar, so Jeff wouldn’t be paying 10x the tax that Bill G would pay.

He’s not taking full advantage of Trump’s tax system, and has been speaking out against it.

Came here to see the discussion on this. My only assumption is he’s been paying more taxes than others. He’s been one of the few in favor of taxing the rich more.

He’s not ceo of MS anymore

It’s a wealth tax, not an income tax. According to these numbers his wealth is comparable to the other two, so why is his bill over 10x smaller?

Probably something to do with charity or donations.

That I can’t explain then

Bezos isn’t CEO of Amazon. He’s still paying lots more.

This graphic sucks because wealth tax isn’t a term that means they pay this much

For instance a tax where you hand over all wealth is still a wealth tax

To draw more confusion, their fair share is way more than what is illustrated here

It’s not enough.